Hyundai doubles down on green bus push against Chinese ascent

The S.Korean auto giant will scale back on conventional bus production lines at home to beef up eco-friendly bus output

By May 31, 2023 (Gmt+09:00)

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Seoul-backed K-beauty brands set to make global mark

Maybe Happy Ending: A robot love story that rewrote Broadway playbook

NPS yet to schedule external manager selection; PE firms’ fundraising woes deepen

Hyundai Motor Co. is expected to start remodeling its conventional bus production facility at home this fall to ramp up zero-emission and low-floor bus output to regain ground in the South Korean green bus market, currently dominated by Chinese brands, amid surging eco-friendly bus demand.

The Korean auto giant plans to start refurbishing its compressed natural gas (CNG) and diesel engine bus production line at its Jeonju Factory in North Jeolla Province in September at the earliest, according to auto industry sources on Wednesday.

The factory is responsible for churning out commercial vehicles including buses and trucks, as well as engines, with an annual production capacity of 103,000 units and 85,000 units, respectively. This is the world’s largest commercial vehicle factory.

Hyundai Motor and its labor union in October last year agreed to come up with detailed plans by the end of this month to scale down production lines for conventional, high-floor coaches to expand its green commercial vehicle lineup, the company said.

Both parties agreed to reinforce the company’s competitiveness in commercial vehicle production against the fast penetration of Chinese electric buses in the local market given the speedy transition to zero-emission vehicles.

But Hyundai Motor has not yet come out with a definite timeline for the factory renovation, it said.

ASCENT OF CHINA-MADE E-BUS

Korea’s total battery-powered bus shipments surged 146.6% on-year to 895 units as of the end of the first half of last year, of which nearly half were China-made electric buses after their threefold on-year growth, according to the latest data on domestic vehicle shipments by Korea Automobile Manufacturers Association (KAMA).

The remaining half of the Korean e-bus market in the same period was largely shared by runner-up Hyundai Motor, as then Edison Motors Co.

Chinese electric buses rapidly expanded their presence in Korea thanks to their cheaper prices and more diverse models than those of their Korean rivals.

Coupled with the Korean government’s generous subsidies for electric vehicles that were equally applied to both local and import brands in full, Chinese e-buses were priced much cheaper than their Korean counterparts, making them more attractive.

This has drawn the attention of local carmakers discriminated by Beijing in terms of EV subsidies, of which foreign brands have received only partially or not at all in China, and they have called on the Korean government to take action to level the field at home.

In response, Korea’s Ministry of Environment earlier this year came up with the 2023 Electric Vehicle Subsidy Reform Plan, designed to offer differing EV subsidies based on levels of vehicle performance, after-sales service infrastructure and battery energy density, a move that could favor local auto brands like Hyundai Motor.

Under the new EV subsidy program, Chinese electric buses fitted with low energy density batteries are subject to only partial subsidies in Korea this year, shifting EV bus operators’ interest to Korean e-buses eligible for more generous subsidies.

HYUNDAI MOTOR IN THE UPPER HAND

Korean bus producers like Hyundai Motor are advised to take advantage of the current situation to fight back and stop the Chinese rise in the local e-bus market.

To recapture the market, Hyundai Motor has decided to jack up its production -- not only eco-friendly buses but also low-entry buses -- through a factory line overhaul.

The low-entry bus has no stairs or only a minimum step between the ground and the bus floor at one or more entrances for easy access, especially for disabled passengers.

They are not always run by batteries or hydrogen fuel cells, but all of Hyundai Motor’s electric and fuel-cell buses are built on a low-entry chassis, one reason why the Korean auto giant is set to up its low-floor bus production.

Since replacing old city buses with low-floor buses has become mandatory in Korea from this year, demand for greener low-entry buses, which are subject to a subsidy of up to 70 million won ($52,800) per car, has been on the sharp rise.

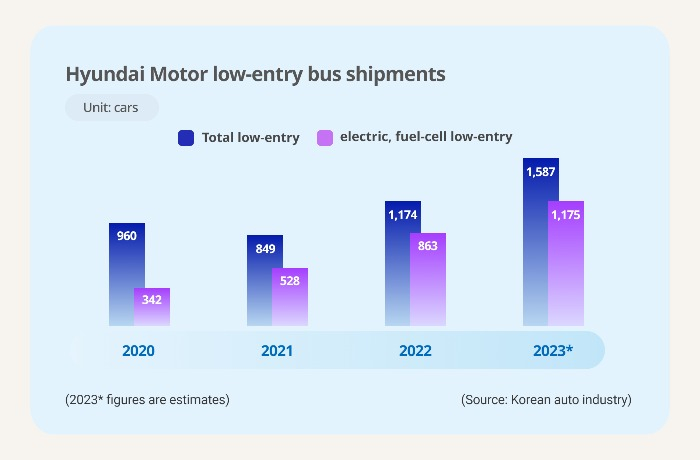

Of Hyundai Motor’s total low-entry bus sales last year, 74% were powered by electric and fuel-cell batteries, more than doubled from 35% in 2020, and their demand is expected to continue to grow.

To meet the rising demand, Hyundai Motor and its unionized workers agreed earlier to double the number of flat-entry bus manufacturing workers and operate the factory in a two-shift mode starting in March while reducing the number of conventional bus production line workers.

Hyundai Motor plans to bump up its low-floor bus output to at least 1,500 units this year from last year’s 1,170.

It also reviews discontinuing CNG low-floor bus production amid surging electric and hydrogen buses.

Hyundai Motor management and the union will also discuss the possible mass production of eco-friendly mid-size trucks like the Pavise and the Mighty Electric from the Jeonju Factory starting in 2025.

The Korean electric truck market was 95.2% controlled by Korean brands as of the first half of last year, while Chinese models sold 915 units from 11 units over the same period, according to KAMA.

Write to Nan-Sae Bin at binthere@hankyung.com

Sookyung Seo edited this article.

-

AutomobilesHyundai Motor unveils XCIENT fuel cell tractor in N.America

AutomobilesHyundai Motor unveils XCIENT fuel cell tractor in N.AmericaMay 03, 2023 (Gmt+09:00)

1 Min read -

Business & PoliticsKorea’s new EV subsidy plan favors Hyundai over Tesla, other imports

Business & PoliticsKorea’s new EV subsidy plan favors Hyundai over Tesla, other importsFeb 03, 2023 (Gmt+09:00)

4 Min read -

AutomobilesHyundai Motor transforms buses into mobile office spaces

AutomobilesHyundai Motor transforms buses into mobile office spacesDec 19, 2022 (Gmt+09:00)

1 Min read -

AutomobilesHyundai Motor enters Israeli market for hydrogen-powered trucks

AutomobilesHyundai Motor enters Israeli market for hydrogen-powered trucksDec 13, 2022 (Gmt+09:00)

1 Min read -

AutomobilesHyundai Motor sells hydrogen-powered truck Xcient in S.Korea

AutomobilesHyundai Motor sells hydrogen-powered truck Xcient in S.KoreaDec 08, 2022 (Gmt+09:00)

2 Min read