Why batteries were left out of Samsung's huge investment plan

Samsung lost market share in its core segment of prismatic batteries in Q1, despite a surge in operating profit

By May 30, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Citigroup Global Markets on Monday slashed its target price for Samsung SDI Co., one of South Korea's top three battery makers, by almost half and downgraded its recommendation on the stock to "sell" from buy on the back of its reduced market share.

The brokerage company lowered its target price to 480,000 won ($387) from 930,000 won. That indicated the stock might have more room to slide by about 20% from its current price of 581,000 won as of Monday's market close.

The target price cut comes after Samsung Group failed to mention batteries when it unveiled its largest-ever, five-year investment plan of 450 trillion won ($355 billion) last week, with which its Vice Chairman and de facto leader Jay Y. Lee said it will push ahead in a do-or-die situation.

At the center of the investment blueprint are chips, biotechnology and 6G telecommunications.

Even for the group's 240 trillion won spending plan announced last year, batteries were left off its priority list. The three-year investment plan centered on semiconductors, displays and biopharmaceutical products.

Its noticeable absence from the group's priority list raised concerns over whether Samsung is still keen to further grow the battery business.

"The explosion of Galaxy Note 7 might have weakened Samsung SDI's position within Samsung Group," an industry insider told The Korea Economic Daily.

The handsets caught fire due to battery-related issues in 2016 and Samsung Electronics recalled 2.5 million units of the smartphone.

"After the incident, Samsung Electronics replaced Samsung SDI's batteries (embedded in the smartphone) with those of CATL."

CATL, short for China's Contemporary Amperex Technology Co., is the world’s top battery maker.

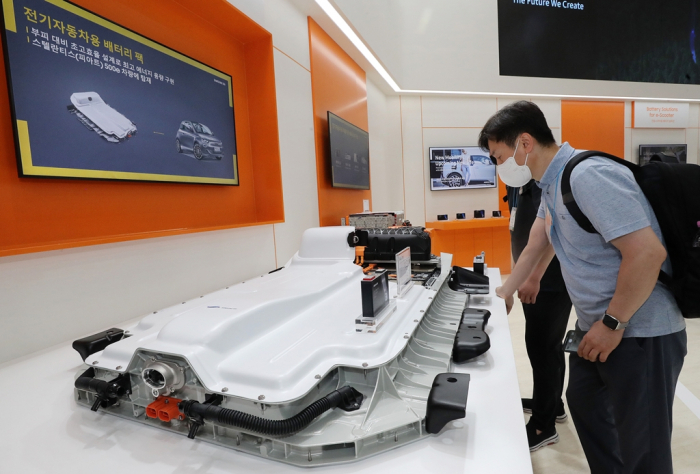

Despite a 2.5-fold jump on-year in its first-quarter operating profit to 322.3 billion won ($260 million), Samsung SDI saw its market share decline to 3.8% in the same quarter, down from 5.8% the year previous, according to market tracker SNE Research.

Sales shot up nearly 40% on-year to 4 trillion won during the January-March quarter.

A decrease in demand for prismatic batteries, Samsung SDI's flagship product, and its cautious stance on new investment, as opposed to its bigger rivals, are likely to further erode its market share, according to Citigroup analyst.

"Facility expansion led by Chinese companies such as CATL is fanning competition in the prismatic battery market, leading to a loss in Samsung SDI's market share," said a Citigroup source.

The prismatic type accounted for 63.6% of the global battery market in the first quarter, up from 53.1% a year earlier, according to SNE Research.

In contrast to Samsung SDI, CATL has been raising its market share not only on its home turf but also in Europe.

Recently, CATL announced that it will be supplying BMW with cylindrical lithium-ion battery cells for electric vehicles, starting from 2025. BMW is Samsung SDI's biggest customer.

OUTLOOK FOR PRISMATIC BATTERIES

Adding to concerns about Samsung SDI, LG Energy Solution Ltd. and SK On Co., the world’s No. 2 and No. 5 battery makers, respectively, are set to add prismatic batteries to their lithium-ion battery lineups as these battery types are increasingly prevalent in the global electric vehicle market.

But some industry watchers warn that prismatic batteries would be replaced by other types such as cylindrical and pouch batteries.

"Prismatic batteries have higher performance than other types. But the development of battery management systems makes up for the shortcomings of other types of batteries," said one industry insider.

Samsung and Dutch-domiciled automaker Stellantis are planning to build a multi-billion-dollar battery facility in the US state of Indiana.

SHARE PRICE

Samsung SDI dropped 1.53% to close at 581,000 won, its weakest point in more than two weeks. By comparison, LG Energy Solution ended up 2.09% at 439,500 won.

As part of an effort to find a new growth driver, Samsung SDI is developing all-solid-state batteries made of sulfide solid electrolytes and plans to run a pilot production line for the new-type batteries.

But analysts are turning a cold shoulder on the company's plan to enter the new segment.

"Even though it might shift its focus to all-solid-state batteries instead of joining competition for facility expansion, it's weird that batteries were missing in its investment blueprint," said another industry insider.

"Their cautious steps could boomerang on the company and erode its future competitiveness."

Write to Hyung-Kyu Kim at khk@hankyung.com

Yeonhee Kim edited this article.

-

BatteriesSamsung SDI, Stellantis pick Indiana for US EV battery plant

BatteriesSamsung SDI, Stellantis pick Indiana for US EV battery plantMay 24, 2022 (Gmt+09:00)

1 Min read -

BatteriesLG Energy, SK On to add prismatic types to EV cell lineups

BatteriesLG Energy, SK On to add prismatic types to EV cell lineupsMay 17, 2022 (Gmt+09:00)

3 Min read -