Seoul mulls joint review of Alaska LNG project with Japan, Taiwan, Vietnam

The $45 billion Alaska LNG project is too risky and financially burdensome for just a couple of firms to join, analysts say

By Apr 27, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea has proposed forming a consortium with Japan, Taiwan and Vietnam to jointly assess the feasibility of investing in the $45 billion Alaska LNG project, a move that could reshape regional energy cooperation amid US pressure to deepen economic ties.

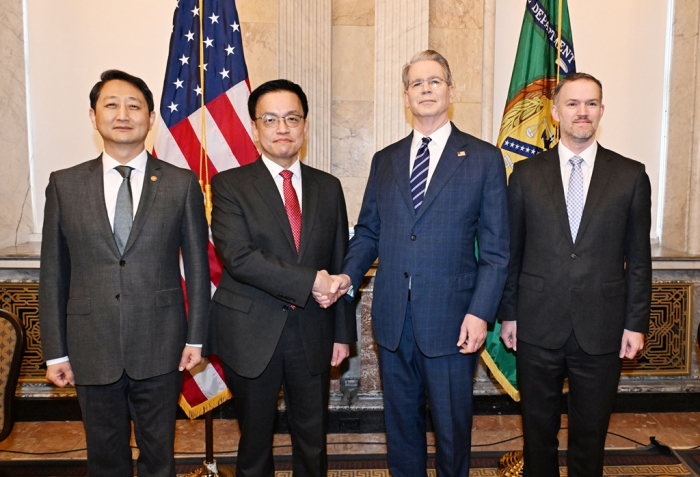

Seoul raised the idea during discussions with US officials in Washington, D.C. on April 24, suggesting the creation of a "buyers' consortium" involving major Asian energy importers such as Japan, Taiwan and Vietnam, according to foreign media reports.

The Alaska LNG project is shaping up not just as a test of economic viability but also as a barometer of how much US allies in Asia are willing to align their energy strategies with Washington’s broader geopolitical agenda, analysts said.

The proposal came after Korean government officials emphasized to the US that a full economic viability study must precede any investment decision in the $45 billion liquefied natural gas project.

A senior official at Korea’s Ministry of Trade, Industry and Energy effectively confirmed the discussions on Sunday, saying the idea was raised in the country's recent "2+2" trade talks with its US counterparts.

“It is clear that the project isn’t feasible with Korea’s participation alone,” the official said.

LONG ON THE DRAWING BOARD

The project, known as Alaska LNG, involves constructing a nearly 1,300-kilometer (800-mile) pipeline from fields in Alaska's vast North Slope to its southern port in Nikiski, where the natural gas would be liquefied and shipped to Asia.

Japan and Korea are among the world’s biggest LNG importers.

The US is seeking investment from key Asian allies – excluding China – and hopes to split the annual output of 20 million tons among them.

Because of its high costs and the time required for construction, Alaska LNG has been viewed as a long shot within the industry. For years, major energy companies and officials in Korea and Japan rebuffed requests from Alaskan delegations to participate, stalling the project’s progress over several decades.

Even global energy giant ExxonMobil walked away from the project after conducting its own review.

“You shouldn’t even call this an LNG project,” said an industry specialist in Seoul. “It’s essentially a massive pipeline project – a very expensive one at that.”

Under the threat of Trump's tariffs, however, Asian countries have started exploring ways to invest in the project.

TOO RISKY TO SHOULDER THE COST BURDEN ALONE

Last month, President Trump, in a transactional approach focused on US industry gains, said in an address to the US Congress that South Korea, Japan and other countries want to partner with the US in the gas pipeline project in Alaska, claiming they would invest “trillions of dollars each.”

Despite Trump’s optimistic tone, however, analysts said Korean participation is uncertain.

While South Korea sees the project as a potential means to bolster energy security and diversify its supply sources, officials have stressed that any decision on participation will be contingent on an on-the-ground due diligence process.

Industry watchers said the Alaska project carries significant risks.

The extreme weather conditions of northern Alaska would complicate pipeline construction, adding to the already daunting $45 billion estimated price tag.

Even securing long-term LNG offtake agreements may prove challenging, with questions remaining over timing and volume commitments, analysts said.

“Given the scale and the risks, it is evaluated as a very high-risk project for now,” said an energy expert in Seoul. “However, forming a consortium among buyer countries could improve objectivity in decision-making and mitigate some of the risks.”

DIFFERENT APPROACHES

Yet, differences in stance are already emerging among the potential participants.

Taiwan, eager to strengthen its strategic alignment with the US in light of tensions with China, is reportedly showing greater enthusiasm.

Last month, Taiwanese state energy firm CPC Corp. signed a non-binding agreement with state-run Alaska Gasline Development Corp. (AGDC) to buy LNG and invest in the project.

By contrast, Japan and Korea are taking a more cautious approach, closely monitoring Washington’s moves.

Following the 2+2 talks, Trade and Industry Minister Ahn Duk-geun said Seoul would take a comprehensive approach, weighing “the possibility of participation, timing and scale” carefully before making any commitments.

Seoul watchers said that any final decision would likely fall to the next Korean administration after the June 3 snap presidential election.

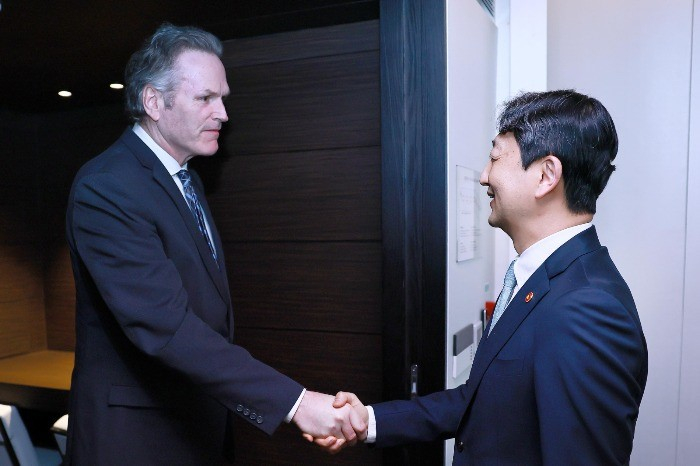

In a related move, Alaska Governor Mike Dunleavy flew to Seoul last month to hold meetings with top executives from Korean energy and steel companies.

In 2017, state-run Korea Gas Corp. (KOGAS) signed a memorandum of understanding on developing the LNG project with AGDC.

The project, however, has seen little progress since, with the MOU deadline extended twice before effectively stalling.

Write to Dae-Hun Kim at daepun@hankyung.com

In-Soo Nam edited this article.

-

Business & PoliticsSeoul, Washington agree on July tariff deal framework in '2+2' trade talks

Business & PoliticsSeoul, Washington agree on July tariff deal framework in '2+2' trade talksApr 25, 2025 (Gmt+09:00)

4 Min read -

Business & PoliticsS.Korea's Han, Trump discuss transactional diplomacy in 1st direct talks

Business & PoliticsS.Korea's Han, Trump discuss transactional diplomacy in 1st direct talksApr 09, 2025 (Gmt+09:00)

3 Min read -

Business & PoliticsSamsung, LG review strategies as Trump slaps Vietnam with steeper tariffs

Business & PoliticsSamsung, LG review strategies as Trump slaps Vietnam with steeper tariffsApr 03, 2025 (Gmt+09:00)

5 Min read -

Shipping & ShipbuildingSamsung Heavy eyes $5.5 bn FLNG ship deals as Trump sanctions China

Shipping & ShipbuildingSamsung Heavy eyes $5.5 bn FLNG ship deals as Trump sanctions ChinaMar 11, 2025 (Gmt+09:00)

3 Min read -

EnergyAlaska governor seeks Korean partners for $44 bn LNG project

EnergyAlaska governor seeks Korean partners for $44 bn LNG projectMar 25, 2025 (Gmt+09:00)

2 Min read -

Business & PoliticsS.Korea wary of inclusion on US ‘Dirty 15’ nations list for reciprocal tariffs

Business & PoliticsS.Korea wary of inclusion on US ‘Dirty 15’ nations list for reciprocal tariffsMar 19, 2025 (Gmt+09:00)

3 Min read -

EnergyTrump-driven energy boom spurs Korean firms to hike US gas investments

EnergyTrump-driven energy boom spurs Korean firms to hike US gas investmentsMar 10, 2025 (Gmt+09:00)

4 Min read -

Business & PoliticsTrump says Korea interested in Alaska gas project; Korean firms skeptical

Business & PoliticsTrump says Korea interested in Alaska gas project; Korean firms skepticalMar 05, 2025 (Gmt+09:00)

3 Min read