Korean food

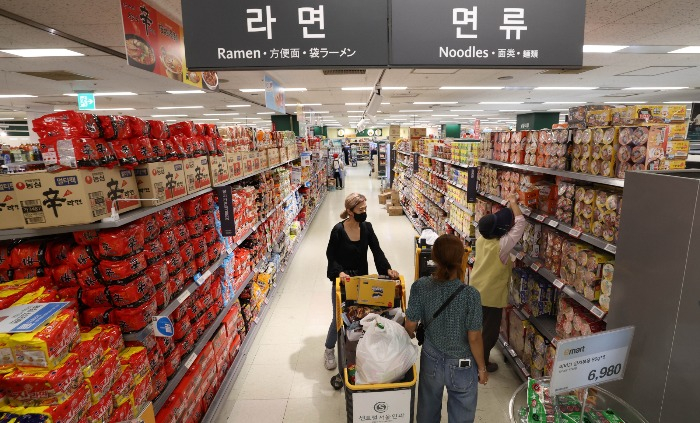

Ramen wars: Nongshim caught out by rising Ottogi

Ottogi's Jin Ramen beats Nongshim's Shin Ramyun in S.Korea's instant noodle market for fifth straight week

By Sep 30, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Ottogi Co. is emerging as a formidable rival to Nongshim Co. in South Korea's instant noodle market, becoming the most popular ramen for the fifth week in a row, a survey showed.

Nongshim has dominated the country's instant noodle market for decades with its world-famous Shin Ramyun brand. It generates 80% of its sales from instant noodles ranging from stew-type to stir-fried varieties.

By comparison, Ottogi boasts a balanced product mix from instant noodles to sauces and home meal replacements.

Ottogi’s flagship Jin Ramen beat Nongshim’s Shin Ramyun and took the top spot in the category for the fifth straight week during the Sept. 19-25 period.

Jin Ramen accounted for 28.9% of the instant noodle brands sold during the period, while Shin Ramyun slipped to second place with a share of 24.6%.

The survey was based on receipts of purchased items, which consumers registered on the CashCow marketing platform to earn redeemable point rewards. It was conducted jointly by The Korea Economic Daily (KED) and CashCow on Sept. 30.

In the category of spicy noodles without broth packages, Ottogi also overtook Nongshim with a share of 22.2%. The percentage is three times more than Nongshim’s 7.4%.

The segment is regarded as a niche market, where Ottogi was ranked second after Paldo Co., which commanded a 43.5% share during the Sept. 19-25 week.

The following shows the results of the KED-CashCow survey for other food categories.

| Ready-to-drink coffee | Market share | Milk | Market share |

| Brista Tools of Maeil Dairies Co. | 20.3% | Seoul Dairy Corp. | 41.7% |

| Cantata of Lotte Chilsung Beverage Co | 16.3% | E-Mart's private brand | 14% |

| T.O.P. of Dongsuh Foods Corp | 13.8% | Maeil Dairies Co. | 13.2% |

| Beer | Market share | Precooked rice | Market share |

| Cass of Belgium-based AB InBev | 32.9% | CJ Cheiljedang Corp. | 53.2% |

| Terra of Hite Jinro Co. | 20.7% | Ottogi | 30.2% |

| FiLite of Hite Jinro Co. | 16.4% | E-Mart's private brand | 15.9% |

| Soy sauce | Market share | Canned tuna | Market share |

| Sempio Co. | 52.2% | Dongwon F&B Co. | 77.5% |

| Daesang Corp. | 32.2% | Sajo | 21.3% |

| E-Mart's private brand | 8.9% | Ottogi | 3.8% |

Write to Keyong-je Han at hankyung@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

BatteriesKorea ramen packet maker inks $1 bn battery material deal

BatteriesKorea ramen packet maker inks $1 bn battery material dealSep 28, 2022 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsCash-rich Nongshim pursues first-ever sizeable acquisition

Mergers & AcquisitionsCash-rich Nongshim pursues first-ever sizeable acquisitionSep 06, 2022 (Gmt+09:00)

2 Min read -

EarningsNongshim posts first operating loss from Korean sales in 24 years

EarningsNongshim posts first operating loss from Korean sales in 24 yearsAug 17, 2022 (Gmt+09:00)

2 Min read -

Food & BeverageSamyang Foods' Hot Chicken Flavor Ramen sales surpass 4 bn

Food & BeverageSamyang Foods' Hot Chicken Flavor Ramen sales surpass 4 bnAug 02, 2022 (Gmt+09:00)

1 Min read -

Korean foodNongshim eyes top spot in global instant noodle market

Korean foodNongshim eyes top spot in global instant noodle marketMay 03, 2022 (Gmt+09:00)

2 Min read -

Comment 0

LOG IN