Year-end review

Korea’s retail investors go West, eye golden ticket for big money

By Dec 31, 2020 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

For South Korean stock investors, 2020 may go down in history as the year of The Great Quest for big money, and at the end of their journey they found hidden treasures in the US.

Korea’s individual and institutional investors turned their eyes overseas for higher returns, buying heavily into US growth stocks in particular amid growing fear of a tech stock bubble.

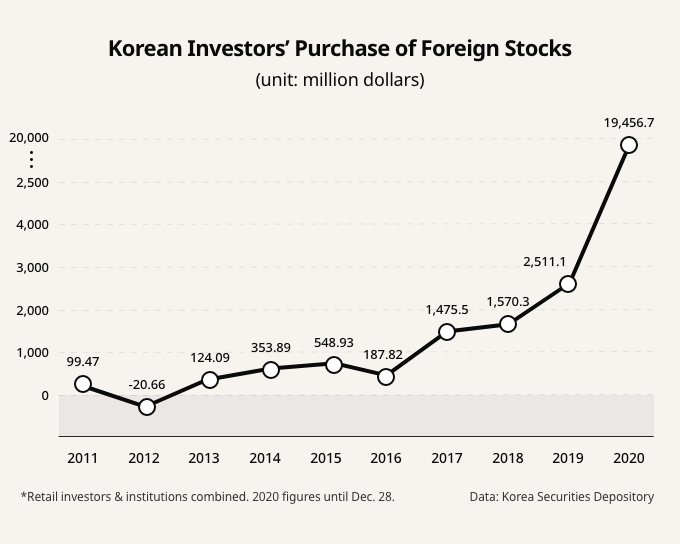

According to the Korea Securities Depository (KSD), their 2020 foreign stock transactions valued at $193.38 billion (210.27 trillion won) until Dec. 28, up nearly fivefold from $40.9 billion in 2019. The 2020 figure is bigger than the combined amount of $142.19 billion between 2011 and 2019.

Their net buying has reached $19.46 billion in 2020, an eightfold increase from the year prior, and three times higher than the combined $6.82 billion in the 2011-2019 period.

“In the past, local investors focused on Korean stocks and real estate. But there has been a big change in their investment pattern this year,” said Jung Yong-taek, head of research at IBK Investment & Securities. “Their portfolio has been widened and diversified. It’s a good thing.”

KOREANS, LONG-TERM FOREIGN BUYERS

Korean investors began looking beyond local bourses for higher returns from mid-March when the domestic markets turned volatile, gripped by the quick spread of the COVID-19 pandemic.

Analysts said when they looked to overseas markets, they were not just seeking bargains for short-term gains, but bought foreign stocks as a long-term investment as the US market, in particular, has shown an uptrend for a decade.

“The consensus now among Korean investors is that what’s important is the return on investment. They don’t care whether the stock is listed on the Korean market or the US market,” said Oh Hyun-suk, head of Samsung Securities’ research center.

EMERGENCE OF SEOHAK ANTS MOVEMENT

Some pundits called their aggressive buying of foreign stocks the “Seohak Ants Movement” as opposed to the “Donghak Ants Movement,” a reference to the 19th-century Donghak Peasant Movement, a peasant revolt against rich and foreign invaders.

The Ants and institutional investors were predominantly attracted to US stocks.

According to the KSD, they bought $17.39 billion won worth of US shares this year, followed by China ($1.13 billion), Hong Kong ($905.4 million) and Japan ($155 million).

Of all the overseas stocks purchased by Korean retail and institutional investors, US shares accounted for 79.1% as of Dec. 28, up from 58.2% at the end of 2019.

Tesla Inc. was their top pick among foreign shares, with their holdings worth $7.47 billion, followed by Apple Inc. ($2.87 billion), Amazon.com ($2.02 billion) and Nvidia Corp. ($1.16 billion).

Other favorite foreign stocks include Jiangsu Hengrui Medicine Co., a Chinese pharmaceutical firm ($745 million), Japan’s video game publisher Nexon Co. ($500 million) and Hong Kong-listed Tencent Holdings Ltd. ($422 million).

Data showed millennials in their 20s and 30s have shown renewed interest in overseas stocks, accounting for 60% of Korean buying of US tech stocks, including Tesla.

NO SUREFIRE GOLDEN TICKET FOR BIG MONEY

Analyst say foreign stock investment is not always the golden ticket for big money, particularly with some Wall Street analysts arguing that the US market is at tech bubble valuation levels, similar to the dot-com bubble in the late 1990s.

Larry Hite, a long-time successful hedge-fund manager who doesn’t believe anyone can predict how the stock market will move, has warned of a bubble in tech stocks, citing Tesla Inc. as one such example.

In a recent interview with The Korea Economic Daily, he said “emotions are running high” in investors' stock purchase behavior.

Kim Hak-gyun, head of research at Shinyoung Securities said, “You’ll be thrilled by the speed by which growth stocks rise. But once they are out of favor, they fall much faster than the market average.”

Write to Byeong-Hun Yang at hun@hankyung.com

In-Soo Nam edited this article.

More to Read

-

SemiconductorsSamsung overtakes TSMC as top chipmaker by market cap

SemiconductorsSamsung overtakes TSMC as top chipmaker by market capDec 27, 2020 (Gmt+09:00)

4 Min read -

-

Year of ants investorsKorea’s retail investors shed loser image, turn pandemic into bonanza

Year of ants investorsKorea’s retail investors shed loser image, turn pandemic into bonanzaDec 21, 2020 (Gmt+09:00)

4 Min read -

Kosdaq outlookKosdaq at 20-yr high, eyes opportune moment to emerge from bush league

Kosdaq outlookKosdaq at 20-yr high, eyes opportune moment to emerge from bush leagueDec 18, 2020 (Gmt+09:00)

2 Min read -

K-contentK-content companies set to rule 2021 stock market after breakneck growth

K-contentK-content companies set to rule 2021 stock market after breakneck growthDec 14, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN