SK E&S mulls sale of real estate to boost clean energy biz

With the proceeds from the sale worth up to 500 billion won ($376 million), the company plans to expand the hydrogen business

By Sep 13, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

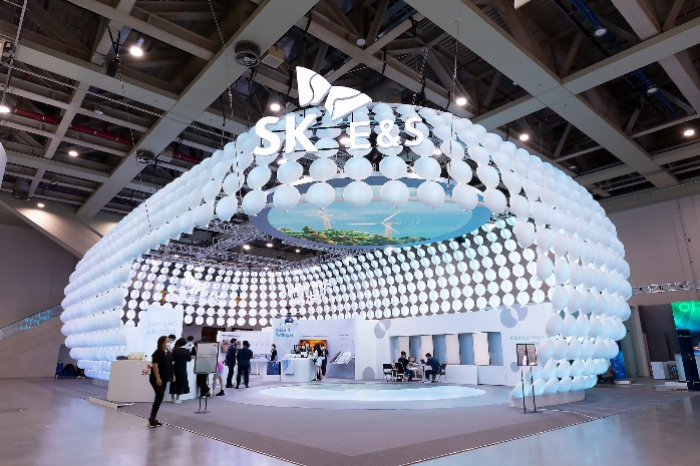

SK E&S Co., the natural gas business unit of South Korea’s SK Group, is considering selling its real estate asset in Seoul, which is expected to fetch up to 500 billion won ($376 million), to give a boost to its new renewable energy business.

According to Korean energy industry sources, SK E&S is reviewing an option to cash in on a building and land occupied by its fully owned city gas subsidiary Ko-won Energy Service in the affluent Gangnam area of Seoul.

It is said to be in talks with one of Korea’s major medical centers to sell off the real estate asset, whose estimated worth is between 400 billion and 500 billion won.

SK E&S is seeking to unload the building and land to raise money needed to expand its new growth engine in the clean energy sector, such as hydrogen, said industry observers.

TO EXPAND A CLEAN ENERGY PORTFOLIO

The company is Korea’s top city gas supplier with multiple related subsidiaries. It is also the country’s biggest liquefied natural gas (LNG) importer, bringing in 5 million tons of LNG of the 9 million tons that the country imports annually.

It has been seeking to add new renewable energy sources to its portfolio with a focus on blue hydrogen, solar energy and wind power farms.

SK E&S is a major stakeholder in the Barossa and Caldita fields off the coast of northern Australia, which are estimated to have at least 70 million tons of natural gas reserves, about a two-year supply for Korea.

It has been operating development projects in the fields with the other shareholders: Australia’s oil and gas company Santos Corp. and ConocoPhillips Corp., a US crude oil producer.

The Korean LNG importer plans to start producing 250,000 tons of blue hydrogen annually in 2026 using low-carbon natural gas from the Barossa field.

Blue hydrogen is decarbonized hydrogen, which is hydrogen manufactured by natural gas reforming coupled with carbon capture and storage (CCS).

With its blue hydrogen project, the company is projected to join a Korean government bid for a clean hydrogen power project, industry observers said.

SK E&S in 2022 announced its foray into the CCS business as part of an effort to enhance its green energy portfolio.

Besides hydrogen and CCS businesses, SK E&S is also building its presence in the solar and wind energy markets.

Write to Woo-Sub Kim at duter@hankyung.com

Sookyung Seo edited this article.

More to Read

-

EnergySK E&S creates value chain from FPSO, gas field project to carbon capture

EnergySK E&S creates value chain from FPSO, gas field project to carbon captureSep 10, 2024 (Gmt+09:00)

3 Min read -

Hydrogen economySK E&S builds world’s largest hydrogen liquefaction plant

Hydrogen economySK E&S builds world’s largest hydrogen liquefaction plantMay 08, 2024 (Gmt+09:00)

1 Min read -

Hydrogen economySK E&S to strengthen Korea's liquid hydrogen ecosystem

Hydrogen economySK E&S to strengthen Korea's liquid hydrogen ecosystemDec 18, 2023 (Gmt+09:00)

1 Min read -

Carbon neutralitySK E&S' low-carbon LNG project enjoys tailwind in Australia

Carbon neutralitySK E&S' low-carbon LNG project enjoys tailwind in AustraliaAug 21, 2023 (Gmt+09:00)

2 Min read -

Carbon neutralitySK E&S seeks Australia's support for Barossa LNG, CCS projects

Carbon neutralitySK E&S seeks Australia's support for Barossa LNG, CCS projectsJul 26, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN