LG Electronics set for early-May Indian stock market debut

The IPO proceeds will be used to build a new plant in India, launch budget-friendly products and pursue M&As

By Apr 06, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

LG Electronics Inc. is set to list its wholly owned subsidiary in India on the country's stock exchange in early May, aiming to raise up to $1.5 billion – a move intended to position South Asia as an alternative to China for overseas manufacturing amid the escalating trade war between Washington and Beijing.

The IPO is also expected to accelerate LG Electronics' expansion into other parts of Asia, including the Middle East and Southwest Asia, as well as Africa, reducing its reliance on North America following the US government's announcement of hefty tariffs on imports last week.

LG Electronics has secured approval from the Securities and Exchange Board of India for the initial public offering of LG Electronics India Pvt.

The South Korean household name will be offering a 15% stake in the Indian unit through the IPO with an estimated enterprise value of about $13.0 billion.

The Indian bourse has scheduled the stock market listing for early next month at the request of LG Electronics, said the sources. Cho Joo-wan, chief executive of LG Electronics, will visit India to ring the opening bell on its first day of trading on the stock exchange.

THIRD PLANT IN INDIA

The IPO comes as LG is slated to break ground on its third consumer electronics plant in the South Asian country this year. The construction is estimated to cost at least $500 million, with operations expected to begin in the first half of next year.

It currently operates two manufacturing factories in India: one in Noida, 30 km southeast of India's capital city, and another in Pune.

It will also use the IPO proceeds to develop and market home appliances tailored to Indian and other Southwest Asian countries, as well as for mergers and acquisitions.

In India, LG plans to roll out ultra-low-cost offerings such as a $100 air conditioner tailored to India's hot climate and a washing machine optimized for the delicate fabrics of the traditional Indian sari.

It is also developing a water purifier equipped with UV sterilization and a stainless steel tank tailored to address India's water quality concerns.

RECIPROCAL TARIFFS BY WASHINGTON

LG is moving forward with the IPO, dismissing concerns over the 26% tariff imposed on India by the US government.

The duties are lower than those imposed on many other Asian countries such as Cambodia, Vietnam, Thailand and China, which face tariffs of 30-40%. South Korea was slapped with a 25% tariff.

LG said the tariffs highlighted the importance of expanding into Asia, lessening its dependence on the US market.

"We want to be a national brand in India. We'll turn the market's potential into reality," Cho said in a recent speech.

The IPO will also bolster LG Electronics' financial strength and support the implementation of shareholder-friendly measures, including share cancellation.

As of the end of 2024, its cash and cash equivalents stood at 1.2 trillion won ($821 million). The company is also beefing up its B2B business in India.

In February, Moody's upgraded its outlook for LG Electronics to positive from stable, while affirming its Baa2 rating. The rating agency commented that LG Electronics India's IPO will contribute to strengthening the Korean company's financial structure.

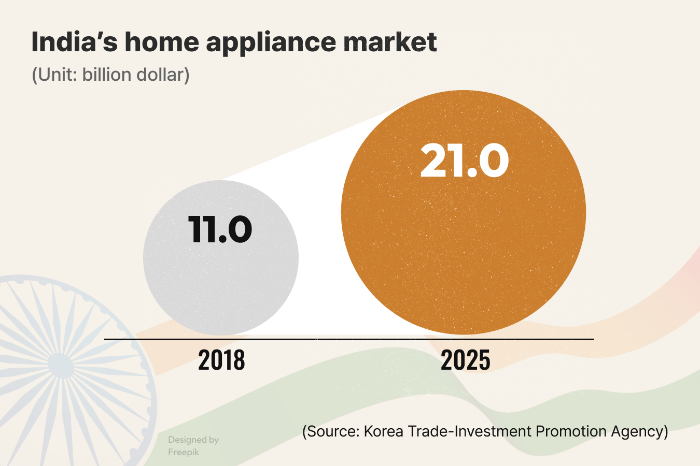

LG is pinning its hopes on the growing middle class, young population and strong economic growth in the world’s most populous country.

The home appliance penetration rate for refrigerators, washing machines and air conditioners in the country was 34%, 21% and 12%, respectively, far below that of China, as of the end of June 2024, according to LG Electronics.

As of the end of June 2024, it controls 33.5% of India’s washing machine market; 28.7% of its refrigerator sector; 25.8% of the TV market; and 19.4% of the air conditioner market.

Last year, LG Electronics Inc. posted its largest-ever sales in India. Revenue at its Indian operations jumped 14.8% to 3.79 trillion won ($2.8 billion) in 2024 from the previous year. Its net profit in India surged 43.4% on-year to 331.8 billion won.

Write to Chae-Yeon Kim, Hwang Jeong-Soo and Ui-Myung Park at why29@hankyung.com

Yeonhee Kim edited this article.

-

ElectronicsLG Electronics restarts home appliance plant in Russia

ElectronicsLG Electronics restarts home appliance plant in RussiaMar 21, 2025 (Gmt+09:00)

2 Min read -

ElectronicsLG Group chair visits India ahead of LG Electronics Indian IPO

ElectronicsLG Group chair visits India ahead of LG Electronics Indian IPOMar 04, 2025 (Gmt+09:00)

1 Min read -

-

ElectronicsLG Electronics hits record sales in India, paving way for 2025 IPO

ElectronicsLG Electronics hits record sales in India, paving way for 2025 IPOFeb 25, 2025 (Gmt+09:00)

2 Min read -

-

Korean Innovators at CES 2025LG Electronics bets big on humanoid robots: CEO Cho

Korean Innovators at CES 2025LG Electronics bets big on humanoid robots: CEO ChoJan 09, 2025 (Gmt+09:00)

3 Min read -

Shareholder valueLG Electronics to retire about $50 mn treasury stock in 2025

Shareholder valueLG Electronics to retire about $50 mn treasury stock in 2025Dec 18, 2024 (Gmt+09:00)

1 Min read -

Shareholder valueLG Electronics unveils value-up plans, begins Indian arm IPO process

Shareholder valueLG Electronics unveils value-up plans, begins Indian arm IPO processOct 22, 2024 (Gmt+09:00)

1 Min read -

ElectronicsLG Electronics rises to global prominence in HVAC segment, ranks fifth

ElectronicsLG Electronics rises to global prominence in HVAC segment, ranks fifthNov 20, 2024 (Gmt+09:00)

3 Min read -

AutomobilesHyundai Motor debuts on Indian bourses in its 1st offshore IPO

AutomobilesHyundai Motor debuts on Indian bourses in its 1st offshore IPOOct 22, 2024 (Gmt+09:00)

3 Min read -

-

ElectronicsLG Electronics to boost mass market presence vs Chinese peers

ElectronicsLG Electronics to boost mass market presence vs Chinese peersSep 09, 2024 (Gmt+09:00)

3 Min read