Energy

Korea Resources seeks sale of Australia coal mine to slash debt

By Jan 06, 2021 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Korea Resources Corp. is planning to sell its 82.25% stake in a coal mine in Australia, as part of efforts to cut its debt totaling 6.7 trillion won ($6.1 billion) as of the end of June last year.

Last week, the government-owned body announced an invitation for bids on a stake in the Wyong Areas coal mine joint venture, to comply with South Korean government instructions to offload all its overseas assets as soon as possible.

It hired Lee & Ko, a law firm, as the sale manager and will receive bids until the morning of April 22, according to the company and industry sources on Jan. 5.

“In the sale process, SK Networks and Kyungdong may offer their shares as well,” said a Korea Resource official.

SK Networks has an 8.5% stake in the joint venture and Kyungdong, a Korean mine developer, 4.25%. Australian private entity Centennial Wallarah Pty holds the remaining 5.0% stake.

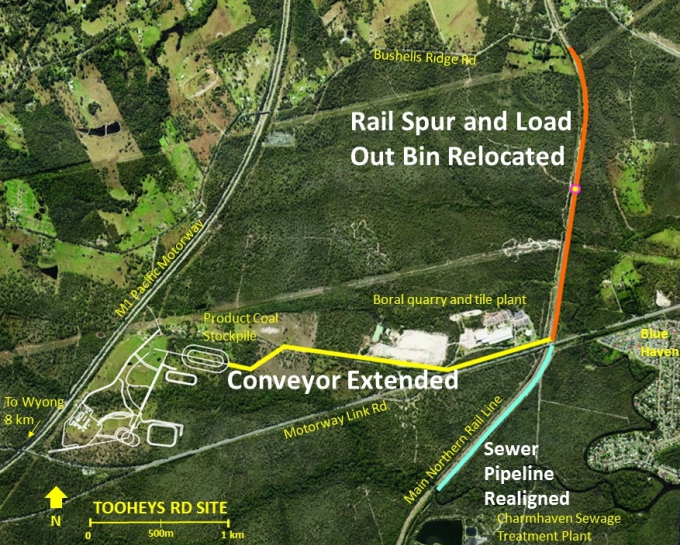

The Wyong Areas coal mine, 80 km north of Sydney, has 1.2 billion tons of thermal coal and an annual extraction capacity of up to 5 million tons.

Korea Resources secured a minority stake in the coal joint venture, which won exploration licenses in 1995 from the New South Wales government.

In 2005, the state-run organization acquired an additional 78% stake held by BHP Billiton for A$16.4 million. It received the mining lease in 2019.

The rapid transition away from fossil fuels, however, overshadows the outlook for global coal demand, which could lead to a drop in the coal mine's selling price.

A resource industry source voiced opposition to any hasty sale of the mine.

“The Wyong mine may be difficult to sell at the right price. But given its productivity, we may need to think about how to utilize its resources directly,” he said.

Since last year, the South Korean ruling party has been seeking to ban state-run institutions, including Korea Electric Power Corp., from financing foreign coal power projects. The proposed bill has not been passed by parliament yet.

Separately, Hanwha Group’s six financial units, including Hanwha Investment & Securities Co. and Hanwha Asset Management Co., agreed on Tuesday not to provide project financing for coal power plants both at home and abroad, nor underwrite bonds issued to finance the construction of coal plants, nor provide them insurance coverage.

Write to Soo-Young Seong and Hyun-Woo Lim at syoung@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Mergers & AcquisitionsCJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

Mergers & AcquisitionsCJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion21 HOURS AGO

-

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to Bunge

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to BungeApr 29, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsLG Chem to sell water filter business to Glenwood PE for $692 million

Mergers & AcquisitionsLG Chem to sell water filter business to Glenwood PE for $692 millionApr 28, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsKyobo Life poised to buy Japan’s SBI Group-owned savings bank

Mergers & AcquisitionsKyobo Life poised to buy Japan’s SBI Group-owned savings bankApr 24, 2025 (Gmt+09:00)

-

Comment 0

LOG IN