The KED View

In South Korea, innovation is subject to regulatory approval

It may be unrealistic to expect the emergence of a Korean fintech firm on a global scale under the current system

By Apr 26, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

In a country like South Korea with few natural resources to run its economy, innovations or brilliant business ideas are crucial to its survival.

It is all the more so in today’s world where nearly everything is done online – e-commerce, financial transactions, payments, you name it.

One recent incident, however, shows Korea believes innovation also comes under government control.

Last November, Naver Financial, the fintech arm of Korea’s online giant Naver Corp., and KEB Hanan Bank Co. jointly launched a digital savings account service dubbed Naver Pay Money Hana Account.

The financial product, upon its launch, became a hit as it allowed Naver Pay digital wallet users to deposit their prepaid money at their Hana Bank account, which protects their money to a certain extent even if the prepaid service goes under.

Users of the service get cash points when they make payments via Naver Pay. They also receive interest on their deposits at KEB Hana Bank.

No wonder it is appealing to many Koreans, who saw their prepaid money vanish into thin air a few years back when Megaplus, the local operator of online discount app Mergepoint, went bust with mounting losses.

The Naver-KEB Hana Bank digital savings account was so innovative that some people likened it to Apple Card’s high-yield savings account, which the iPhone maker created in partnership with Goldman Sachs.

The Korean service, however, is facing regulatory barriers.

Last week, Naver and KEB Hana suspended new openings after the 500,000 accounts permitted by the Financial Services Commission (FSC) were all taken up.

Under the law, the Naver-KEB Hana digital savings account is illegal as non-banks such as Naver are banned from selling savings or other financial products.

Naver and KEB Hana plan to request FSC approval on additional openings. Nevertheless, they must seek an extension of the service when the two-year grant expires in November 2024.

To make things worse, Apple Pay, which began its digital payment service in Korea last month, is set to shake up the Korean market, competing with homegrown platforms such as Kakao Pay and Samsung Pay.

MUSICOW, ANOTHER CASE IN POINT

There’s another case in point that illustrates how innovations fall under government control in Korea.

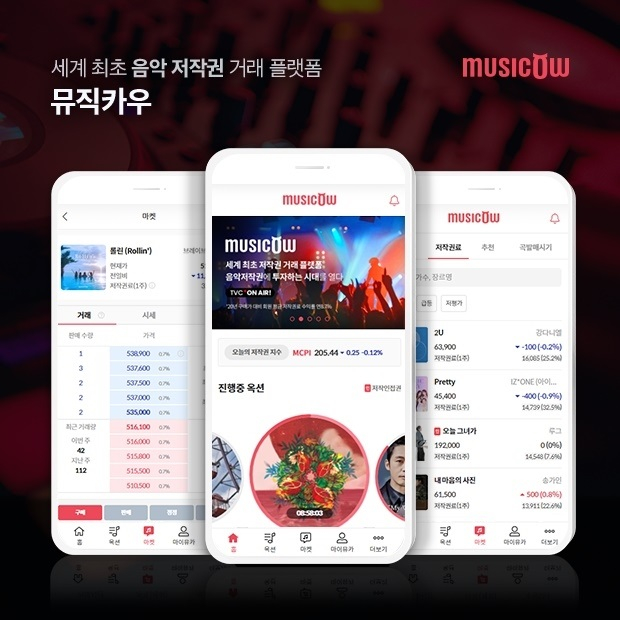

Musicow Inc., the country’s first music copyright trading platform, began fractional intellectual property transaction services – the world’s first of its kind – last September with the FSC’s designation as an innovative financial service.

Musicow also must seek regulatory approval by September 2024 if it wants to continue its business.

According to US market researcher CB Insights, fintech startups accounted for 20.8% of the world’s 1,066 unicorn companies in 2022. A unicorn often has an enterprise value of more than $1 billion.

Stripe Inc., an Irish-American financial services firm, which is the world’s No. 1 online payment processing platform, last year saw its corporate value rise to $95 billion.

By contrast, Viva Republica Inc., a leading Korean fintech unicorn and operator of mobile financial super app Toss, has a valuation that’s less than 10% that of Stripe.

While fintech companies worldwide are raising their enterprise value with brilliant, innovative financial products, their Korean peers are struggling with paperwork to obtain regulatory approval for their businesses.

It may be unrealistic to expect the emergence of a Korean fintech firm on a global scale under the current ecosystem, in which regulatory permission is apparently more important than innovation.

Write to Mi-Hyun Jo at mwise@hankyung.com

In-Soo Nam edited this column.

More to Read

-

-

Culture & TrendsKorea's Musicow to lead fractional IP ownership globally

Culture & TrendsKorea's Musicow to lead fractional IP ownership globallyFeb 20, 2023 (Gmt+09:00)

2 Min read -

Tech, Media & TelecomSamsung launches upgraded digital wallet to take on Apple Pay

Tech, Media & TelecomSamsung launches upgraded digital wallet to take on Apple PayOct 14, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN