Economy

Korea’s household debt sees ‘balloon effect’ as rules tightened in Seoul

With overall household lending at an elevated level, authorities are concerned about the BOK’s easing monetary stance

By Nov 03, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s household lending market is witnessing a balloon effect as tighter government lending rules for Seoul and its surrounding metropolitan area prompt people to flock to regional, online and secondary financial institutions.

According to industry data on Sunday, the outstanding balance of household lending by Korea’s five commercial banks stood at 732.08 trillion won ($523.8 billion) at the end of October, up 1.1 trillion won, or 0.2%, from 730.97 trillion won in the previous month.

Last month’s increased household debt was only a fifth of September’s 5.6 trillion won growth.

The significant slowdown was seen mainly at big commercial banks in the capital region thanks to the government’s stricter lending regulations.

With borrowing becoming more difficult in the Seoul metro region, households have flocked to regional banks, online banks, and second-tier financial organizations instead, creating a balloon effect, data showed.

Analysts said the country’s household debt situation will remain precarious, clouding growth in Asia’s fourth-largest economy and keeping the Bank of Korea in a bind over its next monetary easing move.

TIGHTER LENDING RULES

In September, the Financial Services Commission (FSC), Korea’s top financial regulatory body, implemented the second phase of the stressed debt service ratio (DSR) regulation, limiting individual borrowing capacity.

Major banks followed suit, halting mortgage loans for multiple homeowners, restricting individuals’ requests for mortgage loans and raising their lending rates to curb the growth of household debt.

Banks’ mortgage loan interest rates rose to more than 4% per annum, on average, from 3% previously.

The FSC originally planned to implement tighter DSR rules in July but delayed it until Sept. 1 to limit any negative impact on deeply indebted households and individuals.

The five banks are KB Kookmin, Shinhan, Hana, Woori and Nonghyup, which belong to KB Financial Group, Shinhan Financial Group, Hana Financial Group, Woori Financial Group and Nonghyup Financial Group, respectively.

AGGRESSIVE LENDING BY LOCAL, ONLINE, SECOND-TIER BANKS

As the government squeezed major lenders in the Seoul metropolitan area to refrain from lending, the balloon bulged elsewhere.

Local banks, online banks, savings banks, cooperatives and other second-tier financial institutions have aggressively courted households and individuals by offering them relatively lower mortgage loans, a strategy that aims to expand their client base and hike profits.

On Oct. 8, Busan Bank unveiled the mortgage product "ONE Home Loan,” with an annual interest rate of 3.76%, lower than KB Kookmin Bank’s 3.99% and Shinhan Bank’s 4.26%.

BNK Kyongnam Bank lowered the annual rate of its "BNK Mobile Home Loan" to 3.99%.

Data showed household loans provided by secondary financial institutions alone increased by 2 trillion won in October from the month prior.

“October’s total household lending, including those from the five major banks and regional, online, and secondary financial institutions, seems to be similar to or even greater than the previous month’s 5.2 trillion won,” said an FSC official.

CLOSELY MONITORING

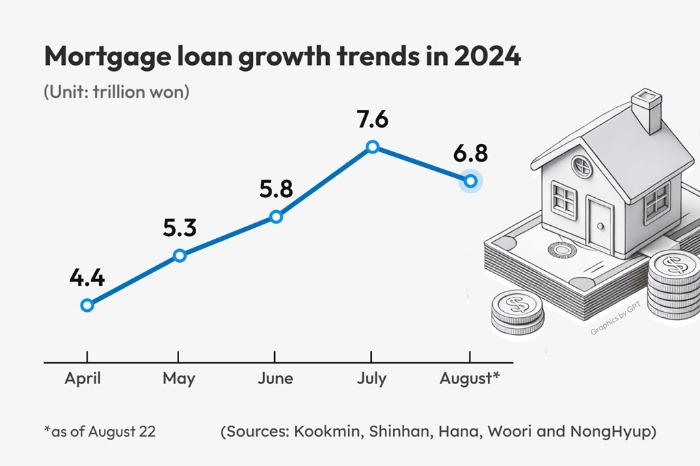

Overall household lending growth was boosted by a surge in mortgage loan demand, which grew amid signs of a recovery in the property market.

The financial authorities are closely monitoring household debt growth at secondary financial institutions.

Last month, the FSC held household debt-related meetings twice to review household lending and issued warnings to second-tier financial institutions.

The regulatory body advised cooperatives and mutual finance companies to refrain from mortgage lending, a relatively easy means of gaining profits, and urged them to focus on supporting mid- and low-credit borrowers from the low income brackets.

Financial regulators, however, are increasingly concerned because blanket regulations could restrict low-income individuals’ access to funding for their financial needs.

Last month, the central bank slashed its benchmark interest rate by a quarter percentage point to 3.25% — the central bank’s first rate cut in more than four years.

Write to Hanjong Choi and Eui-Jin Jeong at onebell@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Real estateKorea’s financial exposure to real estate nearly doubles in 10 years

Real estateKorea’s financial exposure to real estate nearly doubles in 10 yearsOct 13, 2024 (Gmt+09:00)

3 Min read -

Central bankBOK flags more rate cuts but in gradual, small steps

Central bankBOK flags more rate cuts but in gradual, small stepsOct 11, 2024 (Gmt+09:00)

3 Min read -

EconomyKorea’s household debt hits record high on mortage loans

EconomyKorea’s household debt hits record high on mortage loansAug 20, 2024 (Gmt+09:00)

2 Min read -

EconomyS.Korea’s July household debt grows at fastest pace in over 3 years

EconomyS.Korea’s July household debt grows at fastest pace in over 3 yearsAug 01, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN