Korea eyes laws akin to US AMPC to offer subsidies for its battery makers

The move comes as Korea’s battery trio faces growing competition from Chinese rivals and US policy changes

By Mar 21, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

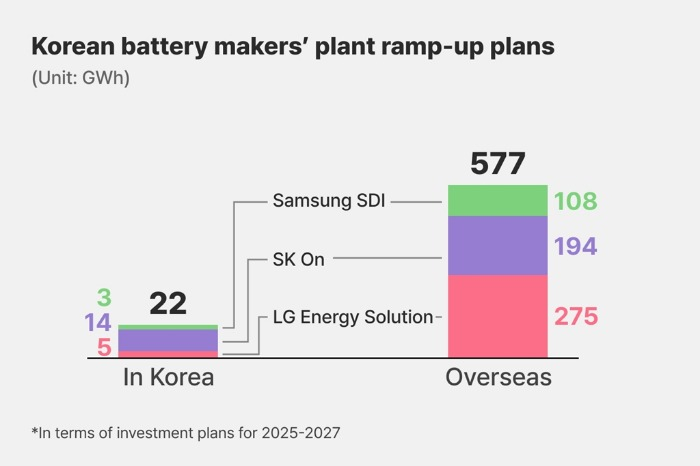

South Korea, home to global top battery makers such as LG Energy Solution Ltd., SK On Co. and Samsung SDI Co., is seeking to enact laws that would lay the groundwork to offer subsidies to its battery makers.

According to industry sources on Thursday, lawmakers are working on a bill to introduce direct subsidies for domestic battery manufacturers – something similar to the US Advanced Manufacturing Production Credit (AMPC).

The initiative aims to bolster the country's battery sector, which faces mounting pressure from Chinese competitors and a global slowdown in electric vehicle (EV) demand.

A group of 11 legislators, led by Lee Sang-hwi of the ruling People Power Party and Shin Young-dae of the main opposition Democratic Party, has formed the Secondary Battery Forum to spearhead the so-called Battery Industry Special Act.

The proposed legislation, expected to be introduced soon, marks Korea's second attempt at targeted industry support, following the 2024 Semiconductor Industry Promotion Act.

In Korea, batteries are often referred to as something close to semiconductors, which have led the Korean economy to what it is now, akin to rice – the staple food of Koreans.

Nevertheless, there’s a severe lack of government support, and critics said Korea must work out its version of the US Inflation Reduction Act (IRA) and AMPC to help its battery companies stay ahead of their rivals.

BRIDGING THE GAP

The bill’s centerpiece is a direct subsidy program modeled after the US AMPC, offering financial support in proportion to the volume of domestically produced battery cells and packs.

Under the proposed scheme, companies would receive cash incentives, addressing the challenges faced by the Korean battery trio, which collectively posted 841.9 billion won in losses ($573 million) in the fourth quarter of 2024.

“Chinese battery makers such as CATL have enjoyed significant state support, propelling them to global leadership,” said a Korean battery industry official. “Meanwhile, the US is using substantial subsidies to attract overseas battery makers to build factories in the country. South Korea risks losing its technological edge without similar measures.”

Currently, the Korean government offers a blanket 15% tax credit on capital investments across industries. This scheme, however, provides little relief for battery companies operating at a loss, as there are no taxable profits to offset.

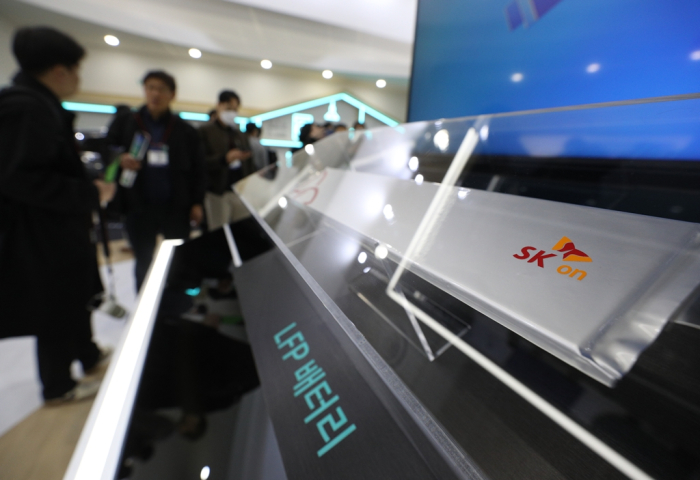

SK On, for example, has annually invested over 3 trillion won for years to expand domestic production but has yet to turn a profit. Last year, it posted 1.13 trillion won in operating loss.

The proposed direct subsidies would offer immediate financial support, unlike deferred tax benefits, sources said.

SECURING STABLE SUPPLY CHAIN

The legislation also calls for robust government support in securing raw materials such as nickel, lithium and cobalt, which are predominantly sourced from countries such as Indonesia, Argentina and the Republic of Congo.

Lawmakers said the government could also play its role in local companies’ supply chain negotiations to enhance procurement stability and ensure competitive pricing for Korean battery makers.

“China’s government-backed investments have ensured a dominant position for its battery makers in the battery supply chain,” said an executive at a Korean battery maker. “Korea also must adopt a strategic approach to secure resources and remain competitive.”

A GLOBAL RACE

China’s battery giants, including Contemporary Amperex Technology Co. Ltd. and BYD Co., have captured a 69% share of the global battery market in 2024, bolstered by extensive state subsidies. CATL alone reportedly received about 1.5 trillion won in government subsidies last year.

Industry leaders have expressed optimism over the proposed legislation.

“Batteries are one of those sectors in which Korea has a competitive edge. Korea needs a tailored support package to ensure our leadership in the evolving EV and battery markets,” said an executive at a major Korean battery firm.

Under the US AMPC program, foreign battery makers receive $35 and $10 per kWh in subsidies for battery cells and modules, respectively, produced in the US.

The IRA grants up to $7,500 per electric vehicle produced if it is assembled in the US and the battery's minerals are either mined or processed in the US or countries with free trade agreements with Washington.

The US government under President Donald Trump, however, said it could drastically reduce or eliminate such subsidies and raise tariffs.

Write to Jin-Won Kim and Sang-Hoon Sung at jin1@hankyung.com

In-Soo Nam edited this article.

-

Business & PoliticsKorean chipmakers, battery makers face new risks with Trump’s comeback

Business & PoliticsKorean chipmakers, battery makers face new risks with Trump’s comebackNov 07, 2024 (Gmt+09:00)

4 Min read -

BatteriesHigh-performance 4680 battery war is on; LG Energy takes lead over rivals

BatteriesHigh-performance 4680 battery war is on; LG Energy takes lead over rivalsAug 30, 2024 (Gmt+09:00)

3 Min read -

BatteriesLG Energy signs multi-billion-dollar LFP battery deal with Renault

BatteriesLG Energy signs multi-billion-dollar LFP battery deal with RenaultJul 02, 2024 (Gmt+09:00)

3 Min read -

BatteriesUltium Cells Spring Hill: LG, GM’s EV battery bastion in North America

BatteriesUltium Cells Spring Hill: LG, GM’s EV battery bastion in North AmericaJun 04, 2024 (Gmt+09:00)

4 Min read -

BatteriesLG Energy, Ford’s battery JV in Turkey scrapped as EV uptake slows

BatteriesLG Energy, Ford’s battery JV in Turkey scrapped as EV uptake slowsNov 12, 2023 (Gmt+09:00)

3 Min read -

BatteriesKorea’s battery trio aims to outsmart Chinese rivals in US

BatteriesKorea’s battery trio aims to outsmart Chinese rivals in USOct 16, 2023 (Gmt+09:00)

3 Min read -

The KED ViewTime for South Korea's answer to the US battery subsidy act

The KED ViewTime for South Korea's answer to the US battery subsidy actApr 04, 2023 (Gmt+09:00)

3 Min read