Corporate value

SK aims to raise enterprise value to over $120 billion by 2025

By Mar 30, 2021 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

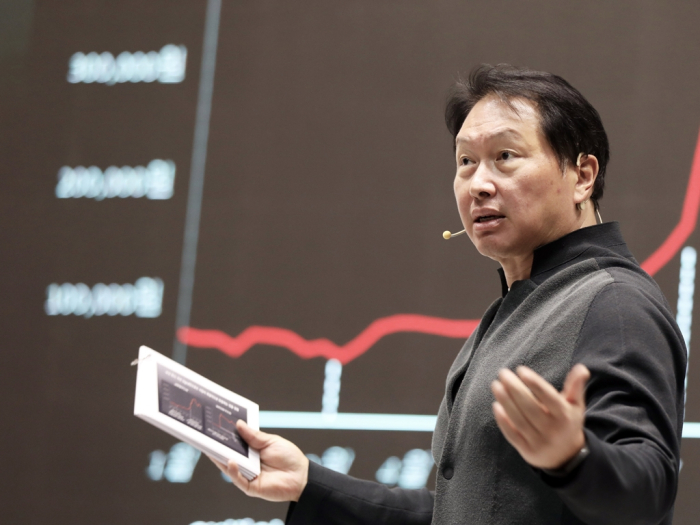

SK Inc., formerly known as SK Holdings Co., has vowed to raise its enterprise value to some 140 trillion won ($123 billion) by 2025 by focusing its resources on four growth sectors.

The holding and investment company of SK Group, South Korea’s third-largest conglomerate, on Monday presented its long-term growth vision, under which it hopes to transform into a “value investor.”

“We are aiming to become a value investor to make SK a company that trades at 2 million won a share by 2025,” Chief Executive Jang Dong-hyun said during its annual general meeting of shareholders.

Shares of SK were trading up 5.2% at 282,500 won on the main bourse in early trade on Tuesday.

Its goal of achieving a market capitalization of 140 trillion won represents more than eight times its current share price. Samsung Electronics Co. is the only listed company in Korea that has more than 140 trillion won in market cap.

CORPORATE NAME CHANGE

As part of its efforts to become a value investor, the company changed its corporate name to SK Inc. from SK Holdings at the shareholders' meeting.

To enhance its corporate value, SK said it will concentrate its investment on four strategic sectors – new materials, bio, green and digital.

“We have achieved an annual return of 50% for the past five years from our investment in the advanced materials business, including electric-car battery parts and copper foils. We want to further expand in these areas through partnerships with global companies,” said the CEO.

In the eco-friendly sector, he said the company will expand its hydrogen business to generate 2.5 trillion won in revenue by 2025 by establishing a hydrogen value chain from production to distribution.

In the digital segment, SK plans to widen collaboration with global tech companies specialized in artificial intelligence.

Last week, SK said it will give outside directors more authority to get involved in the selection and dismissal of its chief executive and independent board members, alongside reviews of investment proposals based on environmental, social and governance (ESG) standards.

Write to Jae-Kwang Ahn at ahnjk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Governance reformsSK Holdings to empower directors to pick and oust CEO

Governance reformsSK Holdings to empower directors to pick and oust CEOMar 26, 2021 (Gmt+09:00)

1 Min read -

Mobility fundsSK Holdings, China’s Geely launch $300 million future mobility fund

Mobility fundsSK Holdings, China’s Geely launch $300 million future mobility fundMar 18, 2021 (Gmt+09:00)

2 Min read -

Block dealSK Holdings raises $1 bn from block sale of SK Biopharm shares

Block dealSK Holdings raises $1 bn from block sale of SK Biopharm sharesFeb 24, 2021 (Gmt+09:00)

2 Min read -

Cold-chain logisticsSK Holdings cryogenic biz eyes jackpot on hopes of imminent COVID-19 vaccine

Cold-chain logisticsSK Holdings cryogenic biz eyes jackpot on hopes of imminent COVID-19 vaccineNov 13, 2020 (Gmt+09:00)

2 Min read -

Corporate governanceSK Holdings' board underpins new standard in Korea

Corporate governanceSK Holdings' board underpins new standard in KoreaOct 29, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN