SKC acquires 45% stake in chip test firm ISC for $400 million

The stake purchase is part of SKC’s move to shift its business focus toward chips and battery materials

By Jul 07, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SKC Ltd., a South Korean chemical materials company, said on Friday it has acquired a 45% stake in semiconductor test equipment maker ISC Co., for 522.5 billion won ($400 million).

SKC is purchasing a 35.8% stake worth 347.5 billion won from ISC’s largest shareholder Helios Private Equity, a Seoul-based investment firm. It will also buy new ISC shares worth 175 billion won, the company said in a regulatory filing.

SKC Chief Executive Park Won-cheol and Helios PE CEO Chun Che-moe signed a share sale and purchase agreement earlier in the day.

In mid-May, The Korea Economic Daily broke the news that SKC is acquiring a controlling stake in ISC from its major shareholders, including New York-based M Capital Group.

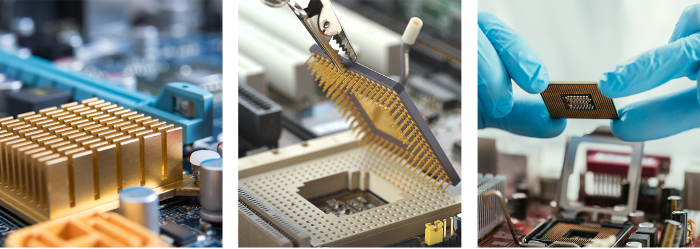

Established in 2001, ISC is the world’s No. 1 producer of semiconductor test sockets used for the post-manufacturing process of integrated circuit chips to assess their quality and find defects.

The company counts Samsung Electronics Co., SK Hynix Inc., Nvidia Corp., Intel Corp. and Broadcom Inc. as well as Big Tech firms such as Google Inc. and Amazon.com among its clients.

BUSINESS SHIFT

SKC has been looking for small- to medium-sized semiconductor parts makers as acquisition targets as part of its business shift toward chip testing and battery materials.

An SKC official said the company will use its own cash, instead of loans, to fund its ISC purchase.

SKC’s cash and cash equivalents stood at 821 billion won as of end-2022.

SKC CEO Park said during its Investor Day forum earlier this month that the company plans to invest over 5 trillion won in three growth sectors – secondary batteries, semiconductors and eco-friendly items – under a sales target of 7.9 trillion won in 2025 and 11 trillion won in 2027.

Started as a videotape maker in 1976, SKC is striving to transform into a rechargeable battery and semiconductor materials company.

Write to Hyung-Kyu Kim and Ji-Eun Ha at khk@hankyung.com

In-Soo Nam edited this article.

-

BatteriesSKC to invest $3.8 bn in secondary battery materials by 2025

BatteriesSKC to invest $3.8 bn in secondary battery materials by 2025Jul 05, 2023 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsSKC to buy controlling stake in chip test maker ISC for about $300 mn

Mergers & AcquisitionsSKC to buy controlling stake in chip test maker ISC for about $300 mnMay 19, 2023 (Gmt+09:00)

3 Min read -

EarningsSKC eyes M&As in semiconductor, rechargeable battery materials

EarningsSKC eyes M&As in semiconductor, rechargeable battery materialsFeb 06, 2023 (Gmt+09:00)

2 Min read -

BatteriesSKC to showcase innovative chip, battery materials at CES 2023

BatteriesSKC to showcase innovative chip, battery materials at CES 2023Dec 25, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsSKC to sell plastic film business to Hahn & Co. for $1.3 billion

Mergers & AcquisitionsSKC to sell plastic film business to Hahn & Co. for $1.3 billionJun 02, 2022 (Gmt+09:00)

3 Min read -

BatteriesSKC breaks ground on Europe’s largest copper foil plant in Poland

BatteriesSKC breaks ground on Europe’s largest copper foil plant in PolandJul 08, 2022 (Gmt+09:00)

2 Min read