Regulations

Go bolder with regulatory reform to foster unicorns in Korea: KERI

Asia’s fourth-largest economy has only one startup in the world’s top 100 unicorn club, partly due to strict regulations

By Jul 12, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Regulatory reform is still slow in South Korea, obstructing innovation in technologies and industries, and the government must take bolder action to abolish outdated regulations to create the most innovative ecosystem in which unicorns can be born, a private Korean economic and industry research institute has urged.

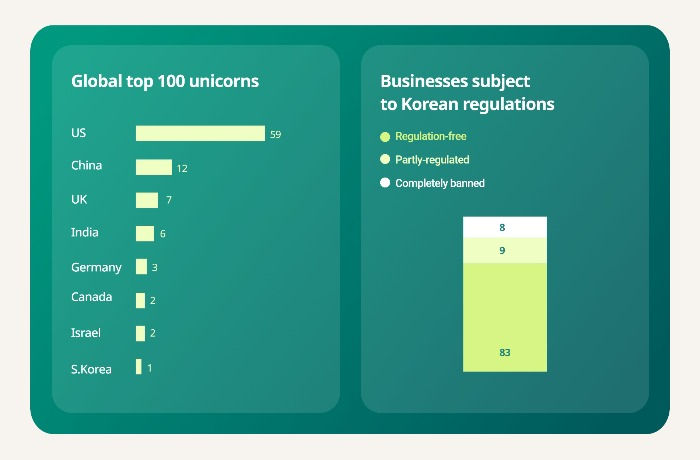

According to a research report released by the Korea Economic Research Institute (KERI) on Wednesday, of the top 100 global unicorn startups, 17 companies could not exist or had to give up some of their services in Korea due to the country’s heavy-handed regulations.

Of the top 100 unicorn startups picked by US market researcher CB Insights as of May this year, only one of them is based in Korea, Viva Republica, a fintech startup operating the country’s finance super app Toss, KERI said.

The US boasts the highest number of 59 unicorns, followed by China with 12, the UK with seven, India with six, Germany with three, then Canada and Israel, each with two. All the other countries on the list have just one, like Korea.

A unicorn is a startup valued at $1 billion and more.

To foster unicorn startups, the Korean government must go bolder with regulatory reform, according to the KERI report.

REGULATORY SANDBOX IS NOT ENOUGH

Since the country introduced the regulatory sandbox program in 2019, the Korean government has relaxed regulations on a total of 918 new products and services.

The regulatory sandbox is a system that exempts or suspends existing regulations for a certain period for the launch of new products and services, then regulates them later if any problem arises.

If a new idea proves to be safe, it will get a nod from the government for its commercial launch.

But the latest data suggests that too many regulations still exist in Korea, restricting and stifling the development of future technologies, new industries and the sharing economy, the report argued.

Musicow Inc. is one of many Korean startups bearing the brunt of the government’s strong grip on innovation.

Korea’s first music copyright trading platform started fractional intellectual property transaction services, the world’s first of its kind, after it was designated as an innovative financial service by the country’s Financial Services Commission last September.

But it must seek regulatory approval by September 2024 if it wants to continue its business.

NEED TO EASE CVC REGULATIONS

KERI especially urged the streamlining of regulatory governing bodies to speed up the implementation of startups’ innovative ideas and the prompt amendment of laws required for an immediate launch of new products and services proved to be safe under the regulatory sandbox program.

The research institute also stressed the importance of active investments by large conglomerates in startups through corporate venture capital (CVC) investments, whereby corporate funds are directly funneled into external startups.

CVC investment is highly recommended because it can often come with large corporates’ business mentoring and incubation services.

“Startups can access the business know-how of established companies through CVC investments, while large conglomerates can acquire future growth engines with their investments in promising startups,” the KERI said.

“The government must ease the country’s CVC regulations to pave the way for a win-win situation for both startups and large conglomerates.”

KERI is a private research institute under the Federation of Korean Industries, a powerful business organization in Korea representing more than 600 members, including Samsung, LG and Hyundai Motor.

Write to Mi-Sun Kang at misunny@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Korean gamesPolitical crypto scandal hits Korean P2E game deregulation hopes

Korean gamesPolitical crypto scandal hits Korean P2E game deregulation hopesMay 15, 2023 (Gmt+09:00)

3 Min read -

The KED ViewIn South Korea, innovation is subject to regulatory approval

The KED ViewIn South Korea, innovation is subject to regulatory approvalApr 26, 2023 (Gmt+09:00)

3 Min read -

Bio & PharmaNanodrug maker CEO calls on Yoon government for deregulation

Bio & PharmaNanodrug maker CEO calls on Yoon government for deregulationFeb 03, 2023 (Gmt+09:00)

2 Min read -

Korean Innovators at CES 2023Korean startups win 4 out of 23 Best of Innovations at CES 2023

Korean Innovators at CES 2023Korean startups win 4 out of 23 Best of Innovations at CES 2023Jan 04, 2023 (Gmt+09:00)

2 Min read -

Business & PoliticsS.Korea's president-elect Yoon vows deregulation, tax cuts

Business & PoliticsS.Korea's president-elect Yoon vows deregulation, tax cutsMar 10, 2022 (Gmt+09:00)

6 Min read

Comment 0

LOG IN