Neptune rises as dark horse in global game industry

By Dec 17, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

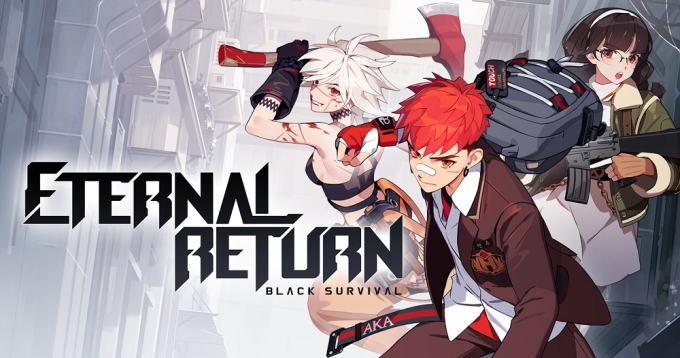

A South Korean game company is hoping to shake up the global game landscape with its latest title, Eternal Return: Black Survival, a PC game that has achieved remarkable success in the two months since its release.

On Oct. 14, Neptune Corp.'s subsidiary Nimble Neuron debuted Eternal Return on the world’s largest PC game platform Steam. Upon its release, the game pulled in around 3,290 players, and in just seven weeks had surged sixteenfold to 52,853 players on Dec. 6.

This is the second time for a Korean game to draw in over 40,000 users on Steam since Krafton Inc. rolled out its global blockbuster PlayerUnknown's Battlegrounds (PUBG) in 2017. It's particularly impressive considering that Korean PC games tend to underperform in the global market.

“Our strategy was to create a game with the help of our players and it worked. We are ready to go all in to make sure we don't miss out on this amazing opportunity," said Jeong Wook, the chief executive of Neptune, in an interview with The Korea Economic Daily as of Dec. 16.

Jeong says the "community snowballing" strategy contributed immensely to the game's success. Community snowballing is a fast-track approach that employs community involvement to drive a project's growth. It was also used by Krafton when developing PUBG, which went on to achieve global success.

Eternal Return is currently offered through early access on Steam. During the early access period, players can enjoy the game in pre-release development cycles and submit feedback, which can be adopted by the developers to fine-tune the game ahead of the official release.

Prior to the October early access release, Nimble Neuron ran seven alpha and beta tests, during which they received and implemented input from over 20,000 players.

“Our team of developers is considerably smaller than those of larger game companies, so the feedback we received from our players was very valuable,” said Jeong.

Eternal Return's popularity can also be attributed to its effective use of factors that were successful in earlier games. For example, Eternal Return selected the Battle Royale genre, already very popular thanks to PUBG.

The game also adopted a Multiplayer Online Battle Arena (MOBA) gameplay from Riot Games’ League of Legends, which has remained the No. 1 PC game for over a decade.

The blending of familiar and popular gameplay elements in Eternal Return has prompted game players to refer to the game as “League of Legends in survival mode.”

“It takes about 30 to 40 minutes to play a full game of League of Legends, but a game on Eternal Return requires around 15 to 20 minutes, which lessens stress for players,” said Jeong. “Simply put, if League of Legends is similar to Youtube, Eternal Return is more like to Tik Tok."

Neptune is committed to spending its resources to promote Eternal Return. The company has expanded its team of developers from 10 members to 50 members this year.

Also, on Dec. 15, the company decided to invest 10 billion won ($9.1 million) into Nimble Neuron, an extraordinary decision given that Neptune has posted four straight years of operating losses since 2016.

Eternal Return is expected to launch its official release in late 2021. During the early access period, Nimble Neuron plans to enhance its features, such as by expanding the choice of game characters and adding a ranking system.

“Our latest achievement is very rare for a Korean game company. It is a stroke of incredible luck and we are ready to put in our best efforts to shake up the game industry,” Jeong said.

Write to Joo-wan Kim at kjwan@hankyung.com

Danbee Lee edited this article.

-

Mobile gamesS.Korean games, entertainment eye China return after 3-year ban

Mobile gamesS.Korean games, entertainment eye China return after 3-year banDec 04, 2020 (Gmt+09:00)

2 Min read -

Firms vie to become Krafton's $883 mn IPO manager

Firms vie to become Krafton's $883 mn IPO managerOct 21, 2020 (Gmt+09:00)

3 Min read -

Korean unicorn Krafton eyes 2021 IPO to raise over $850 mn

Korean unicorn Krafton eyes 2021 IPO to raise over $850 mnSep 24, 2020 (Gmt+09:00)

3 Min read -

Korean mobile game developer buys out German rival

Korean mobile game developer buys out German rivalOct 12, 2020 (Gmt+09:00)

1 Min read -

Kakao Games gears up to become Korea’s IPO blockbuster of the year

Kakao Games gears up to become Korea’s IPO blockbuster of the yearAug 27, 2020 (Gmt+09:00)

2 Min read -

Korean game platform seeks $323 mn IPO in non-contact business boom

Korean game platform seeks $323 mn IPO in non-contact business boomAug 05, 2020 (Gmt+09:00)

3 Min read