debt-to-GD ratio

Scope

Date

~

-

Corporate Bonds

Corporate BondsKorea’s cash-rich firms issue more bonds amid low interest environment

Some of the most cash-abundant firms across different industries in South Korea are issuing large amounts of bonds to raise even more funds amid a l...

Jul 19, 2021 (Gmt+09:00)

language -

Mergers & Acquisitions

Mergers & AcquisitionsDebt-ridden Ssangyong to sell car plant in self-rescue drive

Ssangyong Motor Co., the debt-ridden South Korean unit of India’s Mahindra and Mahindra Ltd. now in court receivership, has decided to sell it...

Jul 12, 2021 (Gmt+09:00)

-

Personal debt

Personal debtA generation indebted: Young Koreans struggle under record loans in Q1

Young South Koreans are drowning in debt.Korean youths in their 20s and 30s are reeling under growing personal debt as they aggressively take out pe...

Jul 06, 2021 (Gmt+09:00)

language -

Economy

EconomyBOK ratchets up warning over asset price bubble, private debt

The recent asset price rises in South Korea, in particular in the equities and real estate markets, have been too rapid, even considering an expecte...

Jun 23, 2021 (Gmt+09:00)

language -

IPOs

IPOsTencent-backed Krafton's mega IPO seen as overvalued

South Korea-based game publisher Krafton Inc.'s highly-anticipated initial public offering is raising concerns that it may be overvalued. The compan...

Jun 17, 2021 (Gmt+09:00)

-

IPOs

IPOsHyundai Oilbank revives IPO push, expands blue hydrogen business

South Korean refiner Hyundai Oilbank Co. is seeking to list its shares on the local bourse next year, according to its parent Hyundai Heavy Industri...

Jun 15, 2021 (Gmt+09:00)

language -

ESG investing

ESG investingKorean insurers finance Carlyle's $2 bn deal with ESG debt

South Korean life insurers have made an environmental, social and governance (ESG)-themed investment in The Carlyle Group's €2 billion ($2.4 bi...

Jun 08, 2021 (Gmt+09:00)

-

Artificial intelligence

Artificial intelligenceMadison Capital Funding raises $460 mn from Korea

A private debt fund managed by Madison Capital Funding, a US middle-market lender, has received a combined $460 million in commitments from seven So...

Jun 03, 2021 (Gmt+09:00)

-

Alternative investments

Alternative investmentsHana, ECP signs $300 mn infra investment partnership

South Korea's Hana Financial Investment Co. has signed a $300 million strategic partnership with US energy infrastructure-specialized firm ECP to in...

May 27, 2021 (Gmt+09:00)

-

ASK 2021 Interview

ASK 2021 InterviewSculptor Capital bets on non-traditional real estate

Non-traditional real estate assets such as cell towers, parking lots and marinas will likely provide significant investment opportunities to debt in...

May 20, 2021 (Gmt+09:00)

-

Economy

EconomyIMF warns against South Korea's debt explosion

South Korea needs to closely monitor government spending to avoid a future debt explosion given its rapidly aging population, according to a senior ...

Apr 15, 2021 (Gmt+09:00)

-

Economy

EconomyS.Korea's public debt tops GDP for first time in 2020

South Korea's government debt surpassed its gross domestic product for the first time in 2020, with public debt reaching its highest level ever foll...

Apr 07, 2021 (Gmt+09:00)

language -

Fintech

FintechSoftBank-backed Balance Hero raises $10 mn in debt funding from India

South Korean fintech startup Balance Hero has raised around $10 million in debt funding led by the India-based non-banking financial company (NBFC) ...

Mar 31, 2021 (Gmt+09:00)

-

Debt financing

Debt financingNaver issues $500 million in first foreign debt amid strong demand

South Korea’s top online portal Naver Corp. has successfully issued its first foreign currency bonds worth $500 million amid strong demand as ...

Mar 23, 2021 (Gmt+09:00)

language -

Energy

EnergyKorea Resources seeks sale of Australia coal mine to slash debt

Korea Resources Corp. is planning to sell its 82.25% stake in a coal mine in Australia, as part of efforts to cut its debt totaling 6.7 trillion won...

Jan 06, 2021 (Gmt+09:00)

-

Airlines

AirlinesHahn & Co finances $700 mn Korean Air deal with about $400 mn debt

Hahn & Co., a South Korean private equity firm, has completed the payment for the 790 billion won ($722 million) purchase of Korean Air Lines' i...

Dec 17, 2020 (Gmt+09:00)

-

RFPs

RFPsKorea Post seeks two direct lending funds for $200 mn mandates

Korea Post’s savings arm plans to select two global direct lending funds focusing on North America and Europe and commit $100 million to each ...

Dec 08, 2020 (Gmt+09:00)

-

Economy

EconomyS.Korea's household debt ratio exceeds 100% for first time

South Korea’s household debt to gross domestic product (GDP) ratio has exceeded 100% for the first time, with its debt growing relatively faster...

Nov 24, 2020 (Gmt+09:00)

-

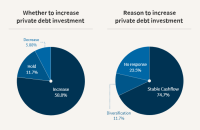

Korean Investors

Korean InvestorsKorean LPs favor direct lending for private debt investment

More than half of South Korea’s key asset owners, led by the National Pension Service, are inclined to expand overseas private debt investment i...

Nov 17, 2020 (Gmt+09:00)

-

Public finance

Public financeS. Korea's fiscal deficit tops $90 bn; public debt hits record high

South Korea's fiscal deficit in September has pushed the annual shortfall to over 100 trillion won ($89.6 billion) with public debt reaching an all-ti...

Nov 10, 2020 (Gmt+09:00)

-

Stepstone

Stepstone[ASK2020] Private Debt: Playing Offense or Defense?

StepStone is a leading private markets firm that oversees over US$296 billion of private capital allocations, including approximately US$67 bill...

Oct 30, 2020 (Gmt+09:00)

-

Nuveen

Nuveen[ASK2020] Is now the right time to invest in UK real estate debt?

Nuveen, the investment management arm of TIAA, is one of the world’s largest investment managers with over US$1 trillion in AUM as of 30 J...

Oct 30, 2020 (Gmt+09:00)

-

IFM Investors

IFM Investors[ASK2020] The outlook for US Infrastructure Debt

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

Oct 28, 2020 (Gmt+09:00)

-

Park Square

Park Square[ASK2020] The Opportunity in European Private Debt

Park Square Capital is one of the world’s most established private debt firms, providing flexible financing solutions to high-quality and ...

Oct 28, 2020 (Gmt+09:00)

-

IFM Investors

IFM Investors[ASK2020] Introduction to Australia’s Private Debt Market

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

Oct 28, 2020 (Gmt+09:00)

-

Tikehau Capital

Tikehau Capital[ASK2020] Trends in European Private Debt and Private Equity Post Covid19

Tikehau Capital is an asset management and investment group with €25.7 billion of assets under management and shareholder equity of €2...

Oct 28, 2020 (Gmt+09:00)

-

Korean investors' survey

Korean investors' surveyKorean investors pick private debt as preferred asset class

South Korea’s institutional investors, including pension funds, mutual aid associations and insurers, plan to increase the private debt portion ...

Oct 27, 2020 (Gmt+09:00)

-

Interview

InterviewKorean police fund raises risk appetite for private debt

South Korea’s Police Mutual Aid Association (PMAA) has recently selected an opportunistic strategy fund for private debt investment as the $3 bi...

Oct 27, 2020 (Gmt+09:00)

-

Private debt

Private debtBrookfield's debt fund to raise $610 mn from Korea

Brookfield Infrastructure Partners will collect around 700 billion won ($610 million) from South Korean institutional investors for its second credit ...

Oct 12, 2020 (Gmt+09:00)

-

Private debt

Private debtBrookfield set to raise $610 mn for new infrastructure debt fund: report

Brookfield Asset Management Inc. will collect around 700 billion won ($610 million) from South Korean institutional investors for its second infrastru...

Oct 11, 2020 (Gmt+09:00)

Latest News

- 1 Seoul appeal: Korean art captivates Indonesia’s affluent connoisseurs

- 2 CJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

- 3 Trump Jr. meets Korean business chiefs in back-to-back sessions

- 4 Samsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

- 5 Kookmin Bank raises $700 mn in forex bonds amid strong demand