SKC to buy controlling stake in chip test maker ISC for about $300 mn

The estimated deal value is about double its largest shareholders' valuation in 2021

By May 19, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SKC Ltd., a South Korean chemical materials company, is slated to buy a controlling stake in semiconductor chip test maker ISC Co., in a deal estimated at 350 billion to 400 billion won ($260 million-$300 million), according to sources with knowledge of the matter on Friday.

SKC recently signed a memorandum of understanding to purchase ISC shares from Seoul-based Helios Private Equity and New York-based M Capital Group.

The deal value represents a management premium of slightly less than 30%, based on ISC’s estimated enterprise value of about 1 trillion won. It is also 14 times its earnings before interest, tax, depreciation and amortization (EBITDA) in 2022, which marked ISC's largest-ever EBITDA.

Its two largest shareholders – Helios PE and M Capital -- are unloading all their shares in ISC, or a 31.56% stake, under the agreement. The price tag is more than double their purchase price of some 150 billion won back in May 2021.

SKC will finalize the transaction as early as next month.

The deal size could increase to as much as 41.4% if other major shareholders join the Helios PE-M Capital consortium to sell their combined 9.85% stake in ISC to the SK Group unit.

ISC founder and Chairman Chung Young-bae has a 7.88% stake. Another 1.97% stake is held by a consortium between homegrown Cactus Private Equity and its subsidiary Mason Capital Corp.

SKC has been looking for small- to medium-sized semiconductor parts makers as acquisition targets since the second half of last year.

Particularly, it zoomed in on companies with diverse business portfolios and customer bases. In that sense, ISC seems to be the perfect fit.

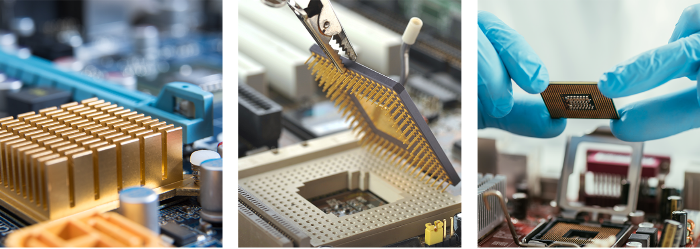

ISC is the world’s No. 1 producer of test sockets, used for the post-manufacturing process of semiconductor integrated circuit chips to assess their quality and find any defects.

It counts Samsung Electronics Co., SK Hynix Inc., Qualcomm Inc., Nvidia Corp., Intel Corp. and Broadcom Inc., as well as Google Inc. and Amazon.com, as its customers.

Early this month, SKC Chief Investment Officer Choi Du-hwan said during a first-quarter earnings call that the company would announce an M&A sooner rather than later.

He dismissed market concerns about its M&A funding capabilities, saying: “We can solve any funding problem with our cash on hand and through asset securitization.”

SKC’s cash and cash equivalents stood at 821 billion won as of end-2022.

Started as a videotape maker in 1976, it is striving to transform into a rechargeable battery and semiconductor materials company.

Last year, SKC sold its plastic film business to private equity firm Hahn & Co. for 1.6 trillion won to raise funds to expand its battery materials business.

HIGHER PROFITS

Semiconductor-related business is SKC’s most profitable segment with an operating profit of 7.9 billion won in the first quarter, below ISC's 9.8 billion won profit during the same period.

But ISC's first-quarter sales of 46.4 billion won are about half the 87.5 billion won of SKC's semiconductor materials business.

Based on data secured from the testing process, it analyzes production yields and causes of defects. It then shares them with its customers: fabless companies or semiconductor manufacturers.

Despite high chip stockpiles and falling prices last year, ISC fared better than other semiconductor parts suppliers. It manufactures pre-order products in a short period of time.

HEFTY RETURNS

The deal will create hefty returns in two years not only for ISC’s major shareholders led by the Helios Private Equity-M Capital consortium but also for the consortium’s anchor investor MG Community Credit Cooperatives, also known as the Korean Federation of Community Credit Cooperatives.

Back in May 2021, the consortium acquired the controlling stake from ISC’s founder Chung Young-bae and three other members from the founding family for some 150 billion won.

At the time, ISC’s enterprise value was estimated at 500 billion won, half the current asking price.

Helios PE was set up in 2018 by former IMM Asset Management CEO Chun Chemo. M Capital is controlled by its majority shareholder MG Community.

Write to Ji-Eun Ha at hazzys@hankyung.com

Yeonhee Kim edited this article.

-

EarningsSKC eyes M&As in semiconductor, rechargeable battery materials

EarningsSKC eyes M&As in semiconductor, rechargeable battery materialsFeb 06, 2023 (Gmt+09:00)

2 Min read -

BatteriesSKC to showcase innovative chip, battery materials at CES 2023

BatteriesSKC to showcase innovative chip, battery materials at CES 2023Dec 25, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsSKC to sell plastic film business to Hahn & Co. for $1.3 billion

Mergers & AcquisitionsSKC to sell plastic film business to Hahn & Co. for $1.3 billionJun 02, 2022 (Gmt+09:00)

3 Min read -

BatteriesSKC breaks ground on Europe’s largest copper foil plant in Poland

BatteriesSKC breaks ground on Europe’s largest copper foil plant in PolandJul 08, 2022 (Gmt+09:00)

2 Min read -

BatteriesSKC co-invests $80 mn in battery materials maker Nexeon

BatteriesSKC co-invests $80 mn in battery materials maker NexeonJan 26, 2022 (Gmt+09:00)

1 Min read