Retail trading

Retail trading surge continues in S.Korea with 40 mn active accounts

By Mar 11, 2021 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The daily schedule of this 26-year-old South Korean university student, identified by his surname Ahn, is not too different from that of a typical fund manager.

As soon as he wakes up in the morning, he checks the overnight performance of the US market and reads analyst reports over breakfast. He prepares for the day ahead by reading the list of stock picks his friend sends over by messenger, all the while watching YouTube clips on market movements.

Another amateur trader, Park, starts her day just like Ahn. The 38-year-old housewife begins the day by reading her favorite business newspaper and watching several YouTube channels on global stocks after sending her child to kindergarten. At night, Park catches up on US stock movements before she goes to bed.

South Korea’s stock market boom thunders on with the number of active trading accounts setting a new record at nearly 40 million -- in a country with just over 50 million people.

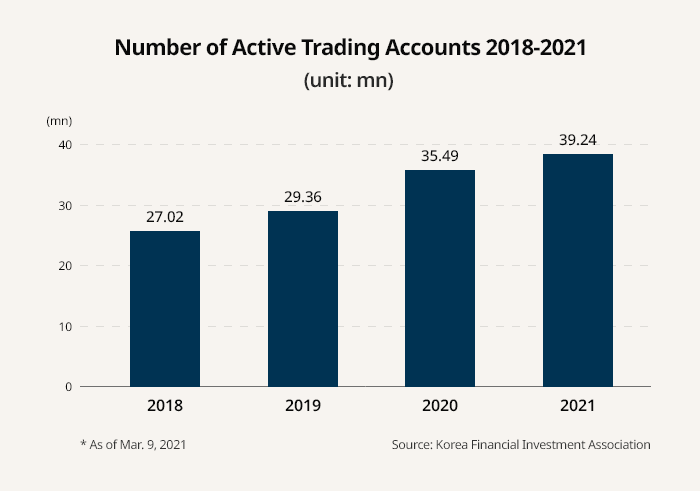

According to data from the Korea Financial Investment Association (KFIA) as of Mar. 9, the number of active trading accounts in the country has reached 39.24 million, up 10.6% from the 35.50 million as of year-end 2020.

The figure marks a faster rate of increase even compared to that of 2020 when the stock market surge began: rising by 6.13 million accounts in 12 full months last year, compared to 3.75 million this year in just over two months.

An active trading account is, by definition, an account that has engaged in stock trading at least once in the past six months with a deposit of more than 100,000 won ($88).

The number is considered a good thermometer to measure the degree of fever over the country’s stock market.

Industry experts analyze that the stock trading population in South Korea must have surpassed 8 million, as an average individual holds four to five trading accounts.

“The sharp increase in the the stock trading population is a common trend in the US as well as in fast-growing countries in Southeast Asia,” said Nam Gil-nam, senior research fellow and head of capital markets at Korea Capital Markets Institute (KCMI).

Nam added that “another factor fueling the current trading fervor in South Korea is this year’s regulatory change regarding the IPO (initial public offering) system, which allows individuals to purchase IPO stocks in proportion to the number of accounts they possess.”

SK Bioscience is an example of such enthusiasm over IPO stocks. The South Korean vaccine maker recently set a new record raising around 63.6 trillion won ($56 billion) in deposits during its two-day public subscription on Mar. 9 and 10. Its shares were oversubscribed by 335 times, attracting around 2.4 million subscription accounts.

With a series of big-name companies like Krafton Inc. planning IPOs this year, analysts project that the number of trading accounts will continue to rise throughout 2021.

NATIONAL PHENOMENON ACROSS GENERATIONS

Nowadays in South Korea, it is commonplace to run into amateur traders like Ahn and Park trading everywhere, at restaurants, cafés, in the workplace and even on public transportation with the spread of mobile trading system (MTS) apps on smartphones.

With the rising popularity of US stocks among South Koreans, there is also an army of zealous fans who almost worship Tesla’s Elon Musk and Ark Invest’s Cathie Wood as demigods of the stock market.

According to App Annie, a global mobile application market research company, the MTS app of Kiwoom Securities is ranked as the16th-most popular app in the country as of early March this year, even higher than Instagram at 28th.

Moreover, online discussion boards at the nation’s top universities such as Seoul National University, Korea University and Sogang University are filled with hundreds of threads on the stock market, even higher in number than those on love and relationships.

Analysts say that the individual traders’ level of understanding on the stock market has also risen significantly – YouTube channels that deal with more technical information, such as how to exercise SPAC (special purpose acquisition company) warrants, have many more viewers than basic content channels, such as those explaining the definition of SPAC, etc.

FLUSH TIMES FOR SECURITIES FIRMS

The drastic increase in the number of trading accounts is rejuvenating Yeouido, the financial center of Seoul. Securities firms in Yeouido had long considered the retail brokerage business – where profits are made from taking commissions on individual trading – somewhat less attractive and unprofitable.

But now the retail brokerage business is the one laying golden eggs for the whole industry.

Thanks to the huge increase in commissions taken from individual traders, Mirae Asset Daewoo’s 2020 operating profit surpassed 1 trillion won ($880 million) for the first time in the industry at 1.13 trillion won ($994 million) and net profit at 818.3 billion won ($720 million).

Kiwoom Securities followed suit with an operating profit of 954.9 billion ($840 million), up 101.58% from 2019.

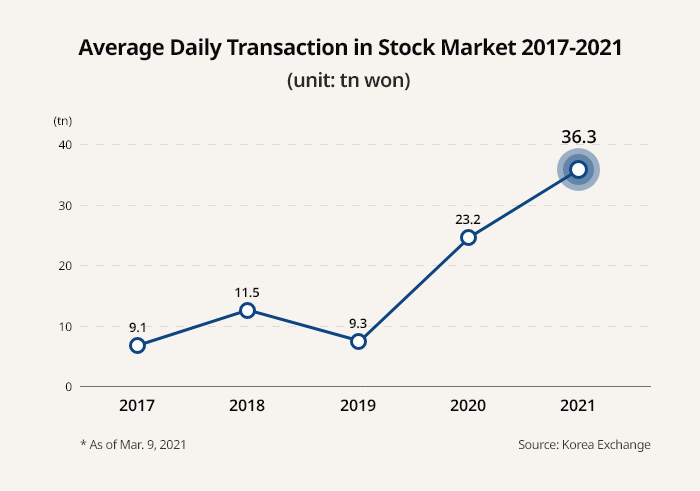

According to Korea Exchange, this year’s daily average transaction amount in the domestic stock markets, Kospi and Kosdaq combined, was 36.3 trillion won so far, almost four times that of the pre-COVID level at 9.3 trillion in 2019.

Industry experts expect that direct investment in stocks will continue to thrive in the years ahead, unlike the short-lived jumps in the 2000s.

Min Soo-ah, executive director and head of value management division at Samsung Active Asset Management, commented: “Struck by COVID-19, the domestic stock market has been reshuffled with a focus on industries that are sustainable in the long run, such as internet, electric batteries and gaming."

She shared her projection that individuals will increasingly commit longer term to the stock market, looking to "companies that can create sustainable, steady growth stories unlike cyclical stocks with high volatility.”

Write to Jae-Won Park, Bum-Jin Chun, Ye-Jin Jeon at wonderful@hankyung.com

Daniel Cho edited this article.

More to Read

-

IPOsSK Bioscience IPO draws record-high demand from retail investors

IPOsSK Bioscience IPO draws record-high demand from retail investorsMar 11, 2021 (Gmt+09:00)

2 Min read -

Short-selling resumptionKorea to lift short-selling ban on large stocks; retail investors resist

Short-selling resumptionKorea to lift short-selling ban on large stocks; retail investors resistFeb 04, 2021 (Gmt+09:00)

2 Min read -

Campaign against short-sellingRetail investors test Celltrion, HLB shares as Korea’s GameStop

Campaign against short-sellingRetail investors test Celltrion, HLB shares as Korea’s GameStopFeb 01, 2021 (Gmt+09:00)

3 Min read -

Year-end reviewKorea’s retail investors go West, eye golden ticket for big money

Year-end reviewKorea’s retail investors go West, eye golden ticket for big moneyDec 31, 2020 (Gmt+09:00)

3 Min read -

Year of ants investorsKorea’s retail investors shed loser image, turn pandemic into bonanza

Year of ants investorsKorea’s retail investors shed loser image, turn pandemic into bonanzaDec 21, 2020 (Gmt+09:00)

4 Min read

Comment 0

LOG IN