Business & Politics

Korea’s new EV subsidy plan favors Hyundai over Tesla, other imports

Korea is taking bolder action to address discrepancies created by the US tax credit law and China’s subsidy plans

By Feb 03, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea is revising its electric vehicle subsidy plan in a way that favors local cars such as the Hyundai IONIQ 6 over imported vehicles, including the Tesla Model 3, to address discrepancies in tax benefits granted by US and Chinese governments in their countries.

According to the Ministry of Environment’s 2023 Electric Vehicle Subsidy Reform Plan obtained by the Korea Economic Daily on Thursday, the government will provide EV subsidies differently based on levels of vehicle performance, after-sales service infrastructure and battery energy density.

Given that foreign EV makers operate fewer charging and other service centers in Korea, some of the importers, especially Tesla Inc., are expected to lose their price competitiveness under a new subsidy policy, analysts said.

Under the revised criteria, full subsidy support will be given to vehicles priced at less than 57 million won ($46,462), compared with 55 million won in 2022.

Any electric car with a price tag of 85 million won or more will be excluded from subsidies.

The government plans to raise the number of subsidized EV units by 34% to 215,000 cars in 2023 from 160,000 units in 2022 while reducing the average subsidy amount per car to 6.8 million won from 7 million won.

The ceiling for the performance subsidies, which range based on fuel efficiency and mileage, is set at 5 million won this year, slashed from last year’s 6 million won.

Any EV maker that has installed at least 100 chargers over the past three years will be given 200,000 won a car under the charging infrastructure subsidy.

A vehicle equipped with V2L technology, which can supply battery power to other EVs or external devices, will be granted an additional 200,000 won in the innovation technology subsidy.

Currently, electric cars manufactured by Hyundai Motor Co. and Kia Corp. have such devices.

All in all, up to 1.8 million won in various incentives will be given in addition to the regular subsidy plans under the new policy.

The government said the new subsidy standard is also aimed at improving the after-sales service infrastructure across the country.

TESLA ENJOYED HEFTY KOREAN SUBSIDIES

Tesla and other US electric vehicle makers have enjoyed strong sales in Korea thanks to government subsidies while the revised US EV tax credit act puts Korean carmakers at a disadvantage in the US market.

According to the Korea Automobile Manufacturers Association (KAMA), the Korean government provided a total of 82.3 billion won in subsidies to imported EVs in the first half of 2022. Tesla was the top beneficiary, receiving 44.2 billion won in subsidies for its 6,746 vehicles sold in Korea.

Korea’s hefty subsidies to imported EVs are in sharp contrast to the situation in the US where the Inflation Reduction Act (IRA) provides a plethora of subsidies to locally produced cars.

Washington’s revised $7,500 credit for new EV purchases requires those cars to be assembled in the US. This creates a problem for Korean cars such as the Hyundai IONIQ 5 and the Kia EV6, all manufactured at their plants in Korea and exported for US consumers, making the Korean-made vehicles ineligible for the incentive program.

Hyundai’s $5.5 billion EV and battery factory in Georgia is only set to open in 2025.

Analysts said the Korean government is taking bolder action to address the discrepancies by revising its own EV subsidy plans.

China is also limiting its subsidies for imported EVs, another blow to Korean vehicles made at home.

HYUNDAI, KIA TO BENEFIT FROM NEW PLAN

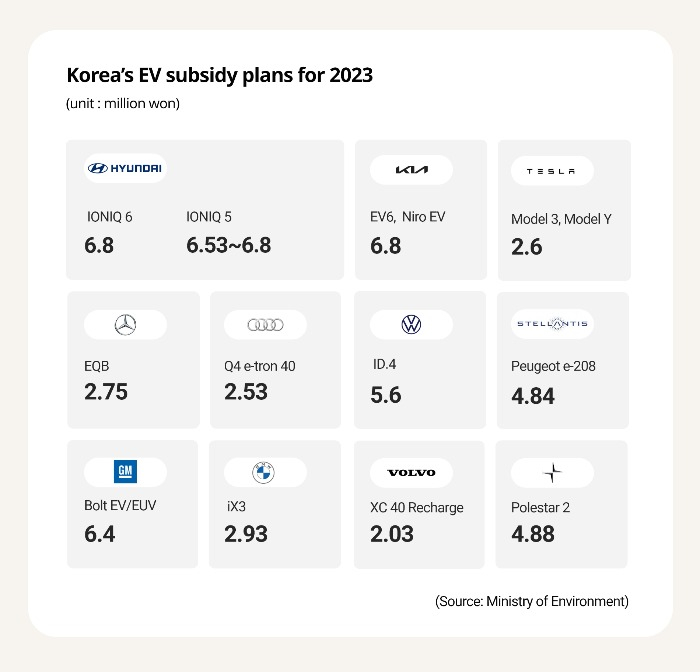

Under the new Korean subsidy policy, the difference in subsidies between Hyundai cars and Tesla EVs will widen to as much as 4.2 million won per unit.

Tesla’s Model 3 and Model Y, which received 3.15 million won in subsidy last year, will get 550,000 won less this year.

GM Korea’s Bolt EV and EUV models will receive up to 6.4 million won in subsidy this year. The subsidy for Ssangyong Motor’s Korando E-motion will be 6.08 million won.

Subsidies for Hyundai’s premium Genesis GV70 and GV60 will be in the 3 million won range.

Most imported cars will receive between 2 million won and 3 million won; 2.7 million won for the Mercedes-Benz EQA and EQB; about 3 million won for the BMW i3 and i4; 2.53 million won for the Audi Q4; and 2 million won for the Volvo C40 and XC40.

Subsidies for commercial vehicles will be cut by up to 30% depending on the battery energy density. Chinese buses, mainly equipped with low-density lithium iron phosphate (LFP) batteries, are expected to take a hit, analysts said.

The government will abolish the universal subsidy of 5 million won for electric trucks. Any truck that can run at least 250 km on a single charge will receive 25 million won. Currently, the Hyundai Porter 2 Electric and the Kia Bongo 3 Electric have such capabilities.

Write to Yong-Hee Kwak and Il-Gue Kim at kyh@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Electric vehiclesS.Korea fines Tesla $2.2 mn for alleged false advertising

Electric vehiclesS.Korea fines Tesla $2.2 mn for alleged false advertisingJan 03, 2023 (Gmt+09:00)

2 Min read -

Electric vehiclesHyundai Motor to boost US presence with $5.5 bn new Georgia EV plant

Electric vehiclesHyundai Motor to boost US presence with $5.5 bn new Georgia EV plantOct 26, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesKorea targets Tesla, imported EVs with new subsidy policy

Electric vehiclesKorea targets Tesla, imported EVs with new subsidy policyAug 24, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesTesla sweeps local EV subsidies as Korean firms at disadvantage in US

Electric vehiclesTesla sweeps local EV subsidies as Korean firms at disadvantage in USAug 22, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesHyundai’s IONIQ 6 travels faster, farther than Tesla Model Y, Mercedes EQS

Electric vehiclesHyundai’s IONIQ 6 travels faster, farther than Tesla Model Y, Mercedes EQSJul 14, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN