S.Korea’s NPS to double pension fund size by 2050, hike risky assets

With an anticipated $2.38 trillion under management by 2050, the NPS will likely add more domestic stocks to its portfolio

By Mar 24, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s National Pension Service (NPS) is projected to nearly double its fund size to 3,500 trillion won ($2.38 trillion) by 2050, following a recent reform designed to strengthen its operational strategy and delay the fund's depletion.

The government is also considering increasing the portion of riskier assets in the state-run pension fund’s investment portfolio to maximize returns, sources said on Monday.

According to the Ministry of Health and Welfare, the National Pension Act amendment passed at the National Assembly on March 20 is expected to push back the timing to deplete the fund by around a decade.

The reform primarily involves a phased increase in the subscribers’ contribution rate from the current 9% to 13% by 2033 – a hike of 0.5 percentage point each year through 2033.

Under the revised pension scheme, the pensioners’ income replacement rate will rise from 40% to 43%, improving retirement benefits. Without the reform, the income replacement rate was expected to gradually fall to 40% by 2028 from an estimated 41.5% this year.

Previous forecasts estimated the fund's peak at 1,777 trillion won by 2040 or 2041, with depletion expected by 2056.

FUND TO PEAK AT 3,500 TRILLION WON, DEPLETION BY 2064

However, the recent pension scheme reform suggests the fund could now reach its peak at 3,500 trillion won by around 2055, extending its lifespan to 2064.

Under a more optimistic scenario, if the government achieves a 1 percentage point increase in the fund’s investment return from 4.5% to 5.5% as it pledged, the fund's solvency could be maintained through 2071, said a senior ministry official.

The pension fund’s rapid growth is largely attributed to the increased contributions thanks to higher premiums from NPS subscribers.

Of the 99.46 trillion won in total contributions last year, 61.74 trillion won, or 62%, came from pension insurance premiums, while 37.71 trillion won was investment returns. Some 12 billion won came from government subsidies.

Given the fund’s projected expansion, the government is contemplating a significant shift in its asset allocation strategy.

While a diversified portfolio is crucial for long-term investment returns, analysts highlighted the importance of enhancing the NPS’ operational expertise.

A health and welfare ministry official said the government is considering raising the ceiling for risk asset investments, currently capped at 65%, to as high as 75%. The upward adjustment would allow greater flexibility in responding to market dynamics, he said.

“Reforming the pension fund’s structure is only half the battle,” said a local pension specialist. “With the fund’s expected growth, ensuring effective asset management through portfolio diversification and professional oversight is equally important.”

TO BUY MORE DOMESTIC STOCKS

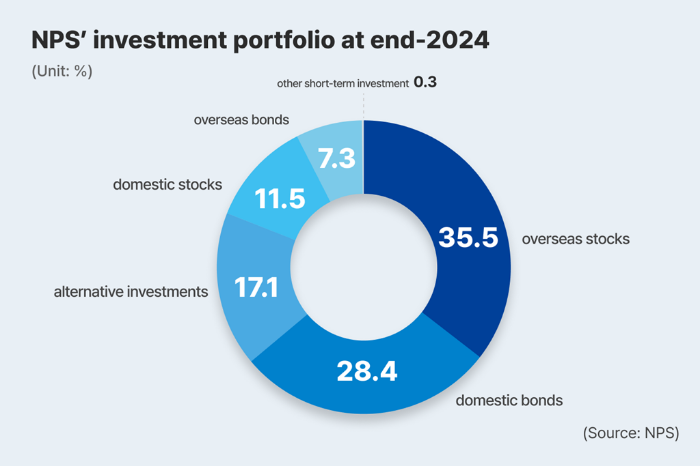

Currently, the NPS’ portfolio consists of 35.5% in foreign equities, 28.4% in domestic bonds, 17.1% in alternative investments, 11.5% in domestic stocks and 7.3% in foreign bonds.

A medium-term asset allocation plan released last May outlined a target of increasing foreign equity holdings to 40% and domestic stock holdings to 15% by 2029.

If the fund’s size reaches the anticipated 3,500 trillion won, its domestic equity investments could surge to 525 trillion won from the current 139.7 trillion won.

Analysts said the NPS, the country’s largest institutional investor, may acquire an additional 200 trillion won to 380 trillion won worth of domestic equities over the next 25 years.

Earlier this month, Seo Won-joo, chief investment officer (CIO) of the NPS’ fund management division, said the pension fund plans to introduce a new benchmark portfolio framework to improve gains from its alternative investments.

FUND DEPLETING FAST AS KOREA SET TO BECOME SUPER-AGED SOCIETY

In 2024, the state pension fund posted a record 15% return from its investment activities, buoyed by a rally in US stocks and gains from alternative investments.

At last year’s return rate, the state fund earned 160 trillion won ($110 billion) in investment gains, with its total assets under management rising to 1,213 trillion won, or $830.3 billion, at the end of 2024.

The pension fund’s cumulative returns since its inception stood at 783 trillion won at the end of 2024, posting an average annual return rate of 6.82%.

The NPS, one of the world’s largest pension funds, has been under growing pressure to improve returns and enhance investment efficiency as the country’s aging population accelerates the fund’s long-term payout obligations.

Write to Ri-Ahn Kim, Jeong-Min Nam and Gyeong-Jin Min at knra@hankyung.com

In-Soo Nam edited this article.

-

Pension fundsKorea’s pension fund NPS rules out investing in MBK’s hostile M&A deals

Pension fundsKorea’s pension fund NPS rules out investing in MBK’s hostile M&A dealsMar 18, 2025 (Gmt+09:00)

1 Min read -

Pension fundsKB, Samsung SRA, Capstone named NPS’ core property fund operators

Pension fundsKB, Samsung SRA, Capstone named NPS’ core property fund operatorsMar 16, 2025 (Gmt+09:00)

3 Min read -

Pension fundsS.Korea’s pension fund NPS to overhaul alternative investment strategy

Pension fundsS.Korea’s pension fund NPS to overhaul alternative investment strategyMar 12, 2025 (Gmt+09:00)

3 Min read -

Pension fundsS.Korea’s pension fund NPS posts record return in 2024 on US stock rally

Pension fundsS.Korea’s pension fund NPS posts record return in 2024 on US stock rallyFeb 28, 2025 (Gmt+09:00)

2 Min read -

EconomySouth Korea becomes super-aged society faster than expected

EconomySouth Korea becomes super-aged society faster than expectedDec 24, 2024 (Gmt+09:00)

3 Min read -

Pension fundsNPS to invest record $1.4 billion in Korean property market in 2025

Pension fundsNPS to invest record $1.4 billion in Korean property market in 2025Dec 18, 2024 (Gmt+09:00)

4 Min read