Hyundai Motor debuts on Indian bourses in its 1st offshore IPO

It will pour most of the IPO proceeds into its Indian operations to increase capacity, including for EVs

By Oct 22, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

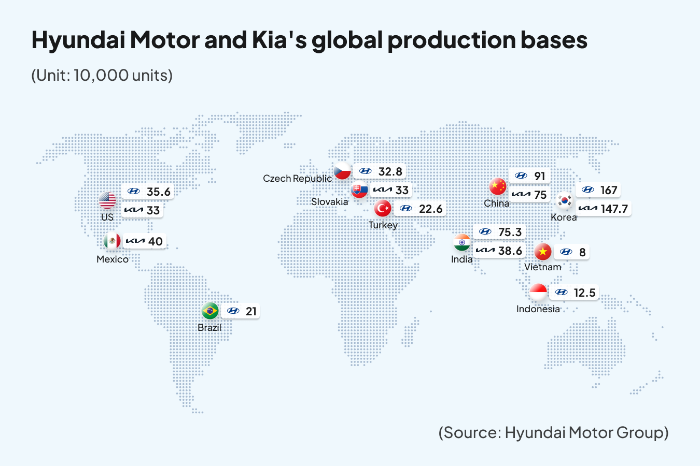

MUMBAI -- Hyundai Motor Co.'s Indian unit debuted on India's stock market on Tuesday as the South Korean carmaker bets big on the South Asian country to become its key export market and manufacturing hub after scaling back in China.

In India's largest initial public offering, Hyundai Motor India raised $3.3 billion and began stock trading on both the National Stock Exchange (NSE) and the BSE, formerly the Bombay Stock Exchange. It became Hyundai Motor Group's first overseas entity to list on a foreign bourse.

"India has plenty of potential. I know India is the future," Hyundai Motor Group Chairman Chung Euisun said at its Indian unit's listing ceremony on the NSE in Mumbai.

It will pour most of the IPO proceeds into its operations in India to expand capacity not only for domestic sales but also for shipments to the Middle East and Africa, as well as Central and South America.

The South Korean carmaker expects the IPO to solidify its position as a local company in India and protect it from regulations and discrimination against foreign companies in the country.

Lessons were learned from the setback it suffered in China blamed on political factors that negatively affected foreign firms, said industry observers.

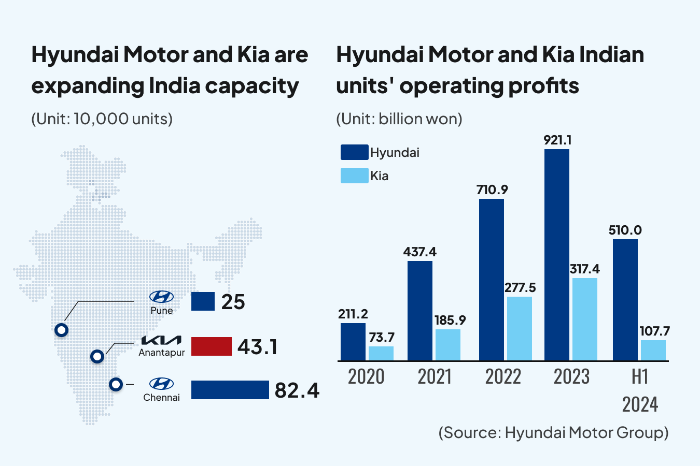

In India, Hyundai Motor operates two factories in Chennai and one in Pune, which it acquired from General Motors in 2023. Its affiliate Kia Corp. runs a plant in Anantapur.

It aims to bump up production capacity in Chennai to 824,000 units by 2028. Its factory in Pune will have a capacity of 170,000 units from the second half of next year.

Hyundai Motor India's stock market debut will accelerate its push into the world's No. 3 automobile market to overtake Maruti Suzuki, a Japanese carmaker and the No. 1 car brand in India, with a 40.8% market share.

Hyundai Motor controls 14.1% of India's automobile market with a 14.1% share in the first half of this year when it delivered a record-high number of cars there, though.

Third-ranked Tata Motors has narrowed its gap with Hyundai Motor by 0.2 percentage point. Kia is the No. 5 carmaker in the country with a 5.8% share.

Hyundai will expand its EV lineup to five models in India by 2030, in line with the Indian government’s goal of increasing EVs to 30% of total car sales by 2030. In January 2025, it will launch an electric model of the compact sport utility vehicle Creta in India -- the first EV to be produced at one of its plants in the country.

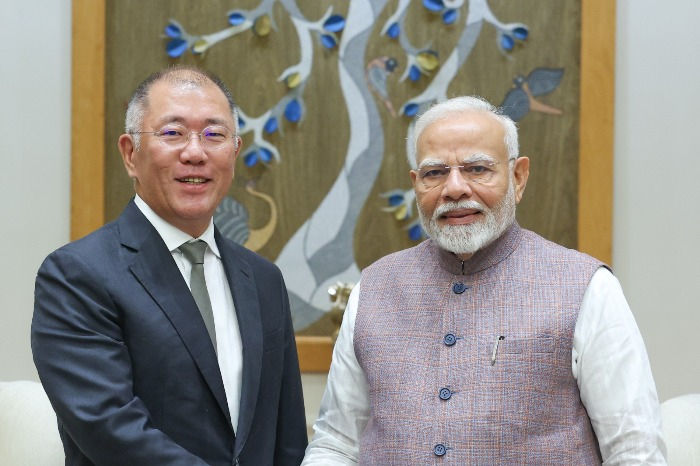

Ahead of Hyundai Motor India's listing, its parent group Chairman Chung Euisun met with Indian Prime Minister Narendra Modi on Monday to share its mid- to long-term vision in the country, including EV launches.

Chung stressed Hyundai would be a reliable partner in India's “Make In India” initiative and vision for growth under the theme Viksit Bharat 2047 by making steady investments in the country with the world's largest population.

He also explained its business diversification into robotics, urban air mobility, hydrogen and small modular reactors during the meeting.

“We will continue to cooperate with the Indian government to launch electric vehicles and contribute to building the Indian electric vehicle ecosystem, including establishing an electric vehicle charging network and localizing components," Chung was quoted as saying in a meeting with Modi.

To boost its annual capacity in India to 1.5 million units, including that of Kia, Hyundai will position itself as a premium brand.

It is building a battery pack plant in its manufacturing complex in Chennai to self-supply batteries for EVs it sells in India.

Through the IPO, Hyundai Motor unloaded some of its shares equivalent to a 17.5% stake in the Indian unit, while selling new shares.

The number of its individual investors recently surpassed 100 million, compared with 31 million in 2022. BSE Sensex index’s price-to-earnings ratio stood at 24.1 as of the end of last month, close to the S&P 500’s multiple of 26.8.

Write to Byeong-Hwa Ryu and Jae-Fu Kim at hwahwa@hankyung.com

Yeonhee Kim edited this article.

-

Future mobilityHyundai-owned Boston Dynamics, Toyota team up for humanoid robots

Future mobilityHyundai-owned Boston Dynamics, Toyota team up for humanoid robotsOct 17, 2024 (Gmt+09:00)

4 Min read -

Electric vehiclesHyundai to produce Creta EV in India for January launch

Electric vehiclesHyundai to produce Creta EV in India for January launchOct 20, 2024 (Gmt+09:00)

2 Min read -

Research & DevelopmentHyundai Motor Group expands R&D partnership with Singapore

Research & DevelopmentHyundai Motor Group expands R&D partnership with SingaporeOct 09, 2024 (Gmt+09:00)

2 Min read -

-

Future mobilityHyundai Motor, Waymo forge multi-year, strategic partnership

Future mobilityHyundai Motor, Waymo forge multi-year, strategic partnershipOct 04, 2024 (Gmt+09:00)

5 Min read -

Asset managementWealthy Koreans look to Indian equities as 'next China' investment

Asset managementWealthy Koreans look to Indian equities as 'next China' investmentSep 30, 2024 (Gmt+09:00)

4 Min read -

Electric vehiclesKia to mass-produce EVs at Hyundai Motor Group’s 1st dedicated plant

Electric vehiclesKia to mass-produce EVs at Hyundai Motor Group’s 1st dedicated plantSep 27, 2024 (Gmt+09:00)

1 Min read -

-

Corporate strategyHyundai Motor cuts 2030 sales goals as EV chasm likely protracted

Corporate strategyHyundai Motor cuts 2030 sales goals as EV chasm likely protractedSep 19, 2024 (Gmt+09:00)

3 Min read -

Banking & FinanceIndia offers Korean firms detailed guidance for forays into India

Banking & FinanceIndia offers Korean firms detailed guidance for forays into IndiaSep 17, 2024 (Gmt+09:00)

3 Min read -

AutomobilesHyundai Motor car sales hit record in India for 1st half

AutomobilesHyundai Motor car sales hit record in India for 1st halfJul 07, 2024 (Gmt+09:00)

3 Min read -

Electric vehiclesHyundai-Kia’s India-only EVs to run on Exide batteries

Electric vehiclesHyundai-Kia’s India-only EVs to run on Exide batteriesApr 08, 2024 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsHyundai sells Chongqing plant at $227 mn for China restructuring

Mergers & AcquisitionsHyundai sells Chongqing plant at $227 mn for China restructuringJan 17, 2024 (Gmt+09:00)

2 Min read