Tech

Samsung regains top spot in SE Asia smartphone market

Smartphone shipments to SE AsiaŌĆÖs four major markets at record highs; Apple logs highest-ever shipment growth

By Feb 11, 2022 (Gmt+09:00)

2

Min read

Most Read

S.Korea's LS Materials set to boost earnings ahead of IPO process

Samsung Heavy Industries succeeds autonomous vessel navigation

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

Samsung shifts to emergency mode with 6-day work week for executives

Korean battery maker SK On expects business turnaround in H2

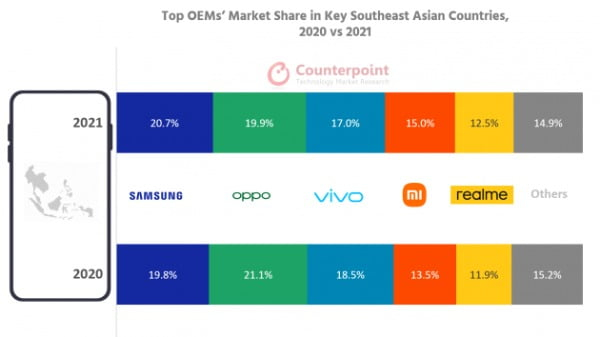

Samsung Electronics Co. outpaced Chinese rival Oppo last year to regain the top spot in the smartphone market in four major Southeast Asian countries, where Chinese brands took a majority 71%.

Upgrade demand and affordable prices of 5G phones fueled sales of higher-end models, despite component shortages and restrictions caused by the spread of COVID-19, according to Counterpoint Research on Thursday.

Smartphone shipments to the regionŌĆÖs key four countries ŌĆō Indonesia, Thailand, Vietnam and the Philippines ŌĆō grew 5% on-year in 2021, surpassing the pre-pandemic levels to a record high of 96 million units.

South KoreaŌĆÖs Samsung commanded 20.7% of the shipments, up 0.9 percentage points from a year earlier.

Oppo slid to second place from its top spot, with its market share edging down to 19.9% from 21.1% over the same period, the research house said.

Three other Chinese brands ŌĆō Vivo, Xiaomi and Realme ŌĆō were among the top five brands in the region. Their shipments in 2021 to the four Southeast Asian countries were the largest ever.

ŌĆ£Samsung┬Āsaw shipment challenges mid-year in 2021 but recuperated to lead in market share,ŌĆØ Counterpoint said in a press release.

ŌĆ£Its manufacturing facilities in Vietnam returned to normal towards Q4 and the brand made sure that marketing campaigns were in focus for all its new launches.ŌĆØ

Between August and September of last year, Samsung halted production at its smartphone factories in Vietnam after dozens of workers at the plants contracted COVID-19.

Among non-Asian brands, Apple Inc. posted its highest-ever shipment growth of 68% on-year to the four SE Asian countries in 2021. Its sales in the region were driven by the iPhone 11 and iPhone 12 series, as well as the iPhone 13 series released in September of last year.

AVERAGE SELLING PRICES (ASPs)

Smartphones under the $150 price level represented about 38% of the total shipments to the four SE Asian countries in 2021, down from more than 55% a year earlier.

ŌĆ£More consumers are opting for smartphones in the $151-$250 bracket,ŌĆØ said┬Ā Counterpoint senior analyst Glen Cardoza.

ŌĆ£We now see the top five OEMs not only launching 5G models but also actively reducing their ASPs and working with operators to further the adoption of 5G in SEA (Southeast Asia).ŌĆØ

5G smartphones took up 18% of smartphones sold in those countries, up sharply from the previous yearŌĆÖs 3%. 5G networks provide faster speeds and connections than 4G.

This year, the prospect of widespread economic reopening adds to the upbeat outlook for the tourism-reliant region, which in turn should boost consumption.

ŌĆ£We are looking at a decent 5% year-on-year growth in the regionŌĆÖs smartphone shipments in 2022. 5G advancement, operator competition and consumer smartphone upgrades should make this possible,ŌĆØ Cardoza added.

┬Ā

Write to Sung-Soo Bae at baebae@hankyung.com

Yeonhee Kim edited this article

More to Read

-

Business & PoliticsSamsung hires ex-US Amb. Lippert as PR chief for N.American business

Business & PoliticsSamsung hires ex-US Amb. Lippert as PR chief for N.American businessFeb 10, 2022 (Gmt+09:00)

3 Min read -

EarningsSamsungŌĆÖs 2022: Year of war on uncertainty, shaky supply chain

EarningsSamsungŌĆÖs 2022: Year of war on uncertainty, shaky supply chainJan 27, 2022 (Gmt+09:00)

4 Min read -

TechSamsung touts latest Exynos 2200 chip as mobile game changer

TechSamsung touts latest Exynos 2200 chip as mobile game changerJan 18, 2022 (Gmt+09:00)

3 Min read -

-

SemiconductorsSamsung cuts NAND output in Xian on COVID-19 lockdown

SemiconductorsSamsung cuts NAND output in Xian on COVID-19 lockdownDec 29, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN