Energy

SK E&S creates value chain from FPSO, gas field project to carbon capture

SK’s first FPSO under construction at Seatrium Yard will be used to extract gas from the Australian Barossa project

By Sep 10, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SINGAPORE – At Seatrium Admiralty Yard on Jurong Island, southwest of Singapore, some 2,000 workers are busy welding gas pipes and doing other construction work on a ship the size of three football fields combined.

The massive ship, 64 meters wide and 360 meters long and nicknamed the "floating gas production factory,” is scheduled for completion by the end of the first quarter of next year.

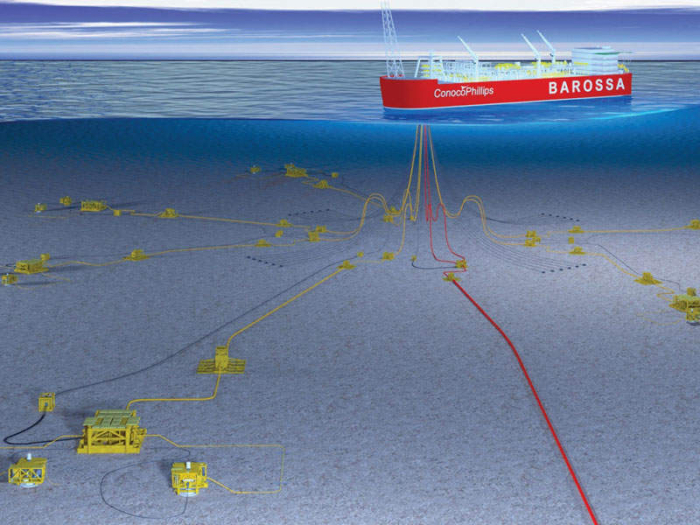

Officially called a floating production storage and offloading (FPSO) vessel, the ship is responsible for extracting natural gas from the seabed and transferring it to land.

One of the owners of this ship – the largest of its kind in the world – is SK E&S Co., the natural gas business unit of South Korea’s SK Group.

According to SK E&S, the FPSO vessel will be used to extract 3.5 million tons of natural gas annually 260 meters deep underwater from the Barossa gas field off Australia’s Northern Territory.

The depth of the sea where the Barossa gas field is located requires an FPSO facility that can withstand strong water pressure and waves to extract gas. No other alternatives are available, says an SK E&S official.

The Korean company has spent over 2 trillion won ($1.5 billion) building the FPSO ship since 2021.

SK E&S aims to begin producing natural gas from the gas field by the third quarter of next year after a two-month trial run of the FPSO vessel.

STABLE GAS PROCUREMENT

SK E&S embarked on this costly overseas gas field development project to ensure a stable gas procurement and supply.

Although the company brings 5 million tons a year of LNG to Korea out of the 9 million tons that the country imports annually, it is always challenging to secure a stable supply via long-term contracts.

As Korea’s top city gas supplier, SK E&S has been trying to meet growing liquefied natural gas (LNG) demand in Korea.

SK E&S has mainly purchased LNG from the Tangguh gas field in Indonesia and North American shale gas reserves.

Its contract with Indonesia, however, will expire in 2026, prompting the company to secure its own gas fields.

In 2012, SK E&S decided to join the Barossa gas field project.

With global energy companies such as Shell and ConocoPhillips confirming enough gas deposits through evaluations, the Barossa gas project was seen as a "sure thing."

SK E&S joined the project by covering the evaluation costs of the gas field in 2014. SK later formed a consortium with Australian energy firm Santos Ltd. and Japan's JERA Co. to jointly develop and own the project.

Holding a 37.5% stake in the project, SK E&S is now the second-largest shareholder of the project after Santos, which owns a 50% stake. SK has invested $4.3 billion in total.

The Barossa gas field is estimated to hold 70 million tons of natural gas. SK E&S plans to bring to Korea 1.3 million tons a year of natural gas out of the planned annual extraction volume of 3.5 million tons.

The imported gas will be used to produce clean hydrogen or in LNG power plants.

VALUE CHAIN FROM GAS PRODUCTION TO CARBON CAPTURE

In addition to acquiring a stake in the Barossa gas field, SK E&S has taken further steps to improve cost competitiveness.

In 2021, the company acquired a 25% stake in the nearby Darwin LNG plant for $390 million to liquefy the natural gas extracted from Barossa and capture carbon emissions.

In addition to the Barossa project, SK also took part in a carbon capture and storage (CCS) project at the Bayu-Undan gas field, located off the south coast of East Timor. The two projects provide SK with a value chain from gas production to liquefaction, carbon capture and storage, and cogeneration.

"Now that SK E&S is directly involved in projects such as gas field development, LNG plant operation and CCS, its business costs will go down significantly, leading to an increase in annual operating profits,” said an industry official.

SK E&S is in the middle of merging with SK Innovation Co., an energy unit of SK Group to cut costs and improve business synergy.

From the Barossa gas field, SK E&S plans to supply condensate, a naphtha raw material, to SK Innovation.

Write to Hyeon-woo Oh at ohw@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Mergers & AcquisitionsSK Innovation-SK E&S merger gains shareholders’ nod

Mergers & AcquisitionsSK Innovation-SK E&S merger gains shareholders’ nodAug 27, 2024 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsSK Innovation looks to merge with SK E&S for organic growth

Mergers & AcquisitionsSK Innovation looks to merge with SK E&S for organic growthJun 20, 2024 (Gmt+09:00)

3 Min read -

Carbon neutralitySK E&S seeks Australia's support for Barossa LNG, CCS projects

Carbon neutralitySK E&S seeks Australia's support for Barossa LNG, CCS projectsJul 26, 2023 (Gmt+09:00)

1 Min read -

Carbon neutralitySK E&S to launch London office in view of growth opportunities in Europe

Carbon neutralitySK E&S to launch London office in view of growth opportunities in EuropeJul 04, 2022 (Gmt+09:00)

2 Min read -

Carbon neutralitySK E&S, Australia’s Santos eye joint carbon capture, hydrogen projects

Carbon neutralitySK E&S, Australia’s Santos eye joint carbon capture, hydrogen projectsMay 26, 2022 (Gmt+09:00)

1 Min read -

Carbon neutralitySK E&S invests $110 million in world’s largest carbon capture project

Carbon neutralitySK E&S invests $110 million in world’s largest carbon capture projectMay 10, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN