DRAM supercycle

Signs of upcoming DRAM boom cycle loom large amid price uptrend

By Feb 25, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

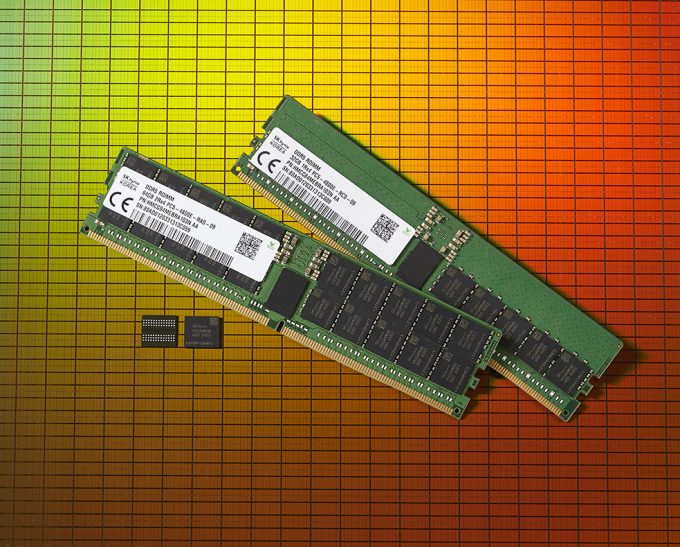

Signs that the global DRAM market is entering a boom cycle are looming large with chip prices on an ascending trendline and major chipmakers spending generously to ramp up facilities.

Industry leaders such as Samsung Electronics Co. and SK Hynix Inc. are already running their plants at full capacity, but a shortage is increasingly becoming an issue as makers of cars, smartphones and electronic devices compete for chips amid depleting supplies.

According to the Korea Customs Service and Mirae Asset Daewoo Co. on Feb. 25, South Korea’s memory chip exports in the first 20 days of February reached $1.07 billion, up 15% from the same period a month earlier – a rare feat in the traditional off-season for IT products and components.

Overseas shipments of DRAM-focused multi-chip packages (MCPs) widely used in smartphones increased 16.6% over the same period, according to the customs office and the local brokerage firm.

SELLER’S MARKET

The global DRAM market has apparently turned into a seller’s market, where the supplier wields the pricing power as low supply meets high demand.

According to market data provider DRAMeXchange, the spot price of DDR4 8G 2400Mbps, one of the most common DRAM products, rose above the $4 mark for the first time in 22 months on Feb. 22. The product is currently trading at $4.2 apiece, a 14% increase from the end of January and a 21.4% gain from the end of 2020.

“Buyers are eager to buy chips to build up their inventories, but the market is full of stony sellers. This is typical of a chip shortage situation,” said a chip industry official.

Rising chip exports and higher prices simply reflect growing demand, ushering in a “supercycle” that analysts and industry watchers expect to persist for at least a few years.

In the server DRAM market, big memory chip buyers including Google, Amazon and Facebook have resumed their hefty investments, while smartphone makers, particularly those in China such as Oppo, Vivo and Xiaomi, are buying massive amounts of semiconductors for use in their new mobile phones.

The latest surge in chip prices is thanks to higher consumer demand for TVs, smartphones, laptops and cars, that bounced back from the COVID-19 crisis sooner than expected.

SAMSUNG EXPECTS 15% DRAM DEMAND RISE

The rise in spot prices is expected to lead to higher contract prices, which chipmakers and big buyers negotiate for large volumes.

Market research firm TrendForce recently raised its second-quarter outlook for server DRAM price hikes to 10-15% from a range of 8-13% previously.

A server requires a capacity of 300 gigabytes of DRAM, compared to 8 GB for a laptop and 2 GB for an infotainment system in a car.

Citing International Data Corp. (IDC) forecasts, Samsung Electronics recently said it expects global DRAM demand to rise about 15% this year from 2020.

Samsung and other global foundry players, which make semiconductors for fabless firms, have boosted their operation rates close to 100%, meaning little room for further output expansion.

The Korean tech giant, instead, is expected to focus on enhancing price and technology competitiveness.

HYNIX TO INTRODUCE CUTTING-EDGE EUV SCANNERS

SK Hynix, the world’s second-largest memory maker, said on Wednesday it has agreed on a five-year procurement contract worth 4.8 trillion won ($4.34 billion) with ASML Holding N.V. to secure extreme ultraviolet (EUV) scanners used in manufacturing chips.

The deal is for the chipmaker’s planned mass production of chips by next-generation processes, SK Hynix said in a regulatory filing.

Shares of SK Hynix, a pure DRAM play, finished up 9.2%, the biggest percentage gain in over three months, at 148,500 won on Thursday.

Write to Jeong-Soo Hwang and Sang-Yong Park at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Foundry ramp-upsSamsung Elec may advance start of leading-edge foundry line to July

Foundry ramp-upsSamsung Elec may advance start of leading-edge foundry line to JulyFeb 21, 2021 (Gmt+09:00)

3 Min read -

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chains

Semiconductor shortagesChip shortages spread to backend firms, disrupting supply chainsFeb 15, 2021 (Gmt+09:00)

2 Min read -

Chip shortagesGM Korea to curb production as global chip shortages worsen

Chip shortagesGM Korea to curb production as global chip shortages worsenJan 22, 2021 (Gmt+09:00)

3 Min read -

Foundry boomSamsung, other foundry players at full capacity as chip orders surge

Foundry boomSamsung, other foundry players at full capacity as chip orders surgeJan 06, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN