Copper foil maker raises $700 mn funding to build Europe plant

By Apr 21, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

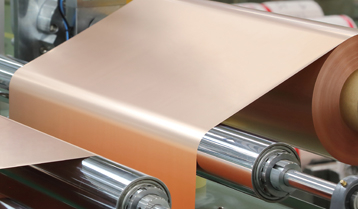

South Korea's Iljin Materials Co., which produces copper foils for rechargeable batteries and printed circuit boards (PCBs), has received 800 billion won ($715 million) in fresh funding from Seoul-based STIC Investments.

STIC will inject the money into Iljin's Malaysia-based subsidiary IMM Technology to fund the construction of Iljin's first production facility in Europe, according to investment banking sources on Apr. 21. The terms and details of STIC's investment, including its ownership of the Malaysia unit after the funding, were not immediately disclosed.

The new factory to be built is understood to be located near a plant of Northvolt, a Swedish battery manufacturer, to which Iljin has recently signed a 10-year contract to supply 17,147-ton copper foils worth at least 400 billion won. The supply contract came shortly after Northvolt won a $14 billion battery order from Volkswagen last month for the next 10 years as the German carmaker is accelerating its push into electric vehicles.

The financing deal marks STIC's second investment in the medium-sized Korean company and also comes as IMM Technology, a wholly owned unit of Iljin Materials, is preparing for a domestic initial public offering. Iljin had acquired 100% of IMM in 2017.

Back in 2019, STIC had invested 600 billion won in Iiljin Materials, which was used to expand IMM Technology's plant in Malaysia. The plant has a bigger capacity than Iljin's 16,000-ton facility in Iksan, North Jeolla Province, which is the largest copper foil plant in South Korea.

Iljin's foray into Europe is expected to speed up IMM Technology's initial public offering. The company mandated Korea Investment & Securities Co. and Shinhan Investment Corp. late last year to prepare its IPO in Korea.

Last year, IMM Technology posted a 43 billion won operating profit on sales of 537 billion won, down slightly from the previous year's 47 billion won operating profit against sales of 550 billion won.

Once listed, its enterprise value is expected to come in the one trillion won range, compared with its parent Iljin Materials' market capitalization of 3.4 trillion won as of Apr. 21.

A copper foil is an anode material for a lithium-ion battery used in electric vehicles and PCBs of smartphones and PCs. It serves as a pathway for the electric current and is the source to emit the heat generated by a battery.

In January this year, South Korea’s SKC Ltd. said it would build its first overseas plant of copper foils in Malaysia for 650 billion won, on the same island of Borneo as the copper foil plant run by IMM Technology.

Iljin Materials, SK Nexilis Co.and Doosan Solus Co. are key copper foil manufacturers in South Korea. Last year, Seoul-based SKyLake Investment had acquired a 53% stake in Doosan Solus for 700 billion won.

Write to Chae-Yeon Kim at why29@hankyung.com

Yeonhee Kim edited this article.

-

EV battery materialsSKC to spend $600 mn to build copper foil plant in Malaysia

EV battery materialsSKC to spend $600 mn to build copper foil plant in MalaysiaJan 26, 2021 (Gmt+09:00)

2 Min read -

EV battery materialsSKC to build first overseas copper foil plant in Malaysia

EV battery materialsSKC to build first overseas copper foil plant in MalaysiaDec 15, 2020 (Gmt+09:00)

3 Min read -