Semiconductors

SK Hynix to list Intel’s NAND unit on Nasdaq

Pledges independence of the newly established US subsidiary, Solidigm, to keep Intel’s core manpower, manage customers

By Dec 30, 2021 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s SK Hynix Inc. decided to list the recently acquired Intel Corp.’s NAND flash memory chip business on the Nasdaq in a move to keep the core workforce of the US tech giant within the company and raise its corporate value.

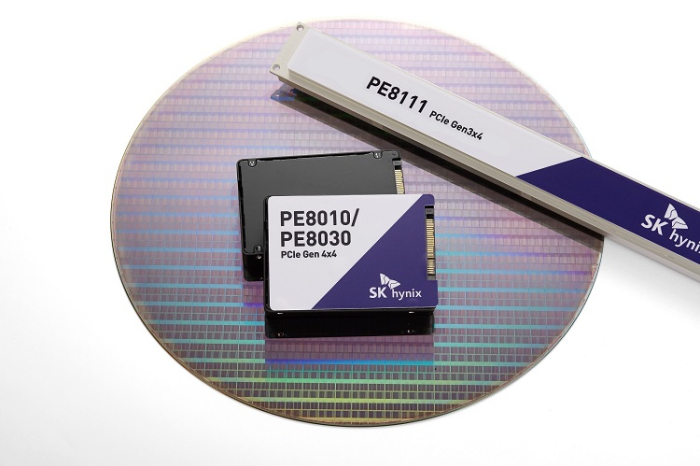

SK Hynix, the world’s second-largest memory chipmaker, announced on Dec. 30 that it has completed the first phase of the $9 billion acquisition of Intel’s NAND and solid-state drive (SSD) business after it received regulatory approval from eight countries including China.

“We will operate Intel’s NAND flash business unit as a completely separate US company,” said a senior SK Group source. “Once follow-up measures of the M&A are completed, we will seek a Nasdaq listing.” SK Hynix named the newly established US subsidiary that will manage the SSD and NAND business as Solidigm, headquartered in San Jose, California.

The plan defied earlier speculations that SK Hynix, the group’s chip-making affiliate, may combine research and other units to create synergy.

NASDAQ LISTING

SK Hynix sought Solidigm’s initial public offering on the Nasdaq to maintain Intel’s core manpower, industry sources said. A listing would be the best way to lure key employees such as engineers with compensation including stock options.

In August, SK Hynix appointed Intel Senior Vice President and General Manager Robert Crooke as head of the US subsidiary. That was also seen as a move to maintain Intel’s existing engineers, according to industry sources.

In order to increase its corporate value, it is better to list on the Nasdaq than to maintain SK Hynix’s subsidiary in South Korea, sources said.

In addition, it is easier for a US company to manage Intel’s existing customers since governments worldwide prefer domestic supply chains in the intensifying war for the global semiconductor hegemony.

COMPLETELY INDEPENDENT MANAGEMENT

“We sought potential measures to maintain its business competitiveness since this is not an aggressive deal to eliminate a competitor,” said a senior SK Hynix official said. “We will respect the management's independence as much as possible after completing the acquisition process as scheduled.”

SK Hynix will present only management policy direction in the big picture but not interfere with detailed management plans.

Lee Seok-hee, president and co-CEO of SK Hynix will be appointed executive chairman of Solidigm, who will lead the post-merger integration processes. Crooke will be appointed its CEO.

Intel’s NAND business has been sluggish since SK Hynix signed the all-cash deal in October 2020. The agreement boosted concerns among Intel’s customers over its future business, causing them to rush to its competitors’ products.

The unit’s sales edged up 0.6% to $1.1 billion in the third quarter from the previous three months, far underperforming an average 15% growth in sales of the industry, according to market tracker TrendForce. Intel’s global NAND memory market shares fell to 5.9% in the July-September period from 9.9% in the second quarter of 2020.

SK Hynix’s plan on Solidigm’s independence is expected to ease such worries, experts said.

“The move may send a signal to the semiconductor market and employees that the unit will stay as a US company that works well without problems as Intel used to operate,” said Yeo Jun-sang, professor at Dongguk Business School in Seoul.

DEAL TO BE COMPLETED IN 2025

SK Hynix said that it has acquired Intel’s Dalian NAND flash manufacturing facility in China and SSD business to complete the first phase of the deal. In exchange, SK Hynix will pay $7 billion.

In the second phase of the transaction, SK Hynix will take over the remaining assets in relation to the NAND business, including intellectual property (IP) related to the manufacture and design of NAND flash wafers, R&D employees for NAND flash wafers, the Dalian facility workforce, and the other associated assets. The second phase is predicted to be concluded in or after March 2025 with the remaining payment of $2 billion.

SK Hynix expected the acquisition to improve its NAND memory chip business, which has been evaluated as less competitive than its DRAM unit.

The company sees the opportunity to enhance its NAND Flash business competitiveness to the level of its world-leading DRAM business, as it excels in mobile NAND flash while Intel is strong in enterprise SSDs (eSSDs). SK Hynix will be able to take advantage of the synergy of the combined business portfolio.

“This acquisition will present a paradigm-shifting moment for SK Hynix’s NAND flash business to enter the global top-tier level,” said Park Jung-ho, SK Hynix’s vice chairman and co-CEO.

Write to Su-Bin Lee and Hyung-Suk Song at lsb@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

M&AsSK Hynix wins China’s approval for $9 billion Intel NAND acquisition

M&AsSK Hynix wins China’s approval for $9 billion Intel NAND acquisitionDec 23, 2021 (Gmt+09:00)

4 Min read -

SK Hynix to set up US NAND firm led by Intel’s senior vice president

SK Hynix to set up US NAND firm led by Intel’s senior vice presidentAug 06, 2021 (Gmt+09:00)

2 Min read -

M&AsSK Hynix's Intel NAND chip deal wins US regulatory approval

M&AsSK Hynix's Intel NAND chip deal wins US regulatory approvalMar 12, 2021 (Gmt+09:00)

1 Min read -

SK Hynix’s $9 bn Intel NAND deal ‘not overvalued’: CEO

SK Hynix’s $9 bn Intel NAND deal ‘not overvalued’: CEOOct 30, 2020 (Gmt+09:00)

2 Min read -

Memory chipsSK Hynix to buy Intel’s NAND business in $9 bn cash deal

Memory chipsSK Hynix to buy Intel’s NAND business in $9 bn cash dealOct 20, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN