Samsung to advance solid-state battery output after record sales

Samsung SDI posts record profit in 2022 led by EV batteries and plans to build pilot lines of solid-based batteries in H1

By Jan 31, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s Samsung SDI Co. reported its largest-ever profit and revenue last year, which will drive its efforts to produce solid-state batteries ahead of rivals.

A solid-state battery is touted as a “dream battery” thanks to its safety and higher energy density than a lithium-ion battery.

Once its pilot production lines are completed in the first half of this year as planned, Samsung is set to become the first battery maker with the production lines for the next-generation cells.

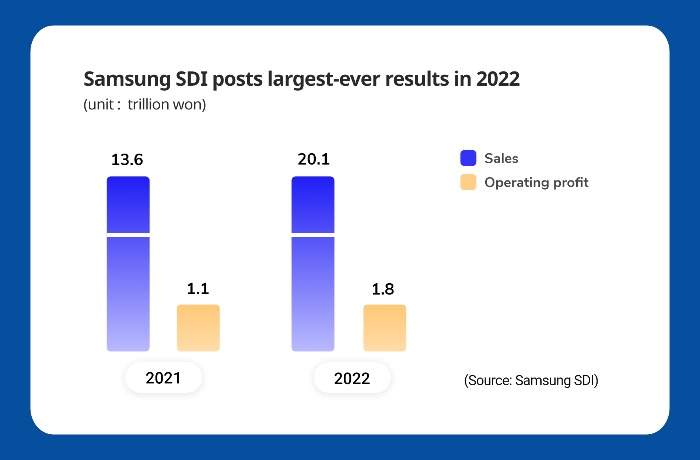

Operating profit at the world’s No. 6 electric vehicle battery maker soared 69.4% on-year to a record 1.8 billion won ($1.5 million) last year, led by batteries for automobiles and energy storage systems, according to its regulatory filing on Monday.

Sales jumped 48.5% to a record 20.1 trillion won during the period. The results are on a preliminary basis and will be confirmed later.

The stellar results will help the company ramp up spending to bring forward the production of solid-state batteries, which it had planned to mass produce from 2027.

Currently, it manufactures cylindrical and pouch-type batteries and they are all liquid-based.

With the planned solid-state battery production, Samsung is aiming to set itself apart from other battery makers, which have been putting efforts into expanding production bases overseas.

“We are in cooperation with multiple vehicle makers for solid-state batteries,” a Samsung SDI executive said in a conference call on Monday.

“We will make efforts to bring forward its mass production.”

Once the pilot lines are completed, the company will produce small-sized batteries to test their materials and performance, while developing high-performance, large-sized ones.

A lithium-ion battery is composed of a cathode, anode, separator and electrolyte. When applied to smartphones and EVs, it uses liquid electrolyte solution. On the other hand, a solid-state battery uses solid electrolyte, not liquid.

UPBEAT OUTLOOK

The company gave a rosy outlook for this year. It predicts that the automotive battery market worldwide will likely grow 40% to reach $159 billion this year from the year prior.

“In the first quarter of 2023, the P5 will lead the sales of our automotive and ESS battery divisions,” it said in a statement. “P5 batteries will propel our sales growth in the premium EV market.”

The P5 or Gen5 is Samsung’s automotive battery model installed into new automobiles. They are being produced at its new factory in Hungary.

CYLINDER-TYPE BATTERIES

Meanwhile, Samsung will unveil a prototype of 46-millimeter cylinder batteries, or 4680 cells, from the second half of this year.Samsung is understood to be in discussions with BMW and other carmakers to supply the medium to large-sized batteries, after it completed the production lines at home.

The 4680 cells are regarded a “game changer” in the industry as it is said to increase energy density by five times and output by six times, compared to the conventional 2170 type and boost electric vehicles' mileage by 16% on average.

Tesla, the world's largest electric car manufacturer and lithium-ion battery consumer, is using the 4680 cell made in-house for its EV models, but seeking to secure more of the type from other suppliers as it increases EV production.

Later this year, Samsung SDI will also launch a prototype of upgraded ESS batteries with a 15% higher energy density than the conventional ones.

The 2022 results came just as Samsung SDI agreed to buy 40 trillion won worth of cathode materials from POSCO Chemical Co. under a 10-year contract.

Write to Hyung-Kyu Kim at khk@hankyung.com

Yeonhee Kim edited this article

-

BatteriesPOSCO Chem, Samsung SDI ink $33 bn EV battery material deal

BatteriesPOSCO Chem, Samsung SDI ink $33 bn EV battery material dealJan 30, 2023 (Gmt+09:00)

4 Min read -

-

Pre-IPOsSamsung SDI supplier Jaewon seeks about $280 mn in pre-IPO

Pre-IPOsSamsung SDI supplier Jaewon seeks about $280 mn in pre-IPOOct 19, 2022 (Gmt+09:00)

2 Min read -

-

BatteriesSamsung SDI in talks with multiple carmakers for 4680 type battery supply

BatteriesSamsung SDI in talks with multiple carmakers for 4680 type battery supplyJul 29, 2022 (Gmt+09:00)

4 Min read