EV battery materials

SKC to build first overseas copper foil plant in Malaysia

By Dec 15, 2020 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

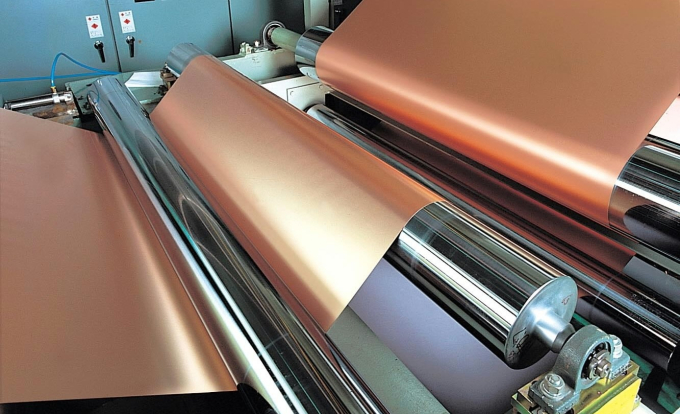

SKC Ltd., a chemical materials maker of South Korea’s SK Group, is planning to more than quadruple its production capacity of copper foils, a key component of electric vehicle batteries, by building its first oversea plant in Malaysia while simultaneously expanding domestic capacity, according to the company sources on Dec. 15.

In line with soaring demand for the EV battery material, SKC is also considering building a factory in Europe, where two leading Korean EV battery makers – LG Energy Solution, spun off from LG Chem Ltd. and SK Innovation Co. – have production facilities.

Last month, SKC opened a subsidiary in Warsaw, the capital of Poland, fanning market speculation that it might begin the preparation for a copper foil plant construction in the European country.

“After reviewing multiple locations, we selected Malaysia as the location,” an SKC source told The Korea Economic Daily. But he added that no decision has been made on running a factory in Europe.

SKC will finalize the Malaysia plant opening plan at a board meeting as early as next week. It will break ground on the plant in the first half of next year for completion by 2023.

Most of the copper foils to be produced in Malaysia will be shipped to foreign EV battery manufacturers, including its clients China’s CATL and Panasonic. SK Nexilis Co., fully owned by SKC, will be in charge of the plant operation in Malaysia.

SKC acquired the copper foil maker, a former LG Group unit, for 1.2 trillion won ($1.1 billion) from KKR early this year, and renamed it SK Nexilis, the latter word meaning connection in Latin.

SK Nexilis has been running four plants in North Jeolla Province, southwest of Seoul. It is now building two more plants in the province, its fifth and sixth plants, for completion by the second half of next year and early 2022, respectively.

The company sources said the lack of available land in the province led to the decision to build an overseas plant.

Upon completion of the Malaysian plant and the two domestic facilities, SK Nexilis is expected to more than quadruple its annual production capacity to 140,000 tons by 2025 from the current 34,000 tons.

SK Nexilis boasts the technology to produce a copper foil measuring 4 micrometers in thickness, or about one-thirtieth of a human hair.

Demand for ultra-thin copper foils is on the rise because the thinner the copper foil is, the more active material such as cathode and anode can be placed in a limited space, therefore increasing the battery’s energy density. Typically, copper foils make up 30 kg of an EV's total weight.

SK Nexilis earned 15.2 billion won in operating profit in the July-September quarter of this year on sales of 103.1 billion won. It was the first time for the company’s quarterly sales to exceed 100 billion.

DOMESTIC COPPER FOIL RIVAL

The decision on the Malaysian plant building, however, has upset its domestic rival, Iljin Materials Co., because of its location. Iljin Materials, a medium-sized Korean company, has already been running a copper foil plant in Sarawak, a Malaysian state on the island of Borneo, since January 2019. It is just 10 km away from the SK Nexilis' plant construction site. The two companies are the country’s two leading battery copper foil makers.

“SKC’s plant construction could spark the outflow of our experienced local employees," said an Iljin source. "We will work out plans to prevent their outflow.”

Chief executives of SK Nexilis and Iljin have met to discuss such issues. But the sources declined to elaborate further.

Write to Kyung-Min Kang at kkm1026@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google24 HOURS AGO

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN