Corporate governance

SK Group to reform governance structure with stronger board of directors

The conlgomerate's governance reform expected to curb market doubts regarding its recent series of major spin-offs

By Oct 12, 2021 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

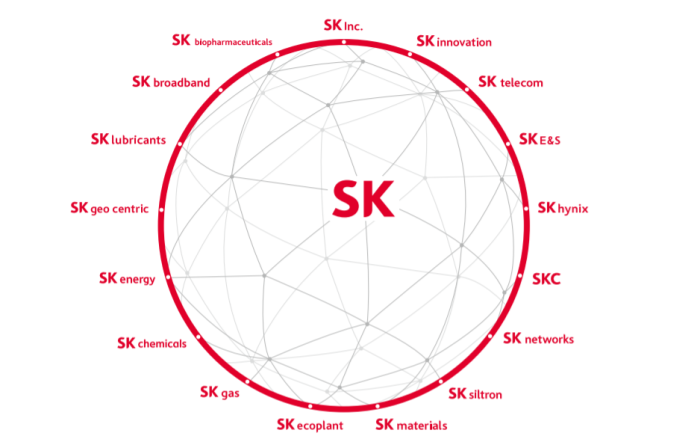

SK Group will undergo a major governance reform with significant empowerment of the board of directors in making key management decisions.

The group said on Oct. 11 that the board members of its holding company SK Inc. and the affiliates will have strengthened authority over the chief executives and also over the long-term strategic direction of the firms.

SK Group added that it held three group-wide workshops between June and October this year, with the group chairman Chey Tae-won as well as the executive and non-executive directors of 13 firms within the group, to discuss the direction and specific action plans in innovating corporate governance.

“The essence of SK’s new governance story is to convey the transparency of our governance structure to the market and win long-term credibility,” said SK Group Chairman Chey Tae-won.

The group’s key affiliates such as SK Hynix and SK Innovation Co. will have their board members conduct CEO performance reviews, recommend candidates for the CEO position, review salary levels of the executive directors, and examine long-term corporate strategies.

SK Group added that such empowerment follows from the success of SK Inc.’s pilot project on governance reform that kicked off in March this year. The holding company in March had created an HR committee and ESG committee under the board to allow the board members to exert more rights over HR and other corporate decisions.

One tangible change that will start before the end of this year is that each key affiliate’s board will review the performance and determine the exact financial incentive that its CEO will receive. The ESG committees of the firms will also have a stronger say in making appropriate revisions in annual business plans.

Business experts note that SK Group’s such shift is remarkable considering that the role of the board of directors at South Korean firms to date have been largely reactive with its authority limited to audit and inspection of the top management and revising internal regulations.

SK Group will also provide more extensive support in strengthening the capabilities of its non-executive board members, recruited from outside the company, by providing exclusive training programs. The group also offers stock grants to the non-executive board members that they can sell in the stock market after the termination of their tenure.

“We hope that our non-executive board members, together with the CEOs, communicate more with the market through occasions like IR events and also engage more with employees internally,” said the group chairman.

GOVERNANCE AGENDA TO COMPLEMENT SK’S “FINANCIAL STORY”

The group chairman Chey Tae-won has been emphasizing the importance of the “financial story” since last year. Financial story is essentially a strategy to maximize revenue, profit as well as the use of its assets through IPOs, M&As and stake sales with a specific long-term business storyline.

Management experts highlight that the group’s recent focus on making changes in corporate governance is closely tied with the financial story. They note that some investors are doubtful in SK Group’s recent series of corporate spin-offs to create new firms.

For instance, SK Innovation Co. spun off a battery unit, SK On, and a petroleum exploration and production unit, SK Earthon, on the first day of October. SK Telecom Co. also spun off its mobility unit last year to create T Map Mobility Co. The investment firm SK Square will also be created in November following SK Telecom’s split of its mobile and non-mobile businesses.

The experts note that the success of such aggressive changes in corporate structure depends on whether the group can earn trust and support from the market. In other words, they are saying that SK Group is reforming its governance structure to demonstrate that the series of spin-offs are not for the benefit of the owners but primarily for business sustainability and the benefits of the shareholders.

“During my meeting with shareholders and investors, I could tell that they are primarily interested in hearing top-level management agenda such as CEO performance and potential clash of interest between the holding company and the affiliates. I believe that SK must provide enough information to the market and conduct sufficient communication with the investors,” said Lee Chan-keun, an independent director of the board that participated in devising the group’s governance reform plan.

Write to Jung-hwan Hwang at jung@hankyung.com

Daniel Cho edited this article.

More to Read

-

Corporate restructuringSK Group’s holding firm to absorb SK Materials in corporate restructuring

Corporate restructuringSK Group’s holding firm to absorb SK Materials in corporate restructuringAug 20, 2021 (Gmt+09:00)

3 Min read -

Group restructuringSK Group’s holding firm aims to become Korea’s Berkshire Hathaway

Group restructuringSK Group’s holding firm aims to become Korea’s Berkshire HathawayApr 21, 2021 (Gmt+09:00)

3 Min read -

Group restructuringSK Telecom to split into mobile and non-mobile units

Group restructuringSK Telecom to split into mobile and non-mobile unitsApr 14, 2021 (Gmt+09:00)

5 Min read -

-

Joint VenturesSK Group to sell stake in petrochemical arm; seeks global partnership

Joint VenturesSK Group to sell stake in petrochemical arm; seeks global partnershipFeb 23, 2021 (Gmt+09:00)

2 Min read

Comment 0

LOG IN