Mergers & Acquisitions

Hana Fin. boosts Vietnam presence with BIDV Securities stake

The S.Korean brokerage aims to transform BIDV Securities into a leading online brokerage platform by 2026

By Apr 25, 2022 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea's Hana Financial Investment Co. has become the second-largest shareholder in Vietnam's BIDV Securities after buying a 35% stake in the Vietnamese brokerage firm for 142 billion won ($114 million), Hana said on Monday.

The purchase of BIDV Securities' new shares is expected to give Hana Financial traction to beef up its non-banking business in Vietnam and other parts of Southeast Asia.

"A combination of BIDV's business network of banking and brokerage across Vietnam and Hana Financial's expertise will create new business opportunities," Lee Jong-seung, Hana Financial Investment's global business head, said in a statement.

Back in 2019, KEB Hana Bank, the banking affiliate of Hana Financial, bought a 15% stake in Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) for 1 trillion won ($840 million).

The largest-ever cross-border investment by a South Korean bank catapulted it to the status of the second-largest shareholder in BIDV.

In December of last year, KEB Hana Bank bought an additional 155.5 million shares in the Vietnamese lender, using the dividend income from the bank.

Hana Financial plans to bolster BIDV Securities' digital platform to transform it into a leading online brokerage firm by 2026. It will also introduce new businesses such as asset management to maximize BIDV's enterprise value.

BIDV is Vietnam's 11th-largest stockbroker by market share.

Since KEB Hana's investment in 2019, BIDV Bank has geared its business portfolio more toward consumer banking than corporate lending and trade finance, utilizing Hana's consumer banking expertise.

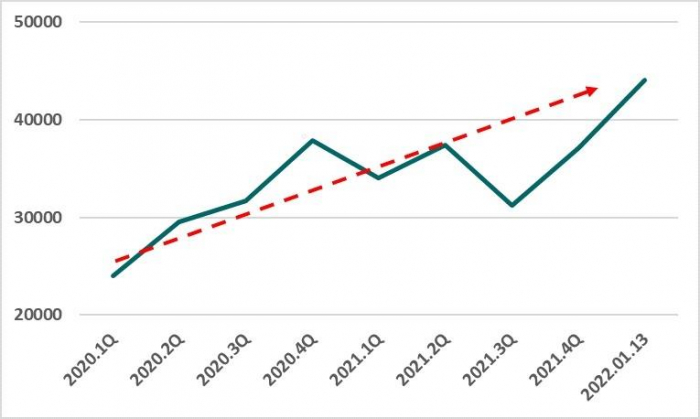

The share price of BIDV had almost doubled to 44,000 dong ($1.94) as of mid-January, compared with Hana's purchase price of 26,747 dong per share.

Hana Financial, South Korea's No. 4 banking group, will continue strategic investments in overseas financial services companies to facilitate its penetration into foreign countries.

Write to Sung-Mi Shim at smshim@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

Banking & FinanceVietnam gives traction to Korean banks' global push

Banking & FinanceVietnam gives traction to Korean banks' global pushJan 19, 2022 (Gmt+09:00)

3 Min read -

RetailKorean retailers scale back on Southeast Asian operations

RetailKorean retailers scale back on Southeast Asian operationsNov 16, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN