SK Holdings' board underpins new standard in Korea

By Oct 29, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

It didn’t stop there. Kim Byung-ho, one of the outside directors, proposed shoring up the board's function through this opportunity. He said that the board should be more thorough when reviewing new investment opportunities as they are the core growth drivers for SK Holdings. All of the outside directors agreed with Kim.

Three months later on Oct. 27, SK Holdings' board passed a proposal that would require investments worth over 1% of the company's equity capital to obtain mandatory approval from the board. Previously it was set at an investment amount of over 1.5% of the company's equity capital.

OUTSIDE DIRECTORS ARE UP FOR MORE WORK

South Korean conglomerate SK Group's holding company SK Holdings primarily focuses on identifying new businesses and investments. In 2017, the company acquired SK Biotek Ireland Ltd. and invested in Singapore-based ride-hailing company Grab in 2018.

The holding company's board reviews investments valued at over 1.5% of its equity capital. The board's main assessment criteria are if the investments are reasonable and fitting. Last year, SK Holdings held 13.4 trillion won ($11.8 billion) in equity capital, meaning that investments that required over around 200 billion won were subject to the board's approval.

Moving forward, the investment amount for mandatory approval will scale down to a range of 130 billion won, or 1% of the company's equity capital from last year, following the board's decision. This means there will be around a 25% increase in the number of investments for review based on the investments carried out since 2017.

“Financial groups in Korea are subject to board approval when they want to make investments that account for over 1% of their equity capital,” said director Kim who formerly held a vice-president title at Hana Financial Group. “This is something that SK Holdings should be willing to adopt given that the company is strongly set on incorporating transparent management."

METICULOUS REVIEWS ARE THE NORM

SK Holdings' outside directors are known to be meticulous and even picky in their investment review process as they are very proactive in discussions.

SK Holdings usually announces the investment agenda a few weeks before raising it to the board. These agenda items are discussed at a governance committee meeting that involves only the outside directors. The company's management does not attend the meeting to ensure independence and transparency.

Outside directors will convene to discuss the suitability of the investment agenda and suggest changes if necessary. All of the agenda items that are raised to the board have usually gone through outside directors' reviews at least a few times. This is why the company management proposed simplifying the reporting procedure.

NO LIMITS ON CHAIRMAN ROLE

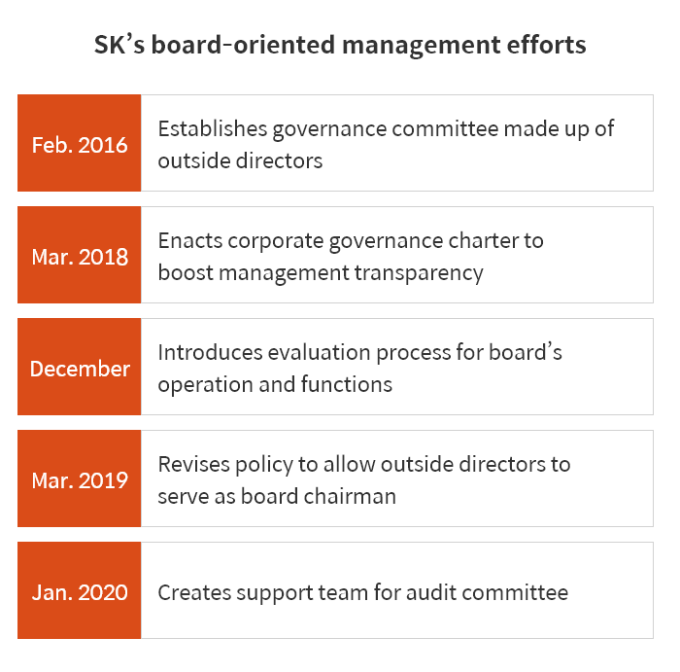

Last year in March, SK Holdings eased qualifications for the board chairman role to allow any registered director, including outside directors, to be chosen for the position. Previously only the company's chief executive officer qualified for the role.

This led SK Group Chairman Chey Tae-won to step down as the board chairman and was replaced by outside director Yeom Jae-ho, the former President of Korea University.

SK Holdings' board-oriented management is highly appraised by outsiders. The company received an A+ rating by the Korea Corporate Governance Service in 2018 for best practices in environmental, social, corporate governance thanks to the company's audit committee and the board's independence and professionalism.

The company has also been on the Dow Jones Sustainability World Index for eight consecutive years thanks to its efforts in transparent management and protection of shareholders’ rights.

Write to Jae-kwang Ahn at ahnjk@hankyung.com

Danbee Lee edited this article.

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-