Hyundai Motor logs highest-ever Q3 revenue; margin drops

Its operating profit margin dipped to 8.3% but it is sticking to the 8-9% profit margin guidance for all of 2024

By Oct 24, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Hyundai Motor Co. on Thursday reported its worst quarterly profit margin for this year, despite delivering its highest-ever revenue for a third quarter, on a drop in sales volume and aggressive sales promotion in overseas markets.

Sports utility vehicles and high-end cars such as Genesis and hybrid models led its sales higher as the softening Korean won made its vehicles more affordable than other foreign brands.

But the hefty sales incentives it offered in the US and Europe, including warranty extensions on its Santa Fe SUVs, ate away at its profit margins, while rising inflation increased labor costs.

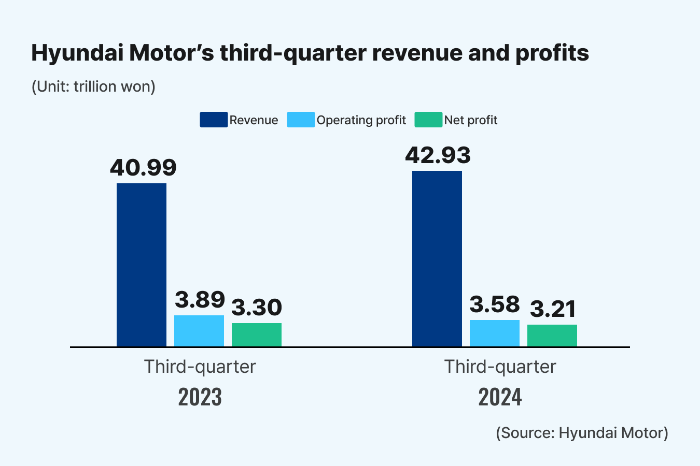

Its operating profit slid 6.5% on-year to 3.6 trillion won ($2.6 billion) in the July-September quarter on a consolidated basis. It missed market expectations of 3.9 trillion won.

Its operating profit margin came in at 8.3%, compared with 9.5% in the second quarter and 8.7% in the first quarter of this year.

In comparison, its revenue rose 4.7% on-year to 42.9 trillion won ($31 billion) in the quarter, in line with market consensus. It marked the strongest revenue for a third quarter in its history.

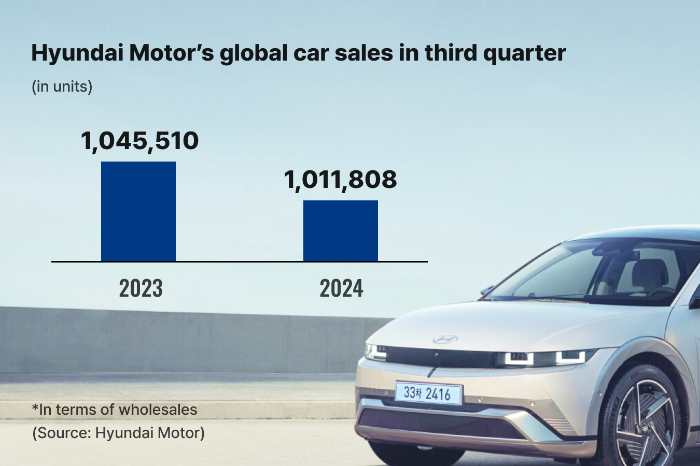

Hyundai Motor's global sales decreased 3.2% on-year to 1,011,808 units in the third quarter. Hybrid vehicles accounted for over 10% of them.

In the domestic market, its sales edged up 1.8% to 169,901 units, led by SUVs and hybrids such as the revamped Santa Fe hybrid.

Hyundai gave a cautious outlook, citing a slowing economy, the won’s weakness and interest rate cuts, as well as escalating geopolitical risks such as the conflict in the Middle East and the prolonged war between Ukraine and Russia.

Further, intensifying competition with Chinese electric vehicle makers poses a threat to Hyundai amid a prolonged EV chasm, or a slowdown in demand.

As part of cost-cutting efforts, Hyundai is considering replacing some EV batteries with lithium iron phosphate (LFP), cheaper than ternary batteries, a Hyundai Motor executive said during its earnings call.

OP MARGIN GUIDANCE

Hyundai Motor is sticking to its operating profit margin guidance of 8-9% for all of 2024.

It has decided to pay a 2,000 won dividend per share for the third quarter, matching its dividend payments in the first and second quarters.

Write to Jae-Fu Kim at hu@hankyung.com

Yeonhee Kim edited this article.

-

AutomobilesHyundai Motor debuts on Indian bourses in its 1st offshore IPO

AutomobilesHyundai Motor debuts on Indian bourses in its 1st offshore IPOOct 22, 2024 (Gmt+09:00)

3 Min read -

Electric vehiclesHyundai to produce Creta EV in India for January launch

Electric vehiclesHyundai to produce Creta EV in India for January launchOct 20, 2024 (Gmt+09:00)

2 Min read -

Future mobilityHyundai Motor, Waymo forge multi-year, strategic partnership

Future mobilityHyundai Motor, Waymo forge multi-year, strategic partnershipOct 04, 2024 (Gmt+09:00)

5 Min read -

AutomobilesHyundai, Kia’s September US sales fall; hybrids buck weak sales trend

AutomobilesHyundai, Kia’s September US sales fall; hybrids buck weak sales trendOct 02, 2024 (Gmt+09:00)

2 Min read -

AutomobilesHyundai's accumulated production hits 100 mn unit milestone

AutomobilesHyundai's accumulated production hits 100 mn unit milestoneSep 30, 2024 (Gmt+09:00)

2 Min read -

-

Corporate strategyHyundai Motor cuts 2030 sales goals as EV chasm likely protracted

Corporate strategyHyundai Motor cuts 2030 sales goals as EV chasm likely protractedSep 19, 2024 (Gmt+09:00)

3 Min read -

-

AutomobilesHyundai, Kia post record August US sales, driven by hybrids, EVs

AutomobilesHyundai, Kia post record August US sales, driven by hybrids, EVsSep 05, 2024 (Gmt+09:00)

3 Min read -

-

-

Electric vehiclesHyundai to release Genesis hybrid variants in 2025

Electric vehiclesHyundai to release Genesis hybrid variants in 2025Feb 13, 2024 (Gmt+09:00)

3 Min read