Korean chipmakers

South KoreaŌĆÖs chip design firms go abroad to tap $426 billion market

As Big Tech such as Apple and Google move to make chips in-house, demand for chip designers is rising accordingly

By Apr 16, 2024 (Gmt+09:00)

3

Min read

Most Read

Alibaba eyes 1st investment in Korean e-commerce platform

Blackstone signs over $1 bn deal with MBK for 1st exit in Korea

Korea's Lotte Insurance put on market for around $1.5 bn

OCI to invest up to $1.5 bn in MalaysiaŌĆÖs polysilicon plant

NPS loses $1.2 bn in local stocks in Q1 on weak battery shares

South KoreaŌĆÖs chip design companies are turning their sights overseas to tap into the 593 trillion won ($426 billion) system semiconductor market.

According to industry officials on Tuesday, Samsung Electronics Co.'s design solution partners (DSPs) are actively establishing branch offices or clinching business cooperation deals with local partners in major international markets.

ADTechnology Co., a Korean chip design firm, expects this year to be a watershed for the company as its US corporation launched last July in Silicon Valley and is soon scheduled to begin mass production of chip products.

The company also operates facilities in Ho Chi Minh City, Vietnam and Munich, Germany.

Gaonchips Co., another Samsung DSP, focuses on the Japanese market.

In 2022, the company established a corporation in Japan and in February of this year, it signed a business cooperation pact with Tomen Devices Corp., a Tokyo-based electronics trading company that markets Samsung-made chip products.

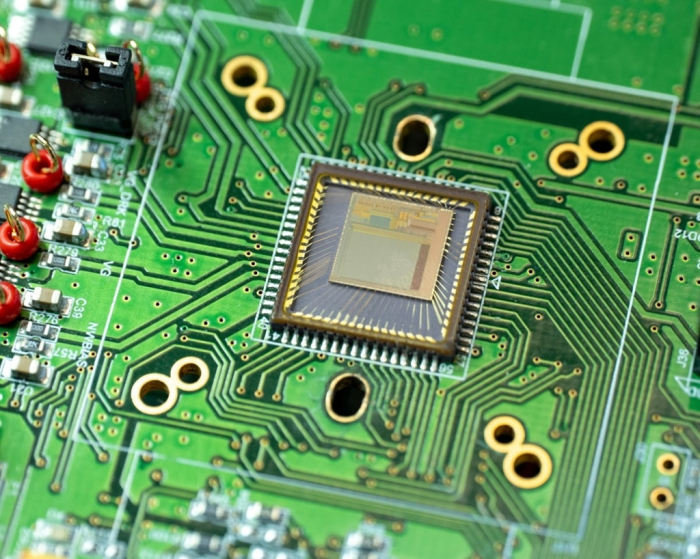

A semiconductor chip design house acts as a bridge between foundry firms such as Samsung and Taiwan Semiconductor Manufacturing Co. (TSMC) and fabless companies like Qualcomm Inc.

Chip designers make integrated circuits designed by fabless companies into marketable products to be manufactured by foundry firms.

Japan has several global fabless firms, including Sony, Panasonic and Renesas Electronics.

ASICLAND Co., another Korean system-on-a-chip (SoC) design firm, has set up a joint venture with a Silicon Valley startup in the US. ASICLAND is KoreaŌĆÖs sole design partner with TSMC, the worldŌĆÖs largest foundry or contract chipmaker.

Last month, ASICLAND held an investor relations session in Hong Kong and Singapore to brief on its global business strategies.

Other Korean chip design houses such as CoAsia Co. and SEMIFIVE seek to expand their businesses in the US, India and China.

China has some 3,400 fabless companies, including Semiconductor Manufacturing International Corp. (SMIC) and Hua Hong Semiconductor Ltd.

CHIP DESIGNERS IN HIGH DEMAND

With Big Tech companies such as Apple and Google moving to make chips in-house, chip designers are increasingly playing a significant role, analysts said.

ŌĆ£As the development of advanced chips requires complex and demanding processes, chip design housesŌĆÖ role of coordination between the fabless firms and foundries has become more important than ever,ŌĆØ said Gaonchips Chief Executive Jung Kyu-dong.

TSMC has been leading the industryŌĆÖs move to strengthen ties with chip design houses by establishing an ecosystem called the Open Innovation Platform (OIP).

Within the OIP infrastructure, the company also launched a Value Chain Alliance (VCA) program to serve a broader range of customers. VCA members are independent design service companies working closely with TSMC to help system companies, application-specific integrated circuit (ASIC) companies and emerging startups bring their innovations to production.

KoreaŌĆÖs ASICLAND is among the eight VCA members.┬Ā

Samsung created an infrastructure dubbed the Samsung Advanced Foundry Ecosystem (SAFE) to promote its partnership with design houses in 2018.

Under the SAFE program, Samsung runs a DSP group. Its members include ADTechnology, SEMIFIVE, CoAsia and Gaonchips.

THE $426 BILLION SYSTEM CHIP MARKET

ŌĆ£Demand for system chips such as AI semiconductors will grow significantly in coming years as you can see the response to ChatGPT,ŌĆØ said Park Jun-kyu, CEO of ADTechnolgy.

According to the Korea Institute for Industrial Economics & Trade (KIET), the global system chip market stood at 593 trillion won ($426 billion) as of 2022.

The US is the worldŌĆÖs largest system chip market with a 54.5% market share, followed by Europe (11.8%), Taiwan (10.3%), Japan (9.2%) and China (6.5%).

The Korean market accounts for a mere 3.3% at 20 trillion won.

The Korean government plans to set up a research and business development center to assist local chip design houses in their advance into the US market.

ŌĆ£With Big Tech such as Apple, Tesla, Google, Amazon and Facebook moving to develop semiconductors in-house, the status of chip design house will rise further,ŌĆØ said Kim Yong-seok, an electronic and electrical engineering professor at Sungkyunkwan University in Seoul.

Write to Kyoung-Ju Kang at qurasoha@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung to produce 290-layer V9 NAND to win chip stacking war

Korean chipmakersSamsung to produce 290-layer V9 NAND to win chip stacking warApr 11, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to supply $752 million in Mach-1 AI chips to Naver, replace Nvidia

Korean chipmakersSamsung to supply $752 million in Mach-1 AI chips to Naver, replace NvidiaMar 22, 2024 (Gmt+09:00)

4 Min read -

Korean startupsBig Tech engineers rush to KoreaŌĆÖs AI chip startups as potential looms

Korean startupsBig Tech engineers rush to KoreaŌĆÖs AI chip startups as potential loomsMar 20, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung takes on TSMC with strengthened chip design IPs

Korean chipmakersSamsung takes on TSMC with strengthened chip design IPsJun 14, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersChip designers in high demand despite industry slowdown

Korean chipmakersChip designers in high demand despite industry slowdownFeb 17, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN