Korean startups opt for Konex, loans for survival during IPO winter

Startups’ Konex listings doubled from 2021 to 2022 and already hit 5 as of May 2023; venture debt and CB sales are also on the rise

By Jun 02, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea's anemic initial public offering market has forced the country’s startups to become more creative in raising funds as they shift toward debt or hybrid financing to secure working capital.

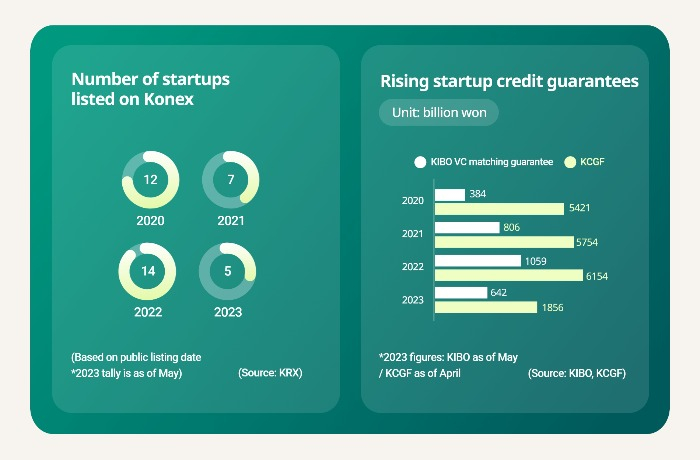

According to Korea’s sole stock market operator, Korea Exchange (KRX) on Wednesday, 10 VC-funded startups applied for listing on the Konex market in November and December last year, raising the total number of Konex listings in 2022 to 14 from seven in the prior year. As of end-May, five more small businesses joined the Konex.

Konex is the acronym for the Korea New Exchange, a minor Korean securities bourse exclusively for small- and medium-sized enterprises (SMEs) and startups that are not eligible to join the bigger tech and bio-heavy Kosdaq market.

Growing debt-financing by Korean startups

(Unit: billion won)

| Issuing date | Main business | Financing type | Financing size |

|---|---|---|---|

| 2023. 03 | Ably: Fashion e-commerce | Venture debt | 50 |

| 2023.05 | Sir.Loin: Korean beef e-commerce | CB | 5 |

| 2023.03 | Green Labs: Agtech | CB | 50 |

| 2022.04 | Musicow: Music copyright trading | CB | 100 |

Shift toward debt financing, SAFE

(Unit: %)

| 2020 | 2021 | 2022 | 2023.03 | |

|---|---|---|---|---|

| Common shares | 18.6 | 17.8 | 17.9 | 13.6 |

| Preferred shares | 67 | 73.4 | 71.9 | 72.1 |

| Debt/hybrid financing (CB/BW/EB) | 8.2 | 6.0 | 5.5 | 7.3 |

| Project | 5.7 | 2.2 | 3.3 | 5.0 |

| Others (SAFE) | 0.4 | 0.6 | 1.4 | 2.0 |

*New investment by type

(Source: The Ministry of Trade, Industry and Energy)

The daily trading volume of the Konex market is so small that it is almost impossible to cash out on a Konex-listed firm through stock trading on the exchange.

Still, a growing number of Korean startups and venture capitalists with their money in startup funds expiring have chosen Konex as an alternative to the bigger Kosdaq market to stay afloat amid the prolonged fund drought in the IPO market.

BIO, MEDICAL DEVICE STARTUPS ON KONEX

Many biotech and medical device startups have opted for the Konex market after failing to get approval for Kosdaq listing.

Curachem Co. went public on the Konex on May 18, after initially planning to debut on the Kosdaq.

Stomach cancer diagnostic kit maker Novomics Co. also debuted on the Konex in April, while Aiobio Co., Anymedi Inc., KaiBioTech Co. and Ai The Nurti Gene Co. joined the Konex late last year.

They are expected to move to the bigger Kosdaq market later because a Konex-listed firm generating operating profit on sales of more than 10 billion won ($7.6 million) and a market capitalization of over 30 billion won is eligible for an express transfer from the Konex to the Kosdaq.

Redeemable convertible preference shares (RCPS) issued by unlisted firms are marked as liabilities in accounting but Konex-listed firms can record RCPS as capital.

SIZZLING DEMAND FOR VENTURE DEBT, CB AND SAFE

Startups struggling with fundraising through common share or RCPS sales are seeking to raise capital through venture debt and convertible bond (CB) issuance.

Korean fashion e-commerce platform operator Ably raised 50 billion won in March via venture debt, a popular capital-raising instrument in the US.

Venture debt comes with warrant coverage that gives the holder the option to purchase the company’s stock at a specified price within a specific period.

Following a recent amendment to Korea’s venture capital investment law, venture debt is now available at banks and other types of lenders at low interest rates in exchange for the right to own minority equity.

CB is another popular funding option for startups grappling with the current fund drought. This bond-stock hybrid financing is preferred by small businesses as it frees a company from share dilution concerns while its bondholders can convert bonds to equity shares should the company perform well.

Korean beef e-commerce platform operator Sir.Loin Inc. last month issued 5 billion won worth of CB, while cash-strapped agtech company Green Labs Co. raised 50 billion won through CB sales in March.

According to the Korea Venture Capital Association, CB accounted for 7.3% of total new VC investments as of the first quarter of 2023 versus 5.5% for whole-2022.

Startups also seek to raise funds via a simple agreement for future equity (SAFE). This financing agreement grants the investor the right to receive shares at some future time, based on the company's valuation at that point, often after a series A funding round.

It is a form of convertible security, not debt. Because it does not require calculation of the company’s valuation before funding, it is a speedy means to finance.

Early-stage startup investor Fast Ventures, based in Seoul, often invests in startups graduating from acceleration programs via SAFEs.

CREDIT GUARANTEES FOR BANK LOANS GAIN POPULARITY

An increasing number of VCs and startups are also relying on credit guarantee services to get bank loans.

The number of startups backed by the VC matching special credit guarantee program of the Korea Technology Finance Corp. (KIBO) jumped to 62 in 2022 from 49 in 2021.

Total guaranteed financing value added up to 105.9 billion won from 80.6 billion won over the same period and already reached 64.2 billion won for 42 startups as of end-May.

Funding backed by the Korea Credit Guarantee Fund’s (KCGF) credit guarantees also increased to 615.4 billion won in 2022 from 575.4 billion won. As of end-April, it hit 185.6 billion won.

Startups rely on KIBO and KCGF’s credit guarantees, which help them borrow money at low interest rates, said Gowid CEO Kim Hang-ki, adding that it is not easy for a startup valued at 2 trillion won to borrow money from commercial banks even in the 10% rate range.

Write to Lan Heo and Jong-Woo Kim at why@hankyung.com

Sookyung Seo edited this article.

-

IPOsS.Korean grocery delivery platform Oasis drops IPO on weak demand

IPOsS.Korean grocery delivery platform Oasis drops IPO on weak demandFeb 13, 2023 (Gmt+09:00)

1 Min read -

Venture capitalKorea's venture capital investment falls 12% last year amid downturn

Venture capitalKorea's venture capital investment falls 12% last year amid downturnJan 30, 2023 (Gmt+09:00)

1 Min read -

-

IPOsE-book platform Millie's Library drops IPO plan on tepid market interest

IPOsE-book platform Millie's Library drops IPO plan on tepid market interestNov 09, 2022 (Gmt+09:00)

2 Min read -

Venture capitalVenture capital heavyweights tighten belts after 13-year spending spree

Venture capitalVenture capital heavyweights tighten belts after 13-year spending spreeMay 26, 2022 (Gmt+09:00)

5 Min read