Factory suspension

Hyundai Motor to halt plant for a week; Kona, IONIQ 5 affected

By Mar 29, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s top automaker Hyundai Motor Co. will halt its main plant in Ulsan for a week due to a component supply disruption, the latest sign that a global shortage of automotive chips is putting carmakers under increasing pressure.

Hyundai’s sister firm Kia Corp. has also decided to adjust its operations at its plant in Hwasung, Gyeonggi Province, by canceling overtime in April.

According to industry officials on Mar. 29, Hyundai Motor will halt the Ulsan Plant 1 from Apr. 5 through Apr. 13. The suspension marks the first time the automaker has stopped its operations since it temporarily shut the factory in February 2020 due to an inventory depletion of wiring harnesses.

The halt will affect the production of some 6,000 units of the compact SUV Kona and 6,500 units of the IONIQ 5, the first model under its standalone electric vehicle sub-brand.

Hyundai is known to be suffering from a short supply of auto chips used in cameras for the Kona SUV. The company is also having difficulty securing a component, the PE module, for the IONIQ 5 from its auto parts-making unit Hyundai Mobis Co.

The component supply disruption at Hyundai comes after US auto giant General Motors Co.’s Korean unit slashed its production rates last month for similar reasons.

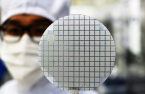

GROWING AUTO RELIANCE ON CHIPS

The disruptions reflect the auto industry’s increasing reliance on the technology provided by semiconductors.

With the rising popularity of smart cars such as autonomous driving vehicles and electric cars, chips are used in a growing number of applications, including driver assistance systems, navigation control, Wi-Fi, Bluetooth, video displays and computerized engines. The latest models have between 200 and 400 chips on average.

The shortage of automotive chips comes as leading foundry chipmakers such as Taiwan Semiconductor Manufacturing Co. (TSMC) reduced capacity for automakers after the COVID-19 pandemic slashed car sales. Instead, foundries shipped more chips to companies that produce smartphones, gaming systems and other tech gadgets that remained in high demand.

The situation for automakers has been exacerbated as car sales bounced back sooner than expected in the second half of last year.

Most automotive chipmakers, including Dutch-American firm NXP Semiconductors N.V., Germany’s Infineon Technologies AG and Japan’s Renesas Electronics Corp., are fabless, outsourcing the production of such chips to the likes of TSMC, Samsung Electronics Co. and Taiwan’s United Microelectronics Corp. (UMC).

Write to Il-Gue Kim and Byung-Uk Do at Black0419@hankyung.com

In-Soo Nam edited this article.

More to Read

-

New EV modelHyundai Motor debuts all-electric IONIQ5 as EV battle rages on

New EV modelHyundai Motor debuts all-electric IONIQ5 as EV battle rages onFeb 23, 2021 (Gmt+09:00)

3 Min read -

-

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chains

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chainsFeb 15, 2021 (Gmt+09:00)

2 Min read -

GM Korea to cut production; carmakers call for govt action

GM Korea to cut production; carmakers call for govt actionFeb 04, 2021 (Gmt+09:00)

3 Min read -

New EV modelHyundai Motor releases IONIQ 5 EV teasers before February reveal

New EV modelHyundai Motor releases IONIQ 5 EV teasers before February revealJan 13, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN