Music and entertainment

HYBE raises $400 mn in a move to diversify BTS-dependent portfolio

The shareholders are optimistic about HYBE's strategic direction to create new revenue streams globally

By Jun 03, 2021 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

HYBE Co., the global entertainment powerhouse behind BTS, has successfully closed its previously announced rights offering to raise 445.5 billion won ($400 million).

According to the investment banking industry on Jun. 3, the company sold an aggregate of 2,227,848 shares at the subscription price of 200,000 won ($180.08).

HYBE shares on Jun. 2 closed at 263,500 won ($237.26), 31.7% higher than the subscription price. The investors can start selling the newly issued stocks in the market immediately from their day of listing on Jun. 22.

HYBE Chairman Bang Si-hyuk is reported to have purchased all 774,057 shares that he was assigned as the largest shareholder. HYBE’s second-largest shareholder Netmarble Co. has fully purchased its assigned shares as well.

Analysts say that the successful closing of the rights issue demonstrates the market’s approval of HYBE’s new corporate direction as a global entertainment company.

HYBE said that the newly raised fund of $400 million will be used for the acquisition of Ithaca Holdings, a US-based integrated media company that manages global artists including Justin Bieber and Ariana Grande. HYBE is acquiring Ithaca holdings at 1.186 trillion won ($1.07 billion).

Write to Jin-seong Kim at jskim1028@hankyung.com

Daniel Cho edited this article.

More to Read

-

Cross-industry collaborationHYBE x McDonald’s: The BTS Meal launches globally

Cross-industry collaborationHYBE x McDonald’s: The BTS Meal launches globallyMay 27, 2021 (Gmt+09:00)

1 Min read -

Music and entertainmentHYBE’s $400 mn rights offering for Ithaca merger to open June 1-2

Music and entertainmentHYBE’s $400 mn rights offering for Ithaca merger to open June 1-2May 26, 2021 (Gmt+09:00)

2 Min read -

Music and entertainmentHYBE’s music unit split-off plan ignites shareholder concern

Music and entertainmentHYBE’s music unit split-off plan ignites shareholder concernApr 13, 2021 (Gmt+09:00)

2 Min read -

-

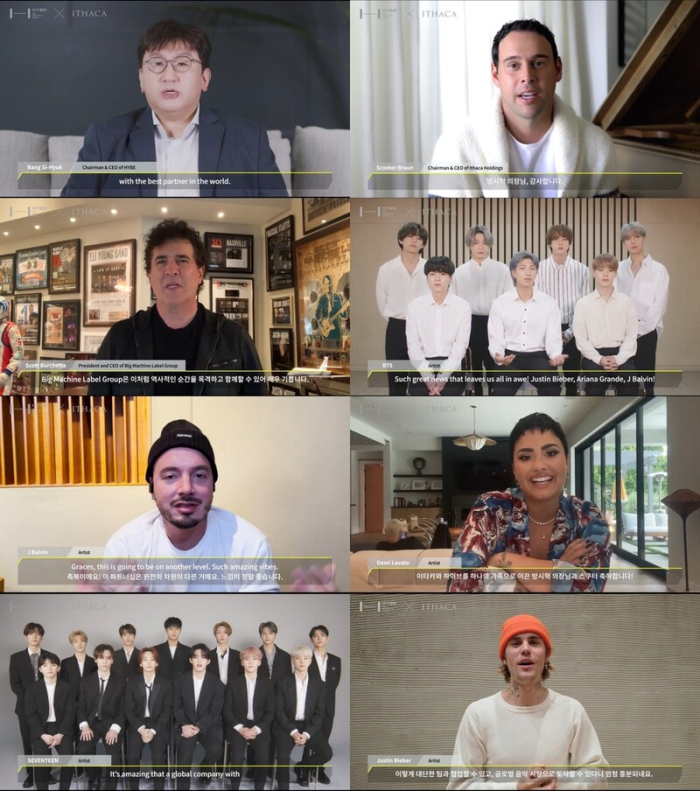

Music and entertainmentBTS, Bieber, Lovato celebrate HYBE-Ithaca alliance

Music and entertainmentBTS, Bieber, Lovato celebrate HYBE-Ithaca allianceApr 06, 2021 (Gmt+09:00)

2 Min read -

Music and entertainmentHYBE-Ithaca merger puts BTS, Justin Bieber under one roof

Music and entertainmentHYBE-Ithaca merger puts BTS, Justin Bieber under one roofApr 02, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN