LG Energy to produce 4680 batteries in August for Tesla, others: CEO

The world’s No. 3 battery maker also plans mass production of LFP batteries from the latter half of 2025

By Feb 15, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

LG Energy Solution Ltd., the world’s third-largest battery maker, plans to begin mass production of larger format cylindrical cells used by Tesla Inc. as early as August to meet growing demand for the next-generation battery type.

LG Energy Chief Executive Kim Dong-myung said on Thursday that he also expects the South Korean company to start producing lithium iron phosphate (LFP) batteries mostly made by Chinese companies in the latter half of 2025.

“We plan to begin mass production of 4680 batteries at our Ochang plant in Korea in August or September,” Kim told reporters before attending a Korea Battery Industry Association (KBIA) meeting in Seoul. “We’re also in supply talks with automakers other than Tesla.”

At the meeting, he assumed the role as KBIA’s chair, previously taken by Kwon Young-soo, former LG Energy CEO.

Asked if LG will also produce cylindrical batteries with the 4680 cell form factor at LG’s facilities in Nanjing, China, Kim said: “We are looking at various options.”

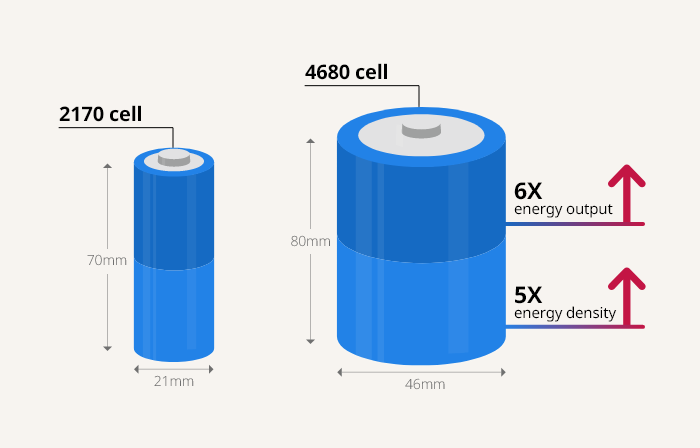

The so-called 4680 battery, which measures 46 millimeters in diameter and 80 mm in length, is being heralded as a game-changer in the battery industry as it is known to increase energy density by five times and output by six times compared to the conventional 2170 type and boost electric vehicles' mileage by 16% on average.

While pouch and prismatic form factors are the most common battery types for many EV makers, some automakers, including BMW, GM and Stellantis, are gradually adopting the 4680 cylindrical type given its strengths.

Tesla, the world’s No. 2 EV maker after China’s BYD Co., is using the 4680 cell made in-house for its EV models but seeking to secure more of the type from other suppliers.

LG Energy said in December 2022 that it would spend billions of dollars on its facilities in Ochang to produce 46-series batteries.

LG’s two crosstown rivals, SK On Co. and Samsung SDI Co., are also working to produce large-size 4680 cylindrical batteries.

Samsung said it is spending heavily to ramp up its 4680-type battery production line for clients, including Tesla.

LFP BATTERIES

LG Energy’s Kim said the company is serious about LFP batteries, saying it will likely begin mass production in the second half of 2025.

The Korean battery trio, which mainly produces nickel-cobalt-manganese (NCM) batteries, is witnessing a fast rise in demand for the rival LFP type that is particularly popular among low-end, entry-level electric cars.

LFP cells are lower in energy density but cheaper to make compared to other types such as NCM batteries. LFP batteries are also more stable, meaning less vulnerable to fire.

Tesla said in 2021 that it will install LFP batteries in all of its standard-range EVs.

With the growing popularity of LFP batteries, Korean companies have joined the race for the cheaper version of battery cells.

China’s Contemporary Amperex Technology Co. Ltd. (CATL) and BYD, the world’s two largest battery makers, are also the industry’s leading LFP battery producers.

SHARING AMPC BENEFITS WITH GM

Asked by reporters about his recent meeting with General Motors CEO Mary Barra in Seoul, LG’s Kim said they discussed closer cooperation in running their 50-50 joint venture, Ultium Cells LLC, which is set to start operations of its Tennessee plant.

Regarding media reports that GM has asked LG to share more than half and up to 85% of the advanced manufacturing production credit (AMPC) benefits that the Korean company receives through Ultium Cells, Kim said: “We’re discussing the matter with GM.”

Under the US government’s AMPC program, eligible battery makers can receive tax benefits, including a $35 tax credit per 1 kilowatt-hour produced by a battery cell and a $10 tax credit per 1 kWh battery module manufactured in North America.

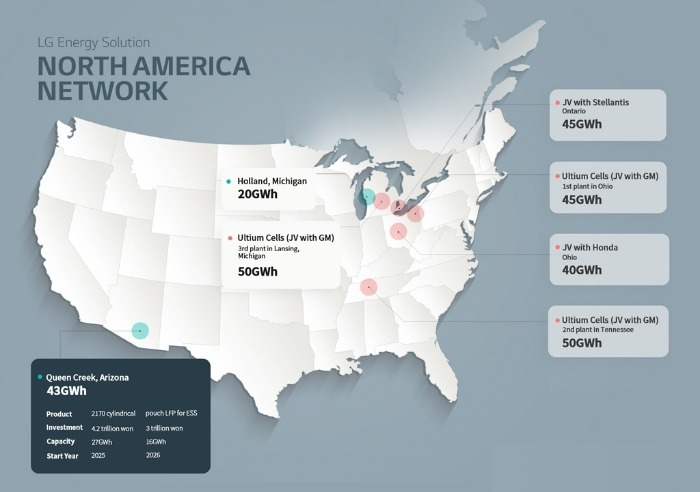

LG Energy is operating and building two plants of its own and six joint factories with automakers in North America for a combined annual capacity of 318 gigawatt-hours (GWh), the largest in the region. Three of these factories are joint investments with GM.

BATTERY JV WITH HYUNDAI IN INDONESIA

Kim said LG Energy’s battery joint venture with Hyundai Motor Co. in Indonesia will be operational in April.

The $1.1 billion battery plant, located in Karawang New Industry City, near Jakarta, broke ground in September 2021 as Hyundai hoped to secure a stable supply of battery cells for its electric cars targeting the ASEAN market.

With an annual capacity of 10 GWh of battery cells, enough for over 150,000 EVs, the 50-50 JV, Hyundai LG Indonesia Green Power, will produce NCMA (nickel cobalt manganese and aluminum) lithium-ion battery cells for Hyundai vehicles, including the IONIQ 5 crossover.

Write to Hyung-Kyu Kim at khk@hankyung.com

In-Soo Nam edited this article.

-

BatteriesLG Energy to buy more Australian lithium for US EV benefits

BatteriesLG Energy to buy more Australian lithium for US EV benefitsFeb 14, 2024 (Gmt+09:00)

2 Min read -

BatteriesGM chair to visit Korea, meet LG Energy, Samsung SDI CEOs

BatteriesGM chair to visit Korea, meet LG Energy, Samsung SDI CEOsFeb 06, 2024 (Gmt+09:00)

2 Min read -

BatteriesLG Energy to supply $748 million worth of batteries to Japan’s Isuzu Motors

BatteriesLG Energy to supply $748 million worth of batteries to Japan’s Isuzu MotorsJan 26, 2024 (Gmt+09:00)

1 Min read -

BatteriesLG Energy, KAIST develop Li-Metal battery tech for improved EV range

BatteriesLG Energy, KAIST develop Li-Metal battery tech for improved EV rangeDec 07, 2023 (Gmt+09:00)

3 Min read -

BatteriesGM asks LG Energy to share huge portion of US EV tax benefits

BatteriesGM asks LG Energy to share huge portion of US EV tax benefitsNov 30, 2023 (Gmt+09:00)

4 Min read -

EarningsLG Energy Q3 profit at record high on gains from US battery tax credit

EarningsLG Energy Q3 profit at record high on gains from US battery tax creditOct 11, 2023 (Gmt+09:00)

3 Min read -

Electric vehiclesHyundai-LG battery JV in Indonesia to power IONIQ 5, other EVs: Chung

Electric vehiclesHyundai-LG battery JV in Indonesia to power IONIQ 5, other EVs: ChungSep 08, 2023 (Gmt+09:00)

4 Min read