infrastructure debt

Scope

Date

~

-

ASK 2021 Interview

ASK 2021 InterviewSculptor Capital bets on non-traditional real estate

Non-traditional real estate assets such as cell towers, parking lots and marinas will likely provide significant investment opportunities to debt in...

May 20, 2021 (Gmt+09:00)

-

Economy

EconomyIMF warns against South Korea's debt explosion

South Korea needs to closely monitor government spending to avoid a future debt explosion given its rapidly aging population, according to a senior ...

Apr 15, 2021 (Gmt+09:00)

-

Economy

EconomyS.Korea's public debt tops GDP for first time in 2020

South Korea's government debt surpassed its gross domestic product for the first time in 2020, with public debt reaching its highest level ever foll...

Apr 07, 2021 (Gmt+09:00)

language -

Fintech

FintechSoftBank-backed Balance Hero raises $10 mn in debt funding from India

South Korean fintech startup Balance Hero has raised around $10 million in debt funding led by the India-based non-banking financial company (NBFC) ...

Mar 31, 2021 (Gmt+09:00)

-

Batteries

BatteriesHyundai to build ultra-fast EV charging infrastructure under E-pit brand

Hyundai Motor Group has unveiled a plan to build high-speed electric car charging infrastructure across the country as the South Korean auto giant s...

Mar 23, 2021 (Gmt+09:00)

-

Debt financing

Debt financingNaver issues $500 million in first foreign debt amid strong demand

South Korea’s top online portal Naver Corp. has successfully issued its first foreign currency bonds worth $500 million amid strong demand as ...

Mar 23, 2021 (Gmt+09:00)

language -

Energy

EnergyKorea Resources seeks sale of Australia coal mine to slash debt

Korea Resources Corp. is planning to sell its 82.25% stake in a coal mine in Australia, as part of efforts to cut its debt totaling 6.7 trillion won...

Jan 06, 2021 (Gmt+09:00)

-

Alternative investments

Alternative investmentsTwo US firms win $200 mn Korea Post infrastructure mandate

Argo Infrastructure Partners and Stonepeak Infrastructure Partners were chosen as Korea Post’s new overseas infrastructure investment managers...

Dec 24, 2020 (Gmt+09:00)

-

Airlines

AirlinesHahn & Co finances $700 mn Korean Air deal with about $400 mn debt

Hahn & Co., a South Korean private equity firm, has completed the payment for the 790 billion won ($722 million) purchase of Korean Air Lines' i...

Dec 17, 2020 (Gmt+09:00)

-

RFPs

RFPsKorea Post seeks two direct lending funds for $200 mn mandates

Korea Post’s savings arm plans to select two global direct lending funds focusing on North America and Europe and commit $100 million to each ...

Dec 08, 2020 (Gmt+09:00)

-

Economy

EconomyS.Korea's household debt ratio exceeds 100% for first time

South Korea’s household debt to gross domestic product (GDP) ratio has exceeded 100% for the first time, with its debt growing relatively faster...

Nov 24, 2020 (Gmt+09:00)

-

Korean Investors

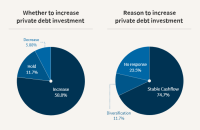

Korean InvestorsKorean LPs favor direct lending for private debt investment

More than half of South Korea’s key asset owners, led by the National Pension Service, are inclined to expand overseas private debt investment i...

Nov 17, 2020 (Gmt+09:00)

-

RFPs

RFPsKorea Post to commit $200 mn to global infrastructure funds

Korea Post’s savings arm will select two infrastructure fund houses to invest $200 million in overseas core infrastructure assets, according to ...

Nov 16, 2020 (Gmt+09:00)

-

Public finance

Public financeS. Korea's fiscal deficit tops $90 bn; public debt hits record high

South Korea's fiscal deficit in September has pushed the annual shortfall to over 100 trillion won ($89.6 billion) with public debt reaching an all-ti...

Nov 10, 2020 (Gmt+09:00)

-

Macquarie (MIRA)

Macquarie (MIRA)[ASK2020] Sustainable Infrastructure Investment

Macquarie Infrastructure and Real Assets (MIRA) is one of the world’s leading alternative asset managers. For more than twenty-five years,...

Nov 03, 2020 (Gmt+09:00)

-

Stepstone

Stepstone[ASK2020] Private Debt: Playing Offense or Defense?

StepStone is a leading private markets firm that oversees over US$296 billion of private capital allocations, including approximately US$67 bill...

Oct 30, 2020 (Gmt+09:00)

-

Nuveen

Nuveen[ASK2020] Is now the right time to invest in UK real estate debt?

Nuveen, the investment management arm of TIAA, is one of the world’s largest investment managers with over US$1 trillion in AUM as of 30 J...

Oct 30, 2020 (Gmt+09:00)

-

Fiera Capital

Fiera Capital[ASK2020] Investing in Global Mid-Market Infrastructure

Fiera Capital is an independent global asset management firm with a multi-boutique approach, with over USD125 billion in assets under management...

Oct 30, 2020 (Gmt+09:00)

-

Hamilton Lane

Hamilton Lane[ASK2020] Infrastructure trends and opportunities

Hamilton Lane (NASDAQ: HLNE) is a leading alternative investment management firm providing innovative private markets solutions to sophisticated...

Oct 28, 2020 (Gmt+09:00)

-

IFM Investors

IFM Investors[ASK2020] The outlook for US Infrastructure Debt

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

Oct 28, 2020 (Gmt+09:00)

-

Aberdeen Standard Investments

Aberdeen Standard Investments[ASK2020] Global PPP Infrastructure, Market Overview and Outlook

Aberdeen Standard Investments is dedicated to helping investors around the world reach their investment goals and broaden their financial horizon...

Oct 28, 2020 (Gmt+09:00)

-

Park Square

Park Square[ASK2020] The Opportunity in European Private Debt

Park Square Capital is one of the world’s most established private debt firms, providing flexible financing solutions to high-quality and ...

Oct 28, 2020 (Gmt+09:00)

-

IFM Investors

IFM Investors[ASK2020] Introduction to Australia’s Private Debt Market

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

Oct 28, 2020 (Gmt+09:00)

-

Tikehau Capital

Tikehau Capital[ASK2020] Trends in European Private Debt and Private Equity Post Covid19

Tikehau Capital is an asset management and investment group with €25.7 billion of assets under management and shareholder equity of €2...

Oct 28, 2020 (Gmt+09:00)

-

Korean investors' survey

Korean investors' surveyKorean investors pick private debt as preferred asset class

South Korea’s institutional investors, including pension funds, mutual aid associations and insurers, plan to increase the private debt portion ...

Oct 27, 2020 (Gmt+09:00)

-

Interview

InterviewKorean police fund raises risk appetite for private debt

South Korea’s Police Mutual Aid Association (PMAA) has recently selected an opportunistic strategy fund for private debt investment as the $3 bi...

Oct 27, 2020 (Gmt+09:00)

-

Private debt

Private debtBrookfield's debt fund to raise $610 mn from Korea

Brookfield Infrastructure Partners will collect around 700 billion won ($610 million) from South Korean institutional investors for its second credit ...

Oct 12, 2020 (Gmt+09:00)

-

Private debt

Private debtBrookfield set to raise $610 mn for new infrastructure debt fund: report

Brookfield Asset Management Inc. will collect around 700 billion won ($610 million) from South Korean institutional investors for its second infrastru...

Oct 11, 2020 (Gmt+09:00)

-

Real estate debt

Real estate debtKorean LPs commit over $94 mn to LaSalle’s $513 mn debt fund

South Korean pension and savings funds, including the Yellow Umbrella Mutual Aid Fund and the Korea Scientists and Engineers Mutual-aid Association (S...

Oct 10, 2020 (Gmt+09:00)

-

Electric vechicle

Electric vechicleUrgent need to expand Korea's EV charging infrastructure: lobby group

It is critical that the South Korean government and carmakers swiftly move to increase local charging stations for electric vehicles and secure raw ma...

Sep 17, 2020 (Gmt+09:00)

Latest News

- 1 Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

- 2 CJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

- 3 Trump Jr. meets Korean business chiefs in back-to-back sessions

- 4 Samsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

- 5 Kookmin Bank raises $700 mn in forex bonds amid strong demand