Samsung prepares for DRAM upturn with bold investment even after chip output cut

The world’s No.1 memory chip maker is determined to make a breakthrough with the undeterred 50 trillion won investment

By Apr 09, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

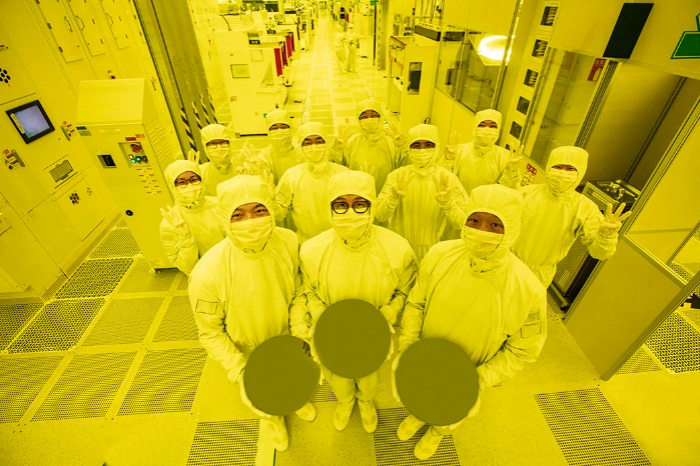

Samsung Electronics Co. has joined its peers in cutting memory chip production on its chip division’s anticipated first loss in more than a decade in the first quarter but has not backed down from an earlier vow to make a massive investment estimated at up to 50 trillion won ($38 billion), a move that could further widen its lead.

“We will continue to invest in infrastructure buildup such as clean rooms,” the company said in a statement on Friday. “We will also expand R&D investment to solidify our technological leadership.”

It did not unveil the exact investment size for the chip business for this year, but market analysts and industry observers forecast Samsung Electronics would spend about 50 trillion won for its Device Solutions (DS) division this year, similar to last year’s 47.9 trillion won.

Kyung Kye-hyun, president of Samsung Electronics DS division, also said in February that the company’s investment in the DS business for this year would be as much as last year's.

Samsung Electronics is projected to invest mainly in the development of artificial intelligence semiconductors such as HBM-PIM and CXL amid the growing demand for generative AIs.

Korea’s No.1 and the world’s biggest dynamic random access memory (DRAM) chip producer reiterated its commitment to massive investment this year despite its decision to downwardly adjust its memory chip output to a meaningful level in the face of worsening chip oversupply that continued to weigh on memory prices.

Samsung Electronics opted for facility rearrangement or maintenance works to fine-tune memory chip production in 2008.

SAMSUNG, THE FINAL WINNER IN A FIGHT AGAINST DOWNTURN?

Now the global chip industry is watching to see whether Samsung Electronics’ massive investment of about 50 trillion won will render it victorious in the latest memory chip industry downturn.

When DRAM prices skidded to one-tenth of their peak levels in the 1996-1998 downcycle, the global semiconductor market went through drastic restructuring with mergers among major players in Korea and Japan.

But Samsung Electronics upped the ante with an investment of 13 trillion won in DRAM capital expenditures from 1998 to 2001 and its operating profit more than doubled to 5.4 trillion won and 9.1 trillion won, respectively, in 2000 and 2001 from the 2 trillion won level recorded in 1997 and 1999.

During the second major downbeat period from 2007 to 2009 ushered in by a chip glut-caused plunge in DRAM prices from the aggressive industry-wide capex expansion, German major memory maker Qimonda AG collapsed, and Samsung Electronics slowed chip production after posting an operating loss in the fourth quarter of 2008.

Its aggressive investments paid off, leading Samsung Electronics to report more than 29 trillion won in operating profit in 2012, breaching the 20 trillion won threshold for the first time. Since 2000, the company’s annual operating profit had remained in the 10 trillion won range.

It remains to be seen whether the global memory chip behemoth would repeat the success this time.

Samsung Electronics on Friday reported its consolidated operating profit for the first quarter is estimated at 600 billion won, down a whopping 96% from the same period a year earlier.

It came in much worse than market expectations of around 1.1 trillion won and would mark its worst quarterly profit since the global financial crisis in 2009 if confirmed later this month.

The grim result has made Samsung Electronics change its previous stance on chip production, a move welcomed by its peers and the market.

Write to Ik-Hwan Kim at lovepen@hankyung.com

Sookyung Seo edited this article.

-

EarningsSamsung’s chip output cut: Boon for industry, price rebound

EarningsSamsung’s chip output cut: Boon for industry, price reboundApr 07, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung, AMD extend partnership for next-generation graphic chips

Korean chipmakersSamsung, AMD extend partnership for next-generation graphic chipsApr 06, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to supply chips for Intel's self-driving tech unit Mobileye

Korean chipmakersSamsung to supply chips for Intel's self-driving tech unit MobileyeApr 02, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersTSMC-Nvidia alliance step up 2 nm chip rivalry with Samsung

Korean chipmakersTSMC-Nvidia alliance step up 2 nm chip rivalry with SamsungMar 29, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS Act

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS ActMar 28, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung unveils Exynos Modem 5300 to rival Qualcomm, MediaTek

Korean chipmakersSamsung unveils Exynos Modem 5300 to rival Qualcomm, MediaTekMar 28, 2023 (Gmt+09:00)

1 Min read -

Korean chipmakersSamsung accelerates nurturing chip talent at tech universities

Korean chipmakersSamsung accelerates nurturing chip talent at tech universitiesMar 27, 2023 (Gmt+09:00)

3 Min read