Korean banking group's Q1 profits drop on ELS sales

The share prices of the four largest banking groups extend gains as investors bet on dividend payment increases

By Apr 23, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

The combined net profit at South Korea’s four largest financial services firms, including KB Financial Group, are estimated to have dropped nearly 20% in the first quarter of this year from their record-high quarterly profits in the year-earlier period, after booking more than 1.4 trillion won ($1 billion) in expenses related to their sale of risky derivatives.

Last month, the regulatory Financial Supervisory Service advised them to compensate for part of several billion-dollar investment losses from equity-linked securities (ELS) tied to the performance of the Hang Seng China Enterprises Index (HSCEI) they had sold to individual investors since 2021.

The regulatory body is set to release detailed guidelines for the compensation soon for their alleged misselling of the derivative products.

Their poor quarterly earnings followed their record loan losses in 2023 on the back of stalled real estate projects and soured overseas commercial property investments.

Looking ahead, however, analysts paint a bright picture for the domestic banking sector as elevated lending rates are expected to continue to boost their interest income amid dashed hopes for imminent interest rate cuts. Interest income makes up 70% of Korean banks’ earnings.

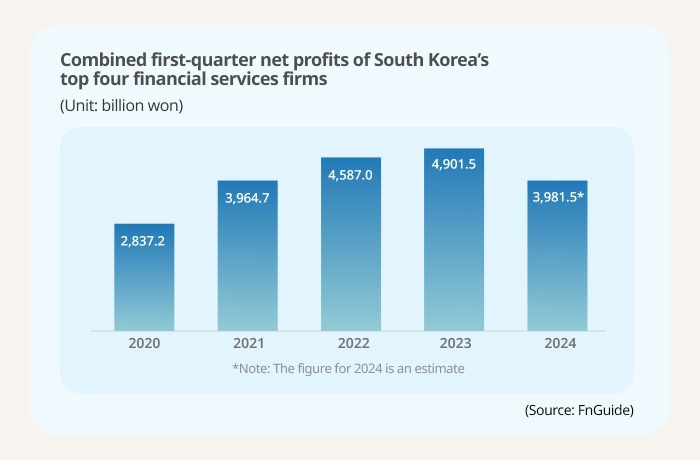

According to financial data provider FnGuide, KB Financial Group, Shinhan Financial Group, Hana Financial Group and Woori Financial Group are projected to have earned a combined 3.98 trillion won in net profit in the first quarter.

That marked a 19% decrease from the prior year’s 4.90 trillion won, their highest-ever net profit. A string of interest rate hikes between 2021 and early 2023 drove their first-quarter profit to their highest-ever levels in the two years in a row in 2022 and 2023.

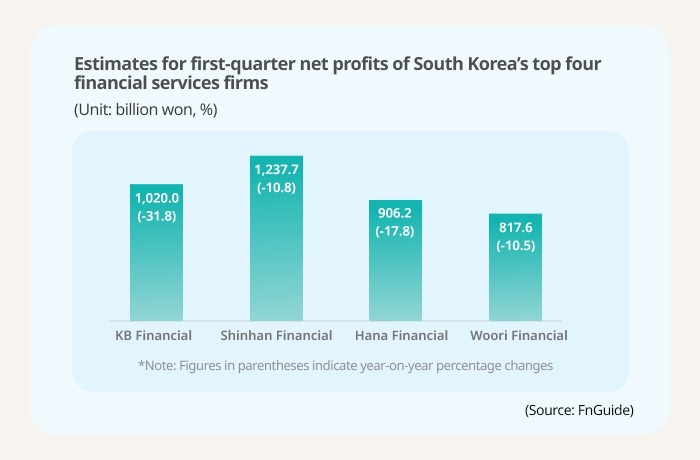

By company, KB Financial saw the biggest fall in net profit among the four financial services firms with an outstanding balance of 7.67 trillion won of HSCEI-tied ELS sales to retail investors.

It is projected to report a 31.8% drop on-year to 1.02 trillion won in first-quarter net profit on April 25.

Its banking arm Kookmin is known to reflect about 900 billion won as non-operating expenses for the planned compensation for the ELS losses caused by the freefall in Hong Kong's main index.

Shinhan, Hana and Woori are slated to release first-quarter results on April 26.

Based on the estimated first-quarter results, Shinhan overtook Koomin as South Korea’s No. 1 financial services group.

Woori Financial Group has a smaller balance of ELS sales amounting to 41.3 billion won.

But disappointing results at its non-banking arms such as credit card and installment financing firms were blamed in large part for the 10.5% decline to 817.6 billion won in first-quarter net profit, according to FnGuide.

| Company | Balance of HSCEI-tied ELS sales | Expenses booked for compensation for HSCEI-tied ELS losses |

| KB Financial Group | 7,669.5 billion won | 900 billion won |

| Shinhan Financial Group | 2,370.1 billion won | 300 billion won |

| Hana Financial Group | N/A | 200 billion won |

| Woori Financial Group | 41.3 billion won | N/A |

| (Source: FnGuide) |

||

By contrast, financial services firms based in provinces bucked the trend as they were not involved in the ELS fiasco.

JB Financial Group, the parent of Kwangju Bank and Jeonbuk Bank, on Monday reported a 6.0% growth on-year to 173.2 billion won in first-quarter profit, its largest-ever quarterly earnings.

SHARE PRICE GAINS

In the Korean stock market, financial services companies are expected to perform better on expectations that they might bump up dividend payouts for tax reasons.

Shares in KB, Shinhan and Hana extended their upward run on Tuesday. Woori's share price has remained firm since April 18.

Last Friday, Choi Sang-mok, deputy finance minister and minister of economy and finance, told reporters that the government would slash taxes on companies that take measures to return profits to investors.

His remarks alleviated concerns the government’s business-friendly proposals might backfire after the ruling People Power Party failed to take a majority in parliament in the April 10 general election.

Write to Bo-Hyung Kim and Hyosung Jeon at kph21c@hankyung.com

Yeonhee Kim edited this article.

-

Banking & FinanceKorean banking groups see record-high loan losses in 2023

Banking & FinanceKorean banking groups see record-high loan losses in 2023Feb 27, 2024 (Gmt+09:00)

1 Min read -

RegulationsState intervention in HSCEI-tied ELS sale debacle could backfire: scholars

RegulationsState intervention in HSCEI-tied ELS sale debacle could backfire: scholarsFeb 19, 2024 (Gmt+09:00)

4 Min read -

Korean stock marketKorean banks stop ELS sales after HSCEI debacle

Korean stock marketKorean banks stop ELS sales after HSCEI debacleJan 31, 2024 (Gmt+09:00)

4 Min read -

Korean stock marketKorea’s ELS market to stagnate after HSCEI debacle: KOFIA chairman

Korean stock marketKorea’s ELS market to stagnate after HSCEI debacle: KOFIA chairmanJan 23, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketKorean investors doomed to suffer $171 mn losses from HSCEI ELS

Korean stock marketKorean investors doomed to suffer $171 mn losses from HSCEI ELSJan 22, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketS.Korea launches official probe into HSCEI-tied ELS sale

Korean stock marketS.Korea launches official probe into HSCEI-tied ELS saleJan 08, 2024 (Gmt+09:00)

5 Min read -

Banking & FinanceKookmin Card acquires Cambodian leasing firm at $5.2 mn

Banking & FinanceKookmin Card acquires Cambodian leasing firm at $5.2 mnJan 13, 2023 (Gmt+09:00)

1 Min read