Batteries

LG Energy, SK On to add prismatic types to EV cell lineups

Prismatic batteries’ market share rises to 64% from 53% in Q1 while pouch and cylindrical types' shares fall

By May 17, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

LG Energy Solution Ltd. and SK On Co., the world’s No. 2 and No. 5 battery makers, respectively, are set to add prismatic batteries to their lithium-ion battery lineups as these battery types are increasingly prevalent in the global electric vehicle market given their dominant use by Chinese major players.

EV batteries come in three basic form factors -- cylindrical, prismatic and pouch types. LG Energy manufactures cylindrical and pouch cells, currently while SK On produces only pouch-style batteries.

South Korea’s LG Energy is considering the development of prismatic nickel-cobalt-manganese (NCM) batteries to meet various demands from carmakers. Its smaller local rival SK On completed the development of a prismatic NCM cell’s B-sample, a functional and basic prototype with full usability and a high level of maturity. It is mulling mass production depending on demand from global automakers.

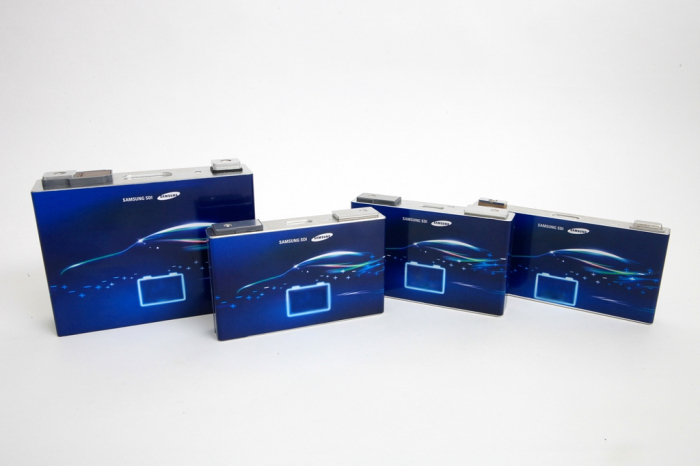

Samsung SDI Co., one of the country’s top three battery makers, is already producing prismatic models along with cylindrical batteries.

GLOBAL DOMINANCE

The prismatic type is expanding its global dominance as Chinese makers such as China’s Contemporary Amperex Technology Co. Ltd. (CATL), the world’s top battery maker, and BYD produce low-cost lithium iron phosphate (LFP) rectangular -shape batteries.

Demand for LFP cells surged on soaring prices of battery raw materials and cheaper prices compared to those of others such as NCM batteries, the main products of the South Korean three major players. LFP batteries are also more stable, making them less vulnerable to fire, although they are lower in energy density.

The prismatic type accounted for 63.6% of the global battery market in the first quarter, up from 53.1% a year earlier, according to market tracker SNE Research on Tuesday. The pouch style’s market share fell 20.8% from 25.7%, while the cylindrical model’s share declined to 15.6% from 21.2% during the period.

That came as CATL and BYD raised their market shares in China and demand for CATL batteries increased in Europe.

CYLINDRICAL BATTERIES FOR TESLA

Prismatic batteries with cells contained in an aluminum container are resistant to external shock and are relatively more durable. But they have inferior space efficiency and lower energy density than pouch and cylindrical type batteries as the cells have to be packed in a rectangular shape. Pouch batteries can store more cells by stacking them with film, but they are hard to mass produce due to complications in the production process. Cylindrical batteries, the most basic type, are inexpensive and easy for mass production.

German premium carmakers such as Mercedes-Benz and BMW use prismatic NCM batteries, while Hyundai Motor Co. and General Motor Co. install pouch types. Tesla Inc., Lucid Group Inc. and Rivian Automotive Inc. use cylindrical batteries. Ford Motor Co., Volkswagen and Stellantis N.V. use both pouch and prismatic types.

LG Energy and Samsung SDI reported strong earnings thanks to strong demand for cylindrical battery cells from Tesla.

“Tesla bought up LG Energy’s cylindrical batteries at good prices, causing the market to suffer a shortage of the models,” said an industry source in South Korea. “That raised Samsung SDI’s selling prices, improving its earnings.”

Samsung SDI plans to increase the production of cylindrical batteries.

Write to Hyung-Kyu Kim and Il-Gue Kim at khk@hankyung.com

Jongwoo Cheon edited this article.

More to Read

Comment 0

LOG IN