Batteries

LG Energy Solution to start producing cheaper EV batteries

LG Energy expects sales growth to slow due to weakening EV demand, Chinese rivals; share hits 15-month low

By Oct 25, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

LG Energy Solution Ltd., the world’s second-largest electric vehicle battery maker, plans to manufacture cheaper EV batteries such as lithium iron phosphate (LFP) models to meet growing demand for such cells as automakers are rushing to launch low-cost eco-friendly cars amid slower sales growth.

LG Energy said on Wednesday it aims to start mass production in 2025 of low-cost LFP batteries in 2026 and nickel-cobalt-manganese (NCM) cells with less nickel and cobalt than the current models. The high-voltage mid-nickel NCM batteries are expected to cut costs by 10%, according to the South Korean leading EV battery manufacturer.

“The company is set to accelerate efforts to strengthen its product portfolio targeting the mid- to low-end EV segment,” a company statement said.

The world’s major producer of NCM batteries has been cornered by the increasing use worldwide of LFP batteries, largely produced by Chinese rivals such as runner-up Contemporary Amperex Technology Co. Ltd. (CATL), as those cells are lower in energy density but relatively cheaper to make.

Global carmakers have rushed to release more affordable EVs with entry prices in the $25,000-$30,000 range, hoping that such models would boost sales, which have been under pressure from smaller government subsidies, higher borrowing costs and insufficient charging stations.

TO BOOST ENERGY DENSITY OF HIGH-NICKEL NCMA BATTERIES

LG Energy also aims to further expand its presence in the premium EV sector by improving the quality of high-end products.

The supplier of the global EV leader Tesla Inc. plans to boost the energy density of its nickel-enriched nickel-cobalt-manganese-aluminum (NCMA) batteries by increasing the proportion of nickel to over 90% while achieving a fast-charging time of less than 15 minutes by adopting high-capacity, high-efficiency silicon anodes.

LG Energy is set to further enhance product safety by improving thermal management technology through design optimization, and by developing module and pack cooling systems.

“We aim to win more orders related to premium EVs with the improvement,” the company said.

LG Energy inked a deal with the world’s top automaker Toyota Motor Corp. earlier this month to supply 20 gigawatt hours (GWh) of battery modules consisting of high-nickel NCMA pouch-type cells annually for a decade.

ARIZONA PLANT TO PRODUCE 46-SERIES CYLINDRICAL BATTERIES

LG Energy plans to use its factory in Arizona under construction as a production hub for the 46-Series, cylindrical battery models with a diameter of 46 millimeters, in North America.

The Arizona facility, which the company had originally planned to produce 27 GWh of 2170-type cylindrical batteries, is scheduled to manufacture 36 GWh of the 46-Series a year from late 2025.

LG Energy has been developing the 4680 batteries for Tesla with an energy density five times higher than that of the 2170 type. The 4680 type is said to boost EVs’ mileage by about 16%.

The battery maker plans to develop the 46-Series after completing the 4680 model, which measures 46 millimeters in diameter and 80 mm in length, according to a company executive.

The Nanjing facility in China will serve as the main production hub for 2170 cylindrical batteries, focusing on demand in the mainland and Europe.

DARKER 2024 OUTLOOK

LG Energy said its business outlook for the next year is challenging, sending its share price to a 15-month low.

“Sales growth in 2024 is unlikely to be as significant as this year,” said another executive during an earnings conference call, citing delays in policies for eco-friendly cars in North America and Europe, the world’s second-and third-largest EV markets, as well as the business expansions of Chinese battery rivals.

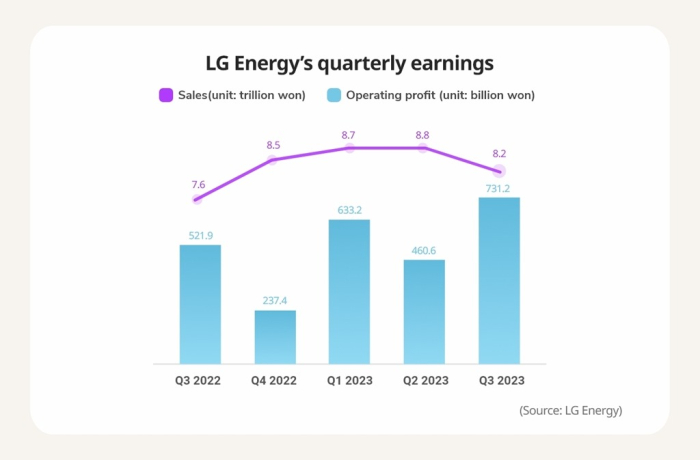

In July, the company revised its 2023 sales growth target to mid-30% from the previous forecast of a 25-30% increase unveiled in January. LG Energy said its sales rose 7.5% to 8.2 trillion won ($6.1 billion) in the third quarter from a year earlier and operating profit soared 40.1% to 731.2 billion won.

LG Energy’s share tumbled 8.7% to end at 409,500 won in the South Korean stock market, far underperforming a 0.9% in the main Kospi. The stock earlier fell to 409,000 won, the lowest since July 28, 2022.

Its smaller rival Samsung SDI Co. lost 7.2%, while battery materials companies suffered sharp drops in their share prices. POSCO Future M Co. skidded 10.2%, while EcoPro BM Co. and EcoPro Co. slid 8.8% and 8.2%, respectively.

General Motors Co. abandoned its self-imposed target to build 400,000 EVs by mid-2024 due to weakening demand, the Wall Street Journal reported on Tuesday.

“It is likely to adjust production volumes in line with conservative EV manufacturing plans of major customers,” said LG Energy Chief Financial Officer Lee Chang Sil during the call when asked about the fourth quarter business outlook. “Falling prices of raw materials such as lithium and nickel are expected to gradually affect battery prices."

Write to Il-Gue Kim at black0419@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EarningsLG Energy Q3 profit at record high on gains from US battery tax credit

EarningsLG Energy Q3 profit at record high on gains from US battery tax creditOct 11, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Energy Solution to supply EV batteries to Toyota for 10 years

BatteriesLG Energy Solution to supply EV batteries to Toyota for 10 yearsOct 05, 2023 (Gmt+09:00)

3 Min read -

BatteriesKorean firms fret over growing adoption of Chinese LFP batteries

BatteriesKorean firms fret over growing adoption of Chinese LFP batteriesAug 28, 2023 (Gmt+09:00)

4 Min read -

BatteriesFalling mineral prices to hit Korean battery materials makers

BatteriesFalling mineral prices to hit Korean battery materials makersAug 14, 2023 (Gmt+09:00)

2 Min read -

Electric vehiclesCarmakers in race for low-cost EVs amid tepid sales growth

Electric vehiclesCarmakers in race for low-cost EVs amid tepid sales growthAug 08, 2023 (Gmt+09:00)

2 Min read -

BatteriesLG Energy to build $5.6 billion battery complex in Arizona

BatteriesLG Energy to build $5.6 billion battery complex in ArizonaMar 24, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN