Korean stock markets set for record-high IPOs in 2021

By Feb 16, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Initial public offerings in South Korea are expected to top 20 trillion won ($18 billion) in value this year, the largest amount for a single year in the country, with a greater number of high-profile companies, including LG Energy Solution Co., preparing for billion-dollar offerings in coming months.

The estimated IPO volume this year is about five times the 4.7 trillion won for the whole of 2020, as a slew of startups race to go public to take advantage of abundant market liquidity and the stock markets' bull run beginning late last year."We are expecting to see a booming IPO market this year, given the number of IPOs, IPO sizes and post-IPO share prices," said Heungkuk Securities analyst Choi Jong-kyung.

A total of 34 companies have so far applied to the Korea Exchange for IPOs to take place this year. But the Exchange has yet to finish the review of IPO files submitted even last September, as it is swamped with applications.

"Both big and small companies are in rush to list to take advantage of the booming IPO market," said a stock market industry source. "After submiting annual reports in March and April, more companies will flood the IPO market."

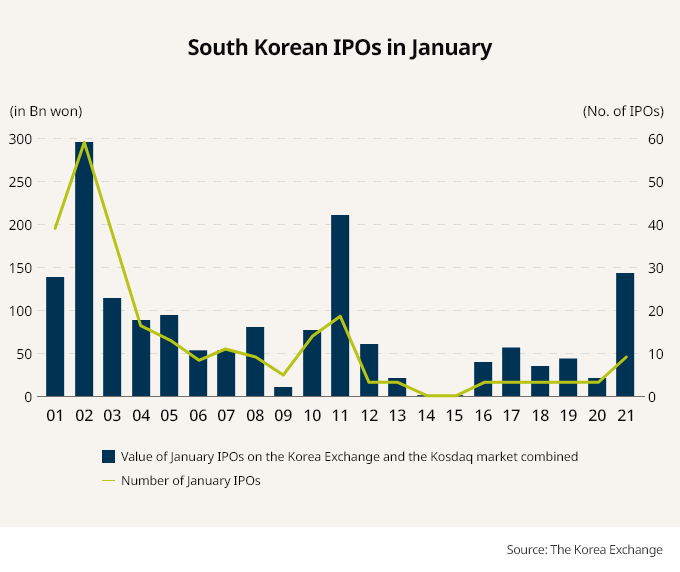

In January, six companies were listed either on the country’s main bourse or the junior Kosdaq market, raising a combined 142.1 billion won ($129.3 million), according to the Korea Exchange. They were heavily oversubscribed and priced at the high end of their indicative ranges.

The January number marked the largest amount of IPOs seen in January since January 2011 when 12 companies went public in Korea to raise a combined 203.3 billion won. Last month's number was also the third-largest January IPO showing since January 2002, when 39 companies listed on the domestic stock markets to raise 295.1 billion won in aggregate.

January is usually a slow month for initial public offerings because IPO underwriters are inclined to wrap up listings by year’s end to shore up their annual results. Back in 2014 and 2015, no IPOs took place in January.

“Both the companies that were pushed back on the IPO list at the end of last year and those rushing to list are flooding the IPO market at the same time,” said an investment banking source.

| January IPOs | |||

| Company name | IPO size | Subscription rate | IPO venue |

| Iquest (software developer) | 22 billion won | 1,054 times (the highest rate for a Korean IPO) | Kosdaq |

| Rainbow Robotics | 26.5 billion won | 1,490 times | Kosdaq |

| NBT (mobile advertising app) | 15.8 billion won | 4,398 times for public subscription | Kosdaq |

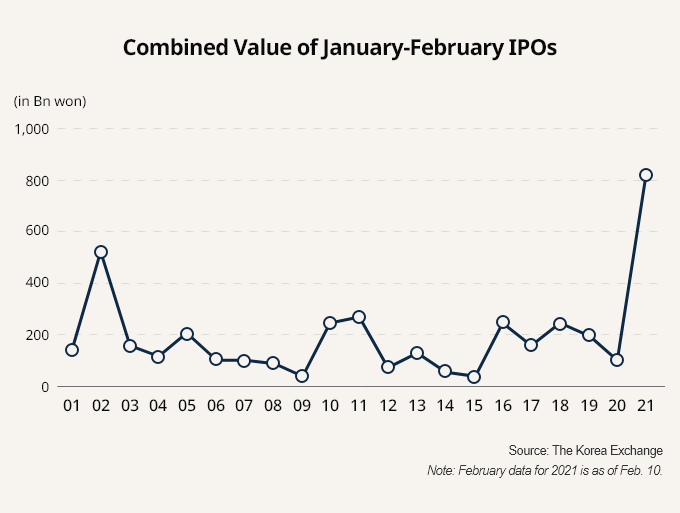

So far in February alone, six companies have gone public, raising a combined 684.2 billion won. That amount is far above the 59 billion won total of IPOs in February of last year, and the largest amount ever for a February in terms of IPO volume.

| Korean IPOs in February 2021 | ||

| Company name | IPO value | Listing venue |

| Prestige BioPharma | 490.9 billion won | Korea Exchange (Kospi) |

| Solum | 108.8 billion won | Korea Exchange (Kospi) |

| P&H Tech Co | 9.4 billion won | Kosdaq (due for Feb) |

| Aurostechnology | 39.9 billion won | Kosdaq (due for Feb) |

| Youil Energy Technology | 38.6 billion won | Kosdaq (due for Feb) |

| Vuno | 37.8 billion won | Kosdaq (due for Feb) |

Next month, SK Bioscience Co. is set to list on the Korea Exchange to raise up to 1.5 trillion won. Its sister company SK IE Technology Co., a manufacturer of polyimide film used in lithium-ion batteries and smartphone displays, is expected to list in April or May, upon receiving approval from the Korea Exchange.

| High-profile Korean IPOs due for 2021 | ||||

| Company name | IPO size | IPO schedule | Enterprise value | Indicative price range |

| SK Bioscience | 1.1 trillion won | March | 6.3 trillion won | 49,000-65,000 won |

| SK IE Technology | N/A | April-May | 5-6 trillion won* | N/A |

| Hanwha General Chemical | N/A | N/A | 4-5 trillion won* | N/A |

| Kakao Page | N/A | N/A | 4-5 trillion won* | N/A |

| Kakao Pay | N/A | N/A | 7-10 trillion won* | N/A |

| Kakao Bank | N/A | N/A | 10-20 trillion won* | N/A |

| LG Energy Solution | N/A | N/A | 90-100 trillion won* | N/A |

| Krafton | N/A | N/A | 20-30 trillion won* | N/A |

| Hyundai Heavy Industries | N/A | N/A | 5 trillion won* | N/A |

| SM Line | N/A | N/A | N/A | N/A |

| Note: *Estimates | ||||

The broader Kospi index has gained 10% since the start of this year, breaching the 3,000 point threshold for the first time in early January. Last year, the benchmark stock index jumped 30%, buoyed by heavy retail money inflows.

Write to Geun-Ho Im at eigen@hankyung.com

Yeonhee Kim edited this article.

-

Kosdaq outlookKosdaq at 20-yr high, eyes opportune moment to emerge from bush league

Kosdaq outlookKosdaq at 20-yr high, eyes opportune moment to emerge from bush leagueDec 18, 2020 (Gmt+09:00)

2 Min read