SK Group's financial story: Measure, divest and focus

By Mar 09, 2021 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Last month, South Korea's third-largest conglomerate SK Group agreed to sell its 21-year-old baseball club SK Wyverns to the country’s leading retailer Shinsegae Group for 100 billion won ($88 million).

The deal followed a recent string of asset sales by the group, highlighting the energy-to-telecom group's shift from its traditional and once flagship businesses to focus on new growth areas such as electric vehicle batteries, hydrogen fuel, bio and chips.

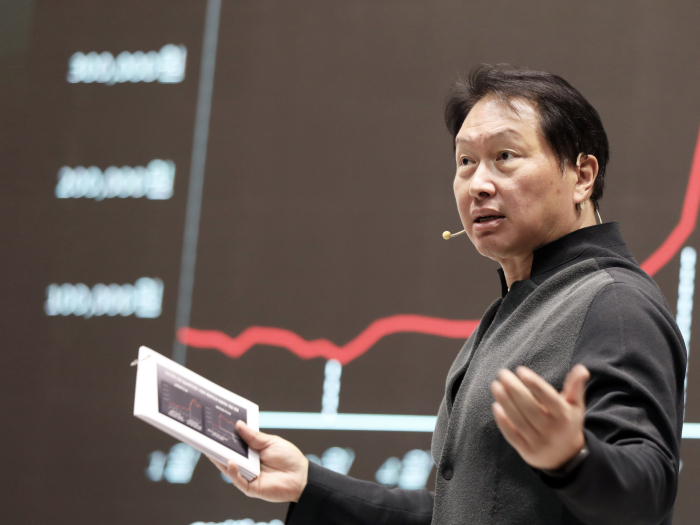

More importantly, the divestments reflect group Chairman Chey Tae-won's new business keyword proposed in a CEO seminar for the group's units in October 2020 -- financial story. The watchword follows his previous "deep change" and "design thinking" initiatives announced in 2018 and 2019, respectively.

Since last year, SK Group has been accelerating its efforts to make maximum use of its assets through initial public offerings and stake sales, as long as it keeps its management rights. Funding secured from the divestiture will be diverted into growth businesses, in particular, into assets that align with the group's environmental, social and governance (ESG) management aims.

"The assets of which we are unconvinced of their return on investment were first in line," a source involved in the group's asset sales told Market Insight recently.

SK Group had been spending 30 billion to 40 billion won per year on the baseball club SK Wyverns, equivalent to its annual interest payments for 1 trillion won in bank borrowings. The sports club may have contributed to the group's corporate image and employee morale boosting, but failed to convince its senior executives, including Chairman Chey, of its financial benefits.

“Rather than running a baseball club of which financial benefits we are unsure, we’d better invest the 1 trillion won into a promising business. That’s Chey’s message,” said a source of a Korean business group.

Under Chey's deep change initiative, the group has moved its focus into ESG-themed businesses such as EV batteries and their components, as well as hydrogen fuel cells, through a series of acquisitions, including a 9.9% stake in Plug Power Inc. of the US.

Now it is sharpening its approach, digging into the financial benefits of each business, while increasingly embracing financial investors for its existing operations.

"If we can’t measure their benefits, we can't manage them, either. That’s Chey’s message," said an SK Group source.

As an example, the chairman had called for a precise calculation of the financial benefits of ESG-related activities, something similar to sales and operating profit reports. In December 2020, the group said its hydrogen business is expected to create additional net asset value of around 30 trillion won by 2025.

SK Group's asset sales since 2019

| Seller | Asset | Proceeds (in Korean won) |

| SK Telecom | SK Wyverns (baseball club) | 100 billion |

| SK Networks | Gas stations | 1.3 trillion |

| SK Chemical | Stake in SK Bioscience IPO | 500 billion |

| SK Holdings | SK Biopharmaceutical IPO | 300 billion |

| SK Innovation | Entire ownership in US shale oil fields | N/A |

| SK Innovation | Stake in gas fields in Peru | 1.25 trillion |

| SK Innovation | SK IE Technology in pre-IPO deal | 300 billion |

| SK Group | REIT | 400 billion-500 billion** |

| SK Holdings | Stake in China’s ESR | 480 billion |

| SK Holdings | Stake in SK Biopharmaceuticals via block sale | 1.1 trillion |

| SK Global Chemical* | Stake in SK Global Chemical | N/A |

| SK E&S* | Stake in its city gas businesses | N/A |

| SKC* | Stake in its polyester (PET) film unit in China | 150 billion-200 billion** |

| SK Battery America | Green bond sale | $1 billion |

| SK Innovation* | Stake in SK Lubricants | N/A |

| SK Innovation* | SK IE Technology IPO in 2021 | N/A |

| SK Telecom* | Stake in T Map Mobility | 300 billion** |

| SK Holdings* | SPC that invests $1.6 bn in Plug Power | 1 trillion** |

| Note: *Planned or underway **Market estimates | ||

SK Holdings is now in talks with several private equity firms to sell a stake in a special purpose company established to buy a $1.6 billion stake in Plug Power, sources told Market Insight on Tuesday. SK Bioscience Co. is set to list on the Korea Exchange next week in a 1.5 trillion won IPO.

If the planned IPOs and divestiture go through as planned, SK Group is projected to raise up to 8 trillion won this year, on top of its cash reserves of 11.9 trillion won as of the end of September 2020.

Analysts expect SK Group will continue to make a series of investments in the biotech industry and hydrogen supply chain, as well as ESG-themed companies.

SK Group's recent investments

| Company | Investment Target | Investment Amount |

| SK Hynix | Intel's NAND memory chip unit | 10.3 trillion won |

| SK E&S | 10% stake in US hydrogen fuel cell maker Plug Power Inc. | $1.6 billion |

| SK Innovation | 13% stake in China’s EV battery swap station operator Blue Park Smart Energy Technology Co. | N/A |

| SKC | To build its first overseas plant of copper foils in Malaysia | 650 billion won |

| SK Innovation | To build its third electric vehicle battery plant in Hungary | $2.29 billion |

| SK Holdings | Switzerland-based Roivant Sciences | $200 million |

| SK Holdings | China's Wason Copper Foil | 100 billion won (additional investment) |

| SK Pharmteco* | France’s biologic contract manufacturing organization (CMO) Yposkesi | N/A |

| SK Holdings | Korea's silicon carbide chipmaker Yespowertechnix | 26.8 billion won |

| Note: * Under negotiation as of December 2020 | ||

Write to Jae-Kwang Ahn at ahnjk@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

Electric vehiclesSK, POSCO agree to develop new lightweight materials for future mobility

Electric vehiclesSK, POSCO agree to develop new lightweight materials for future mobilityMar 08, 2021 (Gmt+09:00)

1 Min read -

Korean chipmakersSK Hynix to unveil industry’s smallest pixel image sensor, eyes $24.9 bn market

Korean chipmakersSK Hynix to unveil industry’s smallest pixel image sensor, eyes $24.9 bn marketMar 04, 2021 (Gmt+09:00)

3 Min read -

-

Mergers & AcquisitionsSK teams with Plug Power to tackle Asia's hydrogen ecosystem

Mergers & AcquisitionsSK teams with Plug Power to tackle Asia's hydrogen ecosystemFeb 25, 2021 (Gmt+09:00)

1 Min read -

Block dealSK Holdings raises $1 bn from block sale of SK Biopharm shares

Block dealSK Holdings raises $1 bn from block sale of SK Biopharm sharesFeb 24, 2021 (Gmt+09:00)

2 Min read -

Joint VenturesSK Group to sell stake in petrochemical arm; seeks global partnership

Joint VenturesSK Group to sell stake in petrochemical arm; seeks global partnershipFeb 23, 2021 (Gmt+09:00)

2 Min read -

BatteriesSK under increasing pressure for costly settlement with LG

BatteriesSK under increasing pressure for costly settlement with LGFeb 14, 2021 (Gmt+09:00)

5 Min read

Comment 0

LOG IN