Real estate

Seoul office leasing turns lender’s market as vacancy rates at 2023 low

Analysts expect office leasing prices to remain elevated as people return to the workplace post-pandemic

By Nov 28, 2023 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

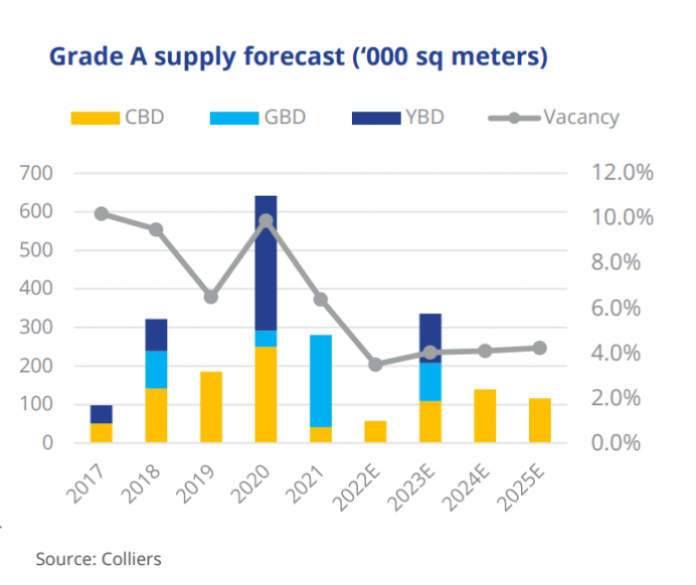

According to RealtyPlanet Co., a Seoul-based commercial real estate consultant, office building vacancy rates in Seoul stood at this year’s low of 2.13% in October, down from 2.4% in September.

The October figure is well below the so-called natural vacancy rate of around 5%.

Of Seoul’s three major business districts – the Yeouido Business District (YBD), Gangnam Business District (GBD) and the Central Business District (CBD) near the Seoul Station – Yeouido posted the lowest vacancy rate of 0.99%, down from 1.35% in September.

The GBD’s vacancy rate declined to 1.18% from 1.27% over the same period while the CBD’s rate dropped to 3.38% from 3.76%.

RealtyPlanet attributed the vacancy rate fall to the growing number of people returning to their offices, quitting their work-from-home business practices.

OFFICE LEASING: A LENDER’S MARKET

According to a recent survey of major companies by the Korea Enterprises Federation, 90.3% of the respondents said they plan to reduce or completely abolish their work-from-home programs.

As demand for offices rebounds, so do office leasing prices.

Industry data show the net occupy cost (NOC) of office buildings in Seoul was 197,854 won ($153) per 3.3 square meters in October, up from 197,590 won in September.

The NOC for the GBD was the highest at 205,718 won, followed by the CBD’s 194,874 won and the YBD’s 189,082 won.

“Office lease and management costs keep rising due to the low office vacancy rates and inflation. Office leasing will be a lender’s market for the time being,” said Jung Soo-min, chief executive of RealtyPlanet.

Write to In-Hyeok Lee at twopeople@hankyung.com

In-Soo Nam edited this article.

More to Read

-

EconomyKorea Inc.’s record short-term borrowing raises specter of debt overhang

EconomyKorea Inc.’s record short-term borrowing raises specter of debt overhangOct 18, 2023 (Gmt+09:00)

3 Min read -

Real estateGrade-A offices in Seoul hit lowest vacancy rate in Q1 2022

Real estateGrade-A offices in Seoul hit lowest vacancy rate in Q1 2022Apr 11, 2022 (Gmt+09:00)

2 Min read -

ASK 2021What to do with office buildings is biggest concern: POBA CIO

ASK 2021What to do with office buildings is biggest concern: POBA CIOOct 28, 2021 (Gmt+09:00)

1 Min read -

Real estateDowntown Seoul office building prices rise to record high

Real estateDowntown Seoul office building prices rise to record highMay 18, 2021 (Gmt+09:00)

5 Min read -

US Prudential unit to buy Seoul office building for $157 mn amid vacancy concerns

US Prudential unit to buy Seoul office building for $157 mn amid vacancy concernsDec 02, 2016 (Gmt+09:00)

2 Min read

Comment 0

LOG IN