Earnings guidance

Samsung flags decent Q4 earnings growth, misses estimates on KRW, Apple

By Jan 08, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s tech giant Samsung Electronics Co. has flagged that its fourth-quarter operating profit likely rose by nearly a third from a year earlier, with remote work due to the pandemic driving demand for devices powered by its chips.

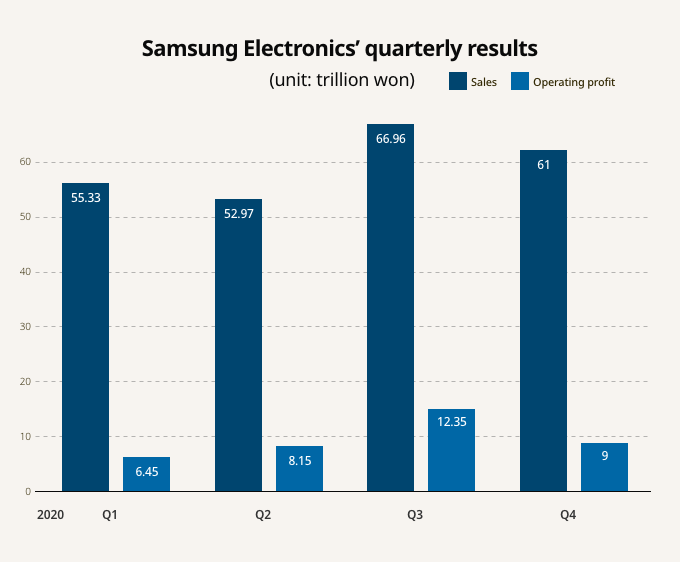

In its earnings guidance announced on Jan. 8, Samsung said it expects operating profit to rise to 9 trillion won ($8.3 billion) in the fourth quarter of 2020, up 26% from the year-earlier period. Sales likely rose 1.9% on the year to 61 trillion won.

The predictions fell short of analysts’ forecasts for an operating profit of 9.35 trillion won on revenue of 61.66 trillion won.

Samsung, the world’s biggest memory chip supplier and maker of smartphones, didn’t provide net income nor break down divisional performance, which will be available later this month when it releases its final results.

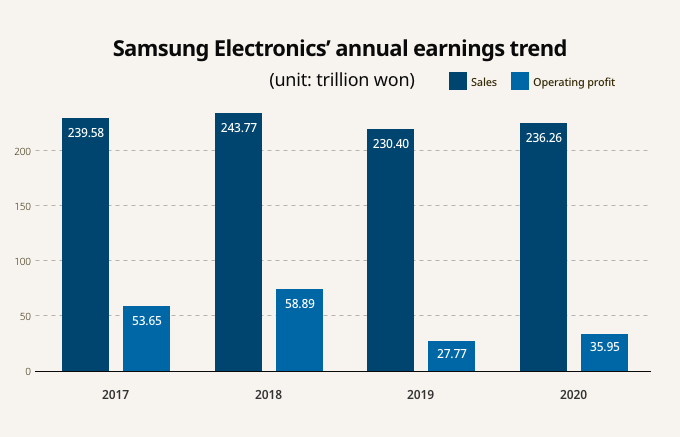

For all of 2020, Samsung said its sales likely rose 2.5% to 236.3 trillion won on a consolidated basis, marking its third-best revenue on record. Full-year operating profit is forecast to gain 29% on year to 35.9 trillion won, it said.

Compared with the third quarter, however, Samsung’s operating profit likely fell 27% while sales declined 8.9%, weighed by the strength of the Korean currency, intensified competition with iPhone maker Apple Inc. and weak memory chip prices.

In the July-September quarter, Samsung posted its highest-ever quarterly sales, with its operating profit hitting a two-year high. The company had warned of a fourth-quarter earnings decline when it reported third-quarter results last year.

STRONG WON, WEAK DRAM PRICES, IPHONES DENT Q4 EARNINGS

Analysts said Samsung’s smartphone sales were weaker in the fourth quarter as Apple released its 5G-compatible iPhone 12 and Chinese competitors launched aggressive campaigns to widen their global market share.

In efforts to better compete with its global rivals, Samsung plans to unveil its next flagship series, the Galaxy S21, next week, earlier than its usual annual schedule.

Memory chip prices fell in the final quarter of 2020 due to a slowdown in server demand, although prices are expected to rise in coming quarters as customers resume purchases.

The stronger Korean won during the period also eroded Samsung’s earnings. The company makes the bulk of its profit in overseas markets, but reports in won. The local currency closed at 1,086.3 won per dollar at the end of December, compared to 1,169.4 won at the end of September.

FOUNDRY, MEMORY SUPERCYCLE TO BOOST EARNINGS IN 2021

Looking forward, analysts expect Samsung to post better earnings this year as the global semiconductor industry is widely seen to be entering a “supercycle,” boosting the prices of Samsung’s mainstay DRAM chips.

Some analysts forecast Samsung will post an operating profit of more than 50 trillion won in 2021, similar to the 53.7 trillion won to 58.9 trillion won range it enjoyed during the previous upcycle between 2017 and 2018.

Samsung stands to benefit from surging foundry orders, in particular.

Samsung and other global foundry players are currently running their plants at full capacity as makers of cars and electronic devices compete for chips amid depleting supplies.

According to KTB Investment & Securities, Samsung is expected to post a record 20 trillion won in sales from its foundry business this year, up from estimated revenue of 14 trillion won to 15 trillion won for 2020.

Write to Jeong-Soo Hwang and Hyung-Suk Song at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Foundry boomSamsung, other foundry players at full capacity as chip orders surge

Foundry boomSamsung, other foundry players at full capacity as chip orders surgeJan 06, 2021 (Gmt+09:00)

4 Min read -

Kakao, NCSoft likely to lead record-breaking earnings in 2021

Kakao, NCSoft likely to lead record-breaking earnings in 2021Jan 03, 2021 (Gmt+09:00)

3 Min read -

SemiconductorsSamsung overtakes TSMC as top chipmaker by market cap

SemiconductorsSamsung overtakes TSMC as top chipmaker by market capDec 27, 2020 (Gmt+09:00)

4 Min read -

Future mobilityLG Electronics, Magna to launch $1 bn EV gear JV

Future mobilityLG Electronics, Magna to launch $1 bn EV gear JVDec 23, 2020 (Gmt+09:00)

3 Min read -

Foundry dealsSamsung clinches 2nd deal to make Nvidia’s latest gaming chips

Foundry dealsSamsung clinches 2nd deal to make Nvidia’s latest gaming chipsDec 17, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN