Real estate

CPPIB to enter South Korean rental housing market

The Canadian pension fund manager will form a JV with equity capital of $344 million alongside Korean developer MGRV

By Jan 31, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

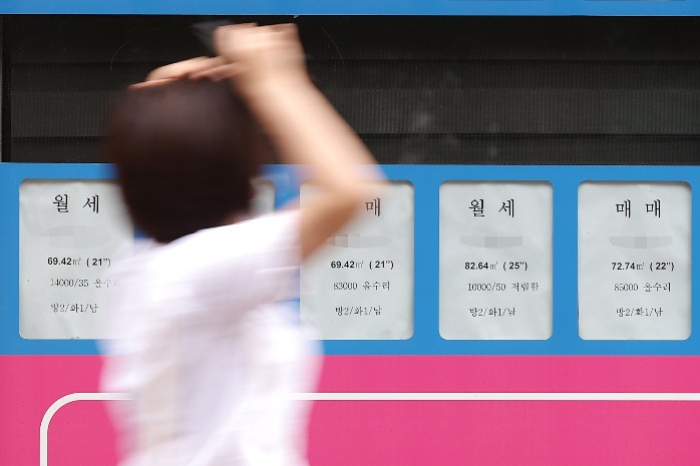

The Canada Pension Plan Investment Board (CPPIB), one of the world’s top 10 global pension fund managers, is joining other foreign asset managers to seize opportunities in South Korea's private rental housing market amid easing regulations and tight supply.

According to sources in the real estate development industry on Friday, CPPIB, or CPP Investments, and Korean property developer MGRV will set up a 95-5% joint venture with an equity capital of 500 billion won ($344 million) to invest in Korean rental housing.

This is the first direct investment in the Korean residential sector by the Canadian pension fund’s investment arm, managing assets worth 675.1 billion Canadian dollars ($466.2 billion) as of September 2024, CPPIB said in a statement released on Jan. 23.

Its advance into the market follows other global real estate asset managers, such as US-based Hines and UK-based M&G Real Estate, which have announced their plans to enter the rental housing market in Seoul.

Last November, Morgan Stanley also formed a JV with local developer SK D&D Co., a real estate development unit of Korea’s SK Group, to invest in the country’s residential properties.

Global household names in the real estate investment sector have shown greater interest in the Korean rental home market since the Korean government eased regulations on institutionalized rental housing in August of last year.

EASED REGULATIONS

Korea’s Ministry of Land, Infrastructure and Transport introduced measures to promote institutional investment in the Korean rental home market with heavy reliance on the country’s unique jeonse system, under which the tenant pays a lump sum refundable deposit, up to 60-70% of the property's value, to a private landlord instead of monthly rent payments.

The jeonse system, which typically runs on a two-year contract, however, has been under scrutiny due to growing housing rental scams in recent years, leading the Korean government to promote other rental options.

As one of them, the Korean government announced it will supply more than 1,000,000 multifamily homes for long-term lease by 2035 to create an institutionalized rental housing market beyond the person-to-person jeonse market.

Under the new plan, real estate investment trust managers, developers and insurers are allowed to operate rental homes for 20-year and longer leases.

The government also vowed to relax the ban on increasing rent despite a change in tenants.

Following the introduction of the new measures, real estate asset managers and capital at home and abroad have rushed to tap the Korean rental housing market to unlock opportunities.

TO DEVELOP PROPERTIES IN SEOUL

CPPIB is one of them, and its JV with MGRV will develop properties in central Seoul.

The Canadian pension fund manager has committed up to 133 billion won to the JV’s seed projects in Seoul.

“This joint venture offers an excellent opportunity to enter the residential sector in Korea and meet the strong demand for high-quality rental housing in the greater Seoul area where half of Korea’s population resides,” said Sophie van Oosterom, managing director and head of Real Estate at CPPIB.

“We are pleased to work alongside an experienced local partner like MGRV to enter this market segment, which we believe can generate attractive long-term returns for the CPP Fund.”

The Korean rental housing market is expected to draw more foreign capital as there is still room to increase Seoul’s monthly housing rent prices, which are relatively lower than those of other big cities like Tokyo, Hong Kong and New York, according to industry observers.

Write to Oh-Sang Yoo at osyoo@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Pension fundsNPS to invest record $1.4 billion in Korean property market in 2025

Pension fundsNPS to invest record $1.4 billion in Korean property market in 2025Dec 18, 2024 (Gmt+09:00)

4 Min read -

EconomyKorea’s household debt sees ‘balloon effect’ as rules tightened in Seoul

EconomyKorea’s household debt sees ‘balloon effect’ as rules tightened in SeoulNov 03, 2024 (Gmt+09:00)

3 Min read -

ASK 2024NPS bullish on real estate in low interest era: chairman

ASK 2024NPS bullish on real estate in low interest era: chairmanOct 16, 2024 (Gmt+09:00)

2 Min read -

Banking & FinanceKookmin to tighten loan limits to cool housing market

Banking & FinanceKookmin to tighten loan limits to cool housing marketAug 26, 2024 (Gmt+09:00)

3 Min read -

EconomyKorea’s household debt hits record high on mortage loans

EconomyKorea’s household debt hits record high on mortage loansAug 20, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN