Automobiles

Hyundai ramps up ties with Samsung, SK, LG for EVs, self-driving cars

The partners-cum-rivals are closing ranks to stay ahead of their peers in the global future mobility arena

By Jun 11, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s top automaker Hyundai Motor Co. is strengthening its tech alliance with its local partners such as Samsung, LG and SK to stay ahead of its global peers in the future mobility arena, including electric vehicles and self-driving cars.

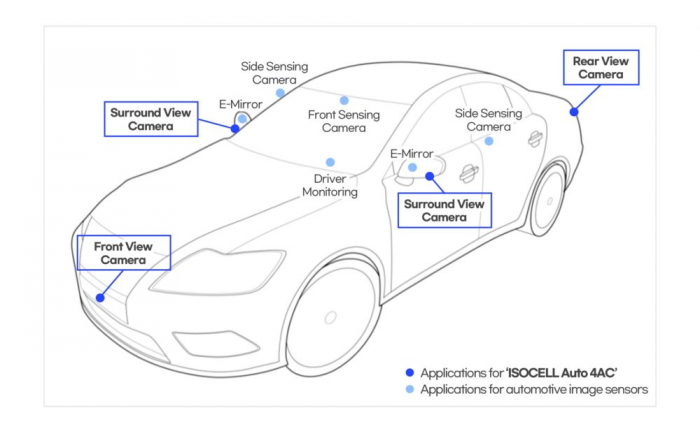

Samsung Electronics Co.’s Dolphin chipset has been chosen as the system on chip for Hyundai’s advanced driver assist system (ADAS) in the Genesis brand’s GV90 sedan.

Dolphin, made using Samsung Foundry’s 8-nanometer process node, is an SoC that combines an artificial intelligence (AI)-enabled neural processing unit (NPU), a graphics processing unit (GPU) and other components to handle functions such as lane-keeping, maintaining distance between vehicles, and driver attention alerts.

The Dolphin chip was designed by Telechips, a Korean fabless chip design firm.

Last week, Samsung said it will supply one of its latest automotive chips to Hyundai to support the carmaker’s advanced features in its in-vehicle infotainment (IVI) systems.

Samsung is already supplying various types of vehicle semiconductors, including image sensors, to Hyundai; the Exynos Auto V920 marks the Korean tech giant’s first collaboration with Hyundai in application processor (AP) chips that control vehicle systems like the human brain.

PARTNERSHIPS WITH LG, SK

Hyundai Motor Group, which includes Korea’s No. 2 carmaker Kia Corp. and auto parts maker Hyundai Mobis Co., has also been strengthening its business partnerships with other Korean conglomerates.

The IONIQ 5, Hyundai’s EV crossover, sits on battery cells manufactured by SK On Co., a unit of SK Innovation Co. The electric car’s side-view cameras use OLED panels supplied by Samsung Display Co.

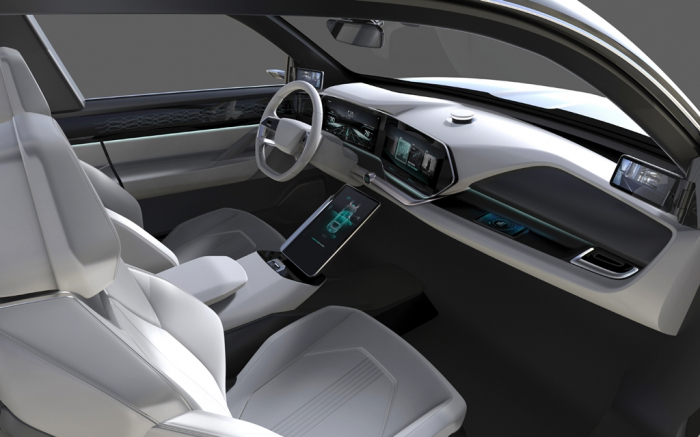

Latest Hyundai cars use dashboard LCD panels made by LG Display Co., while the carmaker receives auto chips from Samsung.

Analysts said Hyundai is strengthening its tech alliance with Korean conglomerates because they are already global leaders in their respective business areas.

Samsung spends billions of dollars on automotive chips, including application processors, annually.

Samsung Electro-Mechanics Co., an auto parts maker, is increasing investments in automotive multi-layer ceramic capacitors (MLCC) for electric cars.

HYUNDAI APPROACHES RIVALS FIRST

LG Group affiliates such as camera module maker LG Innotek Co., EV parts maker LG Magna e-Powertrain Co. and LG Electronics Inc. are major auto component suppliers globally.

Korea’s big three battery makers – LG Energy Solution Ltd., SK On and Samsung SDI Co. – are also top battery players in overseas markets.

Industry sources said Hyundai has approached Samsung, SK and LG first to strengthen their partnerships.

“Recently, Hyundai Motor's purchasing team frequently contacts us, asking if we can also provide it with the components we’re supplying to our overseas clients,” said a conglomerate executive.

Samsung has supplied its auto chip, the Exynos Auto V7, to Volkswagen AG for the German carmaker’s IVI system, Car Application Server (ICAS) 3.1, developed by LG Electronics.

The Korean chipmaker is supplying the Exynos Auto 8890 processor chip and the Exynos Auto V9 to Germany’s Audi AG.

LG Display, which began selling its OLED panels for digital cockpits to Mercedes-Benz in 2021, is widening its client base.

In recent years, Hyundai Motor Group Chairman Chung Euisun has been personally contacting business leaders, including Samsung’s Jay Y. Lee, SK’s Chey Tae-won and LG’s Koo Kwang-mo to expand the scope of their business cooperation.

The enhanced tie-ups among Korea’s big four conglomerates will help promote close communications, cut logistics costs and strengthen the supply chain with smaller local parts suppliers, analysts said.

Write to Jeong-Soo Hwang, Ye-Rin Choi and Ik-Hwan Kim at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung to supply new Exynos auto chip to Hyundai in close tie-up

Korean chipmakersSamsung to supply new Exynos auto chip to Hyundai in close tie-upJun 07, 2023 (Gmt+09:00)

3 Min read -

Electric vehiclesSamsung Electro-Mechanics unveils high-capacity MLCCs for EVs

Electric vehiclesSamsung Electro-Mechanics unveils high-capacity MLCCs for EVsMay 16, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung's Lee visits growth driver MLCC China plant

Korean chipmakersSamsung's Lee visits growth driver MLCC China plantMar 27, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s new auto chip mounted in Volkswagen’s infotainment system

Korean chipmakersSamsung’s new auto chip mounted in Volkswagen’s infotainment systemNov 30, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN