Trump says Korea interested in Alaska gas project; Korean firms skeptical

Due to the high costs and time required for construction, the $44 billion LNG project has been viewed as a long shot

By Mar 05, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea, Japan and other countries want to partner with the US in a $44 billion natural gas pipeline project in Alaska, President Donald Trump said, claiming they would invest “trillions of dollars each.”

While the Korean government said Seoul is closely looking at the project for cooperation, Korea’s energy firms are skeptical about their participation, citing the costs and logistical hurdles.

In an address to the US Congress on Tuesday, Trump said, “Japan, South Korea and other nations want to be our partner with investments of trillions of dollars each … It’s all set to go.”

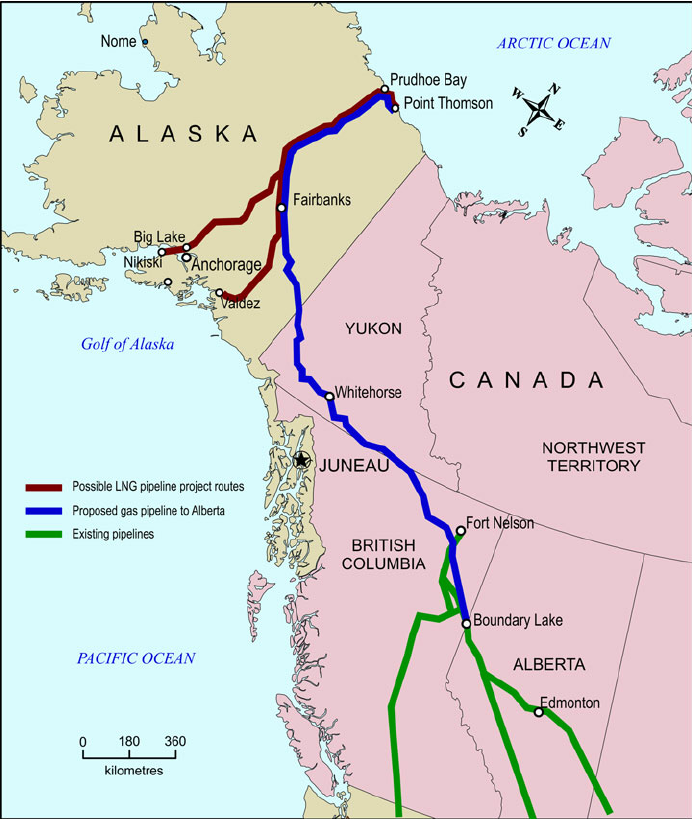

The project, known as Alaska LNG, involves constructing a nearly 1,300-kilometer (800-mile) pipeline from fields in Alaska's vast North Slope to its southern port in Nikiski, where the natural gas would be liquefied and shipped to Asia.

Japan and Korea are among the world’s biggest LNG importers.

SEOUL-WASHINGTON WORKING-LEVEL GROUP TO BE SET UP

Korea's industry and trade ministry said Minister Ahn Duk-geun discussed the project with US officials during his visit to Washington last week.

Ahn said Seoul and Washington agreed to establish a working-level group to discuss the pipeline, energy, shipbuilding, tariffs and non-tariff barriers.

At a media briefing in Seoul, the minister said the US approached Korea, Japan and India for potential investment. “If Korean companies participate, it could serve as a counterbalance against US trade pressures,” he said.

A ministry official, however, said talks with Washington are in early stages. “We’re just looking into the US proposal,” he said. “Decisions on participation will come later.”

Ahn's visit to Washington was aimed at seeking exemptions from the Trump administration tariffs that are expected to hit Korea's export-reliant economy hard.

KOREAN PARTICIPATION UNCERTAIN

Because of its high costs and the time required for construction, Alaska LNG has been viewed as a long shot within the industry. For years, major energy companies and officials in Korea and Japan rebuffed requests from Alaskan delegations to participate, stalling the project’s decades-long progress.

Under the threat of tariffs from Trump, however, Asian countries have started exploring ways to invest in the project.

Despite Trump’s optimistic tone, analysts said Korean participation is uncertain.

Economic feasibility and financial risks are the primary concerns, they said.

In 2017, state-run Korea Gas Corp. (KOGAS) signed a memorandum of understanding on developing the project with the Alaska Gasline Development Corp (AGDC).

However, the project has seen little progress since, with the MOU extended twice before effectively stalling.

Even global energy giant ExxonMobil walked away from the project after conducting its own review.

KOGAS and the country’s overseas energy development firm Korea National Oil Corp (KNOC) are burdened with heavy debts, complicating the prospects of Korean participation.

As of the end of 2024, KOGAS’ debt stood at 46.8 trillion won ($32.4 billion), with a debt-to-equity ratio of 433%. KNOC’s debt at the end of June 2024 was 21.17 trillion won.

SHARES RISE

If Korean companies were to join, the project would likely involve a consortium with private firms, analysts said.

Potential participants include SK Innovation Co. and POSCO International Corp., both of which have experience in overseas gas development.

Despite the uncertainties, Trump’s remarks sparked a surge in Korean gas-related stocks.

On Wednesday, Posco International’s shares closed up 15.3% at 61,000 won, outperforming the broader Kospi index’s 1.2% gain.

KOGAS finished 12.8% higher at 40,100 won.

Pipeline-related stocks also soared.

Dongyang Steel Pipe Co. rose by the daily limit of 30% to close at 897 won. HiSteel Co. also climbed 30% to 3,990 won.

Meanwhile, Minister Ahn said at the media briefing that he has told US officials that Korean shipbuilders are ready to build US warships, tankers and icebreakers for the US Navy and commercial ship owners faster and on better terms than their rivals.

Write to Ji-Eun Ha and Dae-Hun Kim at hazzys@hankyung.com

In-Soo Nam edited this article.

-

Shipping & ShipbuildingKorea, US to expand cooperation in shipbuilding sector

Shipping & ShipbuildingKorea, US to expand cooperation in shipbuilding sectorMar 02, 2025 (Gmt+09:00)

4 Min read -

Shipping & ShipbuildingHD Hyundai, Hanwha Ocean to jointly bid for high-stakes warship deals

Shipping & ShipbuildingHD Hyundai, Hanwha Ocean to jointly bid for high-stakes warship dealsFeb 26, 2025 (Gmt+09:00)

4 Min read -

EnergySK Innovation E&S to secure 10 mn tons of LNG to compete with BP, Shell

EnergySK Innovation E&S to secure 10 mn tons of LNG to compete with BP, ShellFeb 23, 2025 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingKorean shipbuilders to benefit from rising LNG, oil tanker demand

Shipping & ShipbuildingKorean shipbuilders to benefit from rising LNG, oil tanker demandFeb 17, 2025 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHD Hyundai, Hanwha to tap into $242 billion US Navy warship market

Shipping & ShipbuildingHD Hyundai, Hanwha to tap into $242 billion US Navy warship marketFeb 12, 2025 (Gmt+09:00)

4 Min read -

Shipping & ShipbuildingHD Hyundai Marine sets sights on LNG vessel retrofitting in Trump era

Shipping & ShipbuildingHD Hyundai Marine sets sights on LNG vessel retrofitting in Trump eraFeb 05, 2025 (Gmt+09:00)

3 Min read -

EnergyS.Korean firms bet big on US LNG market under new Trump gov't

EnergyS.Korean firms bet big on US LNG market under new Trump gov'tNov 20, 2024 (Gmt+09:00)

2 Min read