Batteries

GM chair to visit Korea, meet LG Energy, Samsung SDI CEOs

Barra will discuss battery supply, prices and US plant operations; it will be her first official visit to Korea since taking the helm

By Feb 06, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

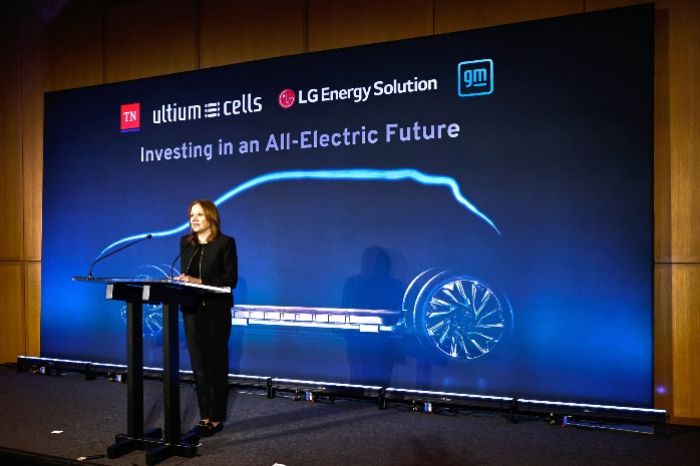

General Motors Chair and Chief Executive Mary Barra will visit South Korea on Wednesday to meet leaders of LG Energy Solution Ltd. and Samsung SDI Co., the US carmaker’s two largest Korean battery suppliers, according to industry sources on Tuesday.

During her visit, the CEO will meet LG Energy Chief Kim Dong-myung and Samsung SDI Chief Choi Yoon-ho to discuss battery supply, unit prices, construction and operations of US factories, sources said. It will be Barra’s first official visit to Korea since she took the helm of GM in 2016.

LG Energy and GM are building or operating three battery plants in the US. Their factory in Ohio started operations in 2022 with 35-gigawatt hours (GWh) of annual production capacity; the Tennessee plant with 35 GWh capacity and the Michigan factory with 50 GWh will begin operations in the first quarter of this year and the first half of next year, respectively.

Samsung SDI and GM are in talks to build a 30 GWh battery plant in Indiana as they entered into a non-binding agreement last June.

Although GM is slowing its EV production amid lower demand for the eco-friendly vehicles, the carmaker will strengthen its ties with LG Energy and Samsung SDI for long-term partnerships, sources said.

During the chair’s visit, GM might ask LG Energy to increase GM's portion of the EV battery tax benefits the two companies together receive through their 50:50 US joint venture Ultium Cells LLC, sources said.

Last November, GM requested that LG Energy share more than half and up to 85% of the advanced manufacturing production credit (AMPC) through the JV in the form of dividends, in exchange for the JV’s profit margin above certain levels, according to sources. The current AMPC ratio between the two firms is around 50:50, sources say.

GM needs financing as its labor deals made last November are estimated to cost $9.3 billion through 2028.

With Samsung SDI, Barra is likely to negotiate the timeline for building a factory. The two firms have secured a site in Indiana intending to operate the facility from 2026, but haven’t yet entered into a binding agreement. There are increasing concerns that the construction will be delayed amid the slow growth of global EV sales.

The US carmaker and Samsung SDI are on track with their memorandum of understanding for the new plan, a GM official told The Korea Economic Daily.

The GM chair is attaching great importance to meeting with the battery makers' CEOs, with a minute-by-minute schedule, an industry source said. Long-term partnerships and investment methods will be primary topics during their meetings, the source added.

Write to Hyung-Kyu Kim and Nan-Sae Bin at khk@hankyung.com

Jihyun Kim edited this article.

More to Read

-

-

BatteriesGM asks LG Energy to share huge portion of US EV tax benefits

BatteriesGM asks LG Energy to share huge portion of US EV tax benefitsNov 30, 2023 (Gmt+09:00)

4 Min read -

AutomobilesHyundai acquires GM’s Indian plant, aims to sell more SUVs, EVs

AutomobilesHyundai acquires GM’s Indian plant, aims to sell more SUVs, EVsAug 16, 2023 (Gmt+09:00)

4 Min read -

AutomobilesGM Korea releases new Trailblazer geared for S.Korean market

AutomobilesGM Korea releases new Trailblazer geared for S.Korean marketJul 19, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN